Walmart’s Angus beef play aimed at controlling costs, quality

by January 20, 2020 2:51 pm 2,759 views

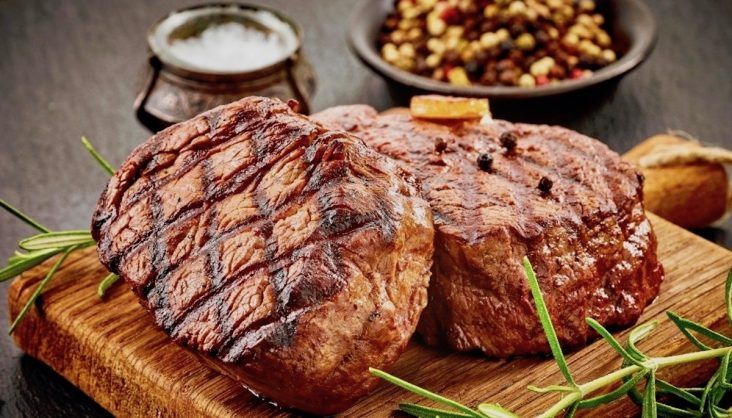

photo courtesy of Walmart

Retail giant Walmart opened a case-ready beef further processing plant in Thomasville, Ga., in the company’s ongoing efforts to unlock growth opportunities in a niche market where it has struggled to compete.

Walmart first announced in April 2019 efforts to control its Angus beef supply chain in order to focus on high-quality beef cuts such as steak and roasts. Last week, the 201,000 square-feet further-processing facility opened for business. This new plant is managed with processing partner Creekstone Farms and Mc6 Cattle Feeders and Prime Pursuits cattle rancher.

The new plant is said to supply roughly 500 Walmart stores in the southeastern U.S. with Angus beef products, or just around 10% of Walmart’s stores, according to Derrell Peel, a beef livestock marketing analyst at Oklahoma State University. Peel told Talk Business & Politics the beef industry is fragmented and it’s difficult to control the supply chain from the calf through slaughter to retail cases. He said Walmart has a history of looking for efficiencies in its vast supply chain which makes this move quite interesting.

“Walmart is not a beef packer, nor will they likely ever be. They will have to work packers, feedlots and ranchers in partnerships if they want to direct more control over the supply chain,” Peel said.

He applauds Walmart for recognizing beef is not a commodity, given so much of the products they sell are commoditized amid the retailer’s low-price strategy.

“Each part of the cow has value and a basic challenge the beef industry has always been looking for ways to add value to the component parts. Walmart is looking for some higher quality, higher-margin products out of this test market. This is quite a departure from the company’s attempt to sell beef products at low, low prices,” Peel said.

The geographic location of the test is also interesting as analysts have said it’s a way for Walmart to better compete with Publix, a traditional grocery leader in Alabama, Florida and Georgia) that employs butchers in its meat markets.

Heather Jones, a meat analyst with Vertical Group, said Walmart would struggle to create a supply chain that could cover all of its beef needs. She said Walmart is going to need the help of packers like Tyson Foods and Cargill who already provide the majority of beef products Walmart sells in the U.S.

Peel agreed, saying the partnership with Creekstone Farms and FLP Foods is small and if Walmart is able to capture some momentum from this test and wants to expand, it would have to rely on larger suppliers like Tyson Food and Cargill for the slaughter, packing and processing.

Walmart opened a milk processing plant last year as a way to control the quality of milk and dairy. By owning and being involved in the processing business, Walmart hopes to leverage its massive scale to help drive costs out of the supply chain and ensure the quality is adequate.