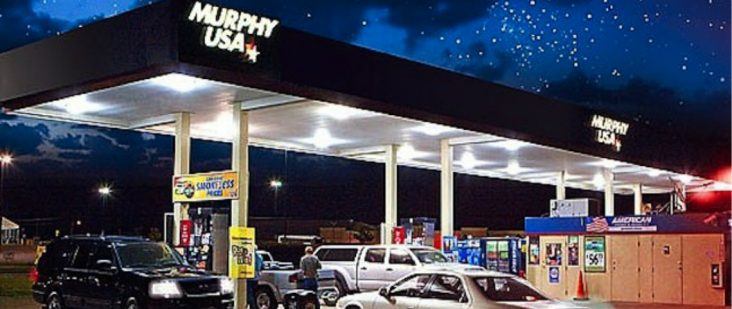

Murphy USA gets $89 million fourth quarter profit boost from GOP tax cuts

by January 31, 2018 6:35 pm 456 views

Murphy USA Inc. saw a $89 million boost in fourth quarter profits due to a deferred benefit from the recent GOP tax reform package enacted into law in December, the Arkansas convenience store operator reported after the close of the market Wednesday (Jan. 31).

For the period ended Dec. 31, the El Dorado gas station owner reported net income of $124.8 million, or $3.58 per share, compared to net income of $43.8 million, or $1.14 share, during the same period of 2016. Revenues in the fourth quarter rose to $3.37 billion, up 10.5% compared to $3.05 billion a year ago.

Wall Street analysts forecasted Murphy USA to report quarterly profits of $1.23 per share on revenue of $3.25 billion. The one-time benefit that resulted in the existing net deferred tax liabilities being revalued to lower corporate tax rates for future periods generated an estimated benefit to income tax expense of $88.9 million, company officials said.

For the full year, net income was $245.3 million, or $6.78 per share, up 10.7% from $221.5 million, or $5.59 per share, in 2016. Yearly revenues grew 10.3% to $12.8 billion, compared to $11.6 billion in 2016.

“We are extremely pleased with the company’s performance in 2017,” Murphy USA President and CEO Andrew Clyde said. “The business was resilient against continued headwinds, challenging macroeconomic conditions, and especially in the first quarter, regulatory uncertainty that resulted in a change to our guidance early in the year.”

Clyde continued: “However, our focused strategy and operating discipline generated full-year results that were within the original guidance range for (adjusted earnings) and well above our guidance for net income thanks to the passage of the Tax Cuts and Jobs Act, which will provide continued tangible benefits into 2018.”

Going forward, Clyde said Murphy USA enter 2018 with an attractive free cash flow profile and will continue to focus on executing the company’s balanced capital allocation strategy to create long-term shareholder value.

“Although challenges and regulatory uncertainty persist, Murphy USA has repeatedly proven its resilience to external factors and its ability to add value to its business,” he said.

Companywide, Murphy USA’s total fuel contributions rose to $171.9 million in the fourth quarter, compared to $164.2 million a year ago. Total merchandise contributions and sales in the fourth quarter were $97.1 million and $595.6 million, respectively, compared to $89.8 million and $588.4 million in 2016.

Merchandise performance was strong in the fourth quarter with total merchandise contribution dollars increasing 8.1% at 16.3% margins, a new quarterly record, driven by growth in both the tobacco and non-tobacco categories, company officials said.

Total state and operating expenses were up slightly in the fourth quarter at $130.3 million, compared to $123.4 million a year ago. The higher gas station operating expenses were largely due to $6.9 million for new store additions and slightly higher payment fees due to 12% higher retail fuel prices.

The El Dorado convenience store giant said it opened 23 retail locations in the fourth quarter, in addition to four raze-and-rebuild locations. For the full year, the Arkansas publicly traded concern opened 45 new stores and completed 21 raze-and-rebuilds bringing the year end store count to 1,446 locations, consisting of 1,158 Murphy USA sites and 288 Murphy Express sites.

The South Arkansas corporation, which split from parent Murphy Oil Corp. in August 2013, said it also completed its previously announced $500 million stock buyback plan at the close of the fiscal year with an additional purchase of 712,000 shares at $54 million in the fourth quarter.

“We expect to continue to conduct share repurchases under quarterly allocations in line with our past practice,” the company said in a statement. At the close of business on Dec. 31, Murphy USA had 34,091,534 shares outstanding.

In its 2018 guidance, Murphy USA plans to build up to 30 new stores and 25 additional raze-and-rebuild locations. The company’s capital budget calls for an outlay of $225 million to $275 million, about the same as the $274 million spent in 2017.

Murphy USA shares closed Wednesday up 21 cents at $85.31. The company’s shares have traded in the range of $62.76 and $89.69 during the past 52 weeks.