TTAGG Team Pivots, Provides Intelligence

by January 7, 2013 12:00 am 101 views

TTAGG Inc. just might be stretching the you-can’t-be-everywhere-at-once maxim to the breaking point.

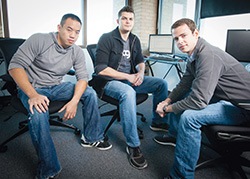

TTAGG (pronounced tag) is a technology-based startup co-founded in October 2011 by University of Arkansas graduates Britt Cagnina, Kenny Cason and Ryan Frazier. The company uses its own algorithm to compile and filter online comments about a wide range of consumer products.

It then breaks down the data into market research reports, and clients pay a monthly subscription fee for access to the reports. The reports are available via TTAGG’s website.

The initial idea was that investors can make better decisions by combining traditional methods with the kinds of sentiment-based transactional data mined by TTAGG. About six months ago, however, a shift in focus resulted in the firm targeting retailers and consumer packaged goods companies, providing them increasingly invaluable comparative product intelligence.

“It’s like standing in the mall all day and counting the number of people leaving each store with a shopping bag in their hand, except you’re in every mall, all over the world, counting millions of shopping bags and millions of people leaving these stores,” Frazier said in a story published by the UA.

Frazier, the company’s CEO, expounded on that notion in a recent interview with the Northwest Arkansas Business Journal.

“Our algorithm doesn’t actually filter in the traditional sense,” Frazier wrote in an email. “It actually applies a quality score to each individual comment based on a number of different variables that we think make comments more valuable.

“Demographic information associated with a comment, for example, might make it more useful than a comment without demographic info, giving it a higher data-rank score and causing it to display higher on the dashboard. And comments with a data-rank too low aren’t displayed on the dashboard.”

Early Endorsements

TTAGG has received heady praise from a variety of sources. In a blog post shortly after the firm’s launch, Forbes.com contributor Peter Cohan wrote: “One of my Babson College students who works with TTAGG showed me a graph of daily trends in TTAGG’s index of purchases of a publicly traded retailers’ products and compared it to its daily stock price.

“What got my attention is that the rise and fall of the TTAGG index nicely preceded changes in that retailer’s stock price by a few weeks. Moreover, the TTAGG index was more accurate than Wall Street earnings forecasts.”

In the UA story, meanwhile, Jeff Amerine said he believes TTAGG “will be one of the leaders in the growing business of intelligence social listening space.”

Amerine is a technology licensing officer and entrepreneurship professor at the UA. In a July Innovate Arkansas blog post, Amerine praised TTAGG for possessing “exactly the kind of entrepreneurial spirit we need to bottle and serve statewide.”

TTAGG has received more than kind words in support, though. The company also has received financial support from 500 Startups, a Silicon Valley angel investment group.

Frazier didn’t disclose the specific funding TTAGG received from 500 Startups, but its website indicates it provides early-stage companies with up to $250,000 in funding, as well as a startup accelerator program and “unique” events. More specifically, according to its website, 500 Startups helps firms in the areas of design, data and distribution.

TTAGG also recently hired R. Brian Henley as its non-executive chairman of the board. Henley is an industrial engineering graduate from the UA, and earned a master’s in business administration from Harvard University. He has worked at Rogge Capital Management in Austin, Texas, and California-based Callaway Golf Co., among other stops.

Strategy Shift

All of it is a remarkable sequence of events for Frazier, Cason and Cagnina, who started the business a little more than a year ago out of the house they rented near the UA campus. These days, TTAGG’s seven employees operate out of fifth-floor office space in downtown Fayetteville.

When asked if he has been surprised by the company’s success — TTAGG became “cash-flow positive around the one-year mark”— Frazier indicated his team might have been too busy over the past 12-plus months to think about such emotions.

“I think working directly with our customers to improve the product has helped to expedite the process,” Frazier wrote in the email. “As first-time entrepreneurs, there was a lot to learn, and we’re still learning on a daily basis.”

Frazier previously told the Business Journal he’s been interested in investing since middle school, when an uncle introduced him to it. The idea for TTAGG began brewing in December 2010, when data from some social media sites convinced Frazier to invest in apparel company Urban Outfitters.

Not long after that, Urban Outfitters’ revenue rose 12 percent, Frazier said. He and some friends continued to use such data as investment tools, and continued to have success, before Frazier decided to partner with Cason and Cagnina.

Frazier was no stranger to start-ups. He was part of the SooiieeSake LLC team, which made the final round of the undergraduate competition at the Governor’s Cup in 2009, while a student at the UA. He also designed and sold the Ekocase, an iPad product, before helping found TTAGG.

Cagnina and Cason also graduated from the UA. Cagnina is a software developer who earned a degree in mathematics, while Cason earned a bachelor’s degree in computer science. A software engineer, Cason was working on missile defense software at Lockheed Martin in Washington, D.C., before joining the TTAGG team.

The co-founders had what Amerine called “a classic pivot” when they were asked during a fundraising round if they could provide the same sort of data to retailers as they were providing to investors. Realizing a chance at a more lucrative client base, TTAGG built a dashboard and service offering for retail and CPG companies.

“Our main focus is on customer insights and market research,” Frazier wrote, “and providing a platform to track and understand your customers and your market in real time.

“But it started out as a financial tool. Our tool basically acted like an analyst. We collected online comments people posted about buying a company’s products, and we would track those buying trends and make forecasts for the company’s earnings reports. The larger the spread between what our data was telling us and what analysts were expecting, the larger the opportunity for that particular trade.

“This technology is now at the core of our customer insights tool. Identifying people buying things can help us validate customers and eliminate noise.”

It also changed TTAGG’s potential, Amerine said. Instead of targeting thousands and thousands of day traders as clients, for example, TTAGG now can target “five to 10 to 15 to 20 corporate accounts.”

“If you get those,” Amerine said, “it gets to be an interesting business pretty quick. They’ve got a lot of traction started with a lot of major players in that space.”

What largely made the shift possible is the fact TTAGG essentially is mining the same sources for the intelligence it passes along to retailers and CPG firms.

“The majority of the content comes from the major social networks, though the more qualitative content tends to come from the more niche content sites,” Frazier wrote.

The data, which comes from thousands of sources, can vary, he added.

“It’s very dependent on the product or brand you’re following. The iPad, for example, generates around a quarter-of-a-million comments per day, while Meow Mix may generate a few hundred per day.”

Regardless, Amerine said that’s exactly the kind of information retailers and CPG companies want in today’s feedback-driven environment. And TTAGG provides it in a hurry.

“We’re talking about high-fidelity information in near-real time, as opposed to somebody putting together a focus group and getting you something in six months,” Amerine said. “They have the marketing savvy and technical ability, and they’re savvy enough and quick enough, to rally around something and make adjustments on the fly if they see that’s what needed.”