Arkansas Tourism Ticker: Travel and tourism industry posts healthy gains, state set for ‘good fall travel season’

by November 18, 2015 6:21 pm 518 views

Editor’s note: The Arkansas Tourism Ticker is sponsored by the Arkansas Hospitality Association.

The pace has not slackened for Arkansas’ travel and tourism industry. The state’s second largest economic sector has in the first eight months of 2015 posted healthy gains in municipal hospitality tax revenue, the statewide tourism tax, and tourism-related jobs.

The Arkansas Tourism Ticker is managed by Talk Business & Politics, and uses the following three measurements to review the health of the state’s tourism industry.

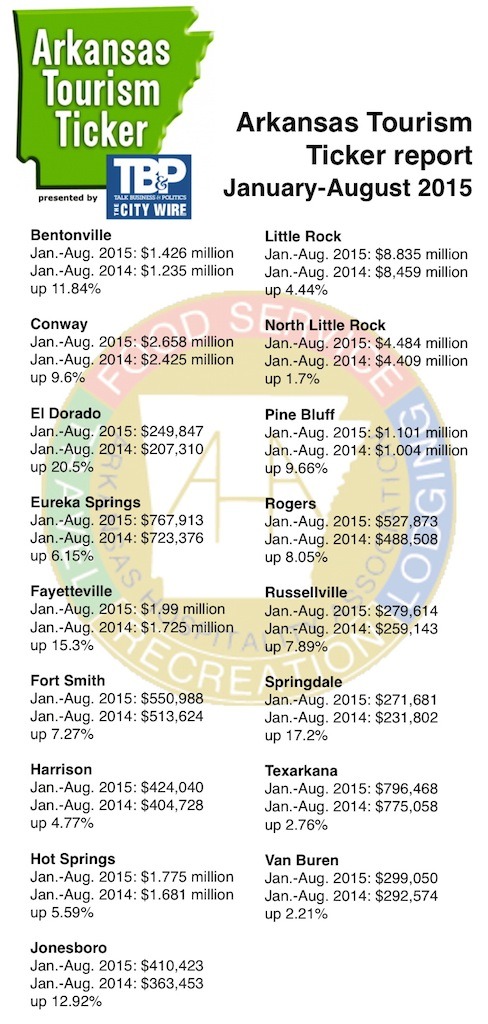

• Hospitality tax collections – prepared food tax and lodging tax – of 17 Arkansas cities (cities listed below along with collections for each city);

• Tourism sector employment numbers as reported by the U.S. Bureau of Labor Statistics; and

• Collections of Arkansas’ 2% statewide tourism tax.

Results for the January-August ticker report are:

• +5%

Gain in combined January-August hospitality tax collections in 17 Arkansas cities compared to the same period in 2014;

• +7.62%

January-August gain in Arkansas’ 2% tourism tax compared to the same period in 2014; and

• +5.8%

Increase in average monthly Arkansas tourism industry jobs during January and August compared to January-August 2014.

The inaugural Ticker report showed that 2014 hospitality tax revenue in the cities was up 3.7% over 2013; Arkansas’ 2% tourism tax revenue in 2014 was up 7.48% compared to 2013; and jobs in the state’s travel and tourism sector were up 6.5% in 2014 compared to 2013. The Arkansas Tourism Ticker is published every two months, or six times a year.

Maryl Koeth, executive director of the Van Buren Advertising and Promotion Commission, said August numbers often dip because consumers are more focused on back to school shopping. She said Van Buren is “well ahead of last year,” and she believes the state will see a “good fall travel season.”

Montine McNulty, executive director of the Arkansas Hospitality Association, said the ticker report is not a surprise.

“This is another strong tourism industry report. The hospitality tax revenues, 2% lodging tax, and the growth in jobs certainly reflect the success we are experiencing getting people traveling Arkansas,” she said.

HOSPITALITY TAXES

The combined hospitality tax collections in the 17 cities totaled $28.955 million in January-August, up 5.01% compared to January-August 2014. The gain was slightly off the 5.78% increase posted in the 17 cities for the first half of 2015.

Restaurant (prepared food tax) tax collections among the 17 cities totaled $21.438 million in January and August, up 5.92% compared to the $20.239 million in January-August 2014.

Hotel tax collections among the 17 cities totaled $7.516 million in the January-August period, up 2.5% compared to the $7.332 million during the same period of 2014.

During the January-August period, none of the 17 cities surveyed for the Arkansas Tourism Ticker posted a year-over-year decline in collections. Gains for the eight month period ranged from a low of 1.7% in North Little Rock to a high of 20.5% in El Dorado.

STATEWIDE TOURISM TAX

Collections of Arkansas’ 2% tourism tax in January and August totaled $10.177 million, up 7.62% compared to the $9.456 million in January-August of 2014. Collections for the first four months of 2015 set a new record for that month. The May tally missed setting a new record by $120. June, July and August collections each set records for the month.

The 2% tourism tax in 2014 totaled $13.677 million, up 7.48% compared to the $12.716 million collected in 2013. The 2014 tally sets a new record for the tax. Following are the past five years of 2% tax collections.

2014: $13.677 million

2013: $12.716 million

2012: $12.404 million

2011: $12.025 million

2010: $11.492 million

TOURISM JOB NUMBERS

The monthly jobs average in the travel and tourism sector during January and August was 113,324, up 5.8% compared to an average of 107,112 during the first eight months of 2014.

Travel and tourism sector employment ranged from a low of 112,100 in January to a high of 114,800 in February. The February level, if not revised, set a new record for the sector.

Travel and tourism sector employment during the first eight months of 2014 ranged from a 106,200 low in January to a high of 107,800 in August.

Job growth in the sector has been significant during the past 10 years. August employment of 113,000 is up 19.7% compared to August 2005 employment of 94,400.

Of the eight metro areas in or connected to Arkansas, the Bureau of Labor Statistics provides tourism employment data on five. The Fort Smith and Memphis-West Memphis areas were the only metro areas to see travel and tourism sector employment declines in the January-August period compared to the same period in 2014. The Memphis-West Memphis area is the only one of the metro areas to see a decline in 2015 compared to 2010. Following are comparisons of the monthly employment averages in the January-August period.

Northwest Arkansas

Jan.-August 2015: 22,475

Jan.-August 2014: 21,825

Jan.-August 2010: 17,975

Fort Smith

Jan.-August 2015: 8,800

Jan.-August 2014: 9,100

Jan.-August 2010: 8,427

Central Arkansas (Little Rock-North Little Rock-Conway)

Jan.-August 2015: 33,662

Jan.-August 2014: 32,162

Jan.-August 2010: 29,562

Memphis-West Memphis

Jan.-August 2015: 64,137

Jan.-August 2014: 65,275

Jan.-August 2010: 65,187

Texarkana (Arkansas-Texas)

Jan.-August 2015: 6,425

Jan.-August 2014: 6,162

Jan.-August 2010: 5,675

WHY THE TICKER?

Arkansas’ tourism industry is an important economic engine for the state, and is often cited as Arkansas’ second largest industry – behind agriculture.

There are many reports and economic indices to measure several areas of the the state’s economy. The City Wire issues a monthly housing report (The Arkansas Home Sales Report). The University of Arkansas issues a quarterly report on economic activity, and has published reports on the economic impact of the Fayetteville Shale Play. There are reports to measure public opinion on various social issues.

But there has not been an independent report looking at the health of the state’s tourism sector. Therefore, Talk Business & Politics decided to work with officials in the state’s travel and tourism sector to capture some indication of the relative health of the industry.