CBID may also assess non-profit property within the district

by December 18, 2019 8:31 pm 705 views

The Central Business Improvement District board on Tuesday (Dec. 17) agreed to move ahead with an assessment on property within the district. The board also agreed that not-for-profit organizations within the district would have an assessment obligation just as other property owners will.

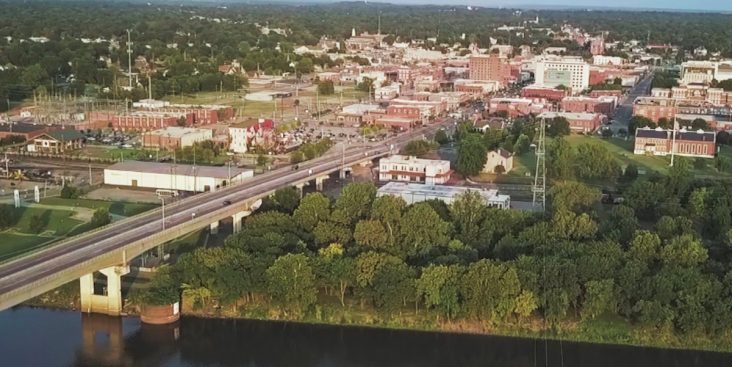

The board voted Aug. 20 to proceed with plans for property assessment within the district, a move they hoped would allow the board to do more things to improve the downtown area of Fort Smith.

According to state law, there are two types of assessments that can be levied against real property inside a city’s improvement district – a project/improvement-specific assessment, levied to fund a “specific ‘plan of improvement,’” or a supplemental annual assessment to be used for ongoing operations or maintenance activities, Deputy City Administrator Jeff Dingman said in a memo to the board dated Aug. 16.

Bill Hanna, CBID board chair, said the Fort Smith CBID is one of the few in the state not funded by an assessment. Based on property valuations as of July 28, each 1-mill assessment on properties within the CBID would amount to $38,834.47 in annual operating revenue, Dingman said. An 8-mil assessment would mean approximately $310,657 in annual funding for the district.

Before an assessment can be levied, more than 50% of property owners in the district must sign a petition agreeing to an assessment. The CBID board would then present that petition and the plan to the Fort Smith City Board of Directors. Dingman said under the state law if the CBID has the required signatures on the petition, the city’s BOD would be compelled to approve the assessment as an ordinance.

The board plans to use monies garnered from an assessment to fund an ambassador program that would hire off-duty police officers as part of a Safety and Security program for downtown. That program would cost about $136,000 annually, according to a proposed operating budget. The assessment would also fund a Green and Clean project that would include streetscape maintenance and landscaping, which could incorporate care of flowerbeds as well as pruning and possible replacement of trees, cleaning and repairs to benches, lighting and trash receptacles, litter control, conversion of lights along Garrison Avenue to LED and more, Dingman said.

Before a complete decision on an assessment can be made, they have to have an idea what the value of all the real estate in the district is, Hanna said.

“We need a value of all the property before we can determine what assessment we would need,” Hanna said.

The board voted to have its attorney and Dingman continue with finding out the property values of all property in the district, including the not-for-profits in the district. Much of the property in the district belongs to Baptist Health-Fort Smith, churches and other not-for-profits.

“We agreed they would have an obligation. Now we have to find out exactly what their obligation, and the obligation of other property owners, is,” Hanna said.