Murphy USA touches yearly high as profits jump 54% from a year ago

by October 30, 2019 5:36 pm 1,189 views

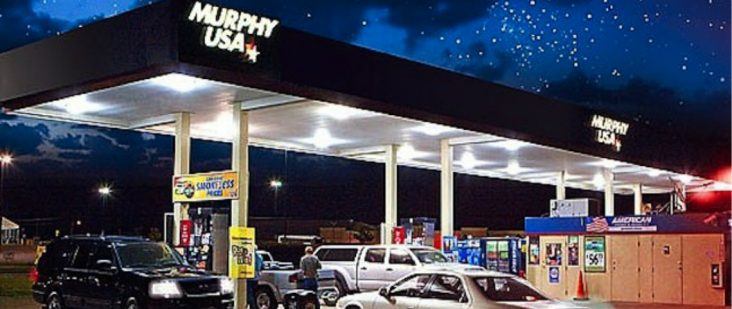

El Dorado-based Murphy USA’s stock touched a 52-week high Wednesday (Oct. 30) after the Arkansas convenience store chain saw improved third quarter earnings on strong gasoline and merchandise sales and benefitted from continued investment in new retail locations.

For the period ended Sept. 30, the former gas station subsidiary of Murphy Oil Corp. reported net income of $69.2 million, or $2.18 per share, up 53.8% compared to $45 million, or $1.38 per share, in the same period a year ago. Revenues for the three-month period, however, were down 3.2% to $3.66 billion, compared with $3.78 billion in the same period of 2018.

A survey of five Wall Street analysts had expected the Arkansas gasoline station owner known for its Walmart parking lot locations to see third quarter earnings of $1.44 per share on revenue of $3.75 billion, according to Thomson Reuters.

“The third quarter performance clearly demonstrates some of the benefits of recent investments as Adjusted EBITDA grew 51% over the prior year, capitalizing on market share gains in both the fuels and merchandise business,” said President and CEO Andrew Clyde. “New stores are also outperforming the network, which gives us a high level of confidence ahead of an increase in our organic growth over the next several years.

“Finally, we re-financed the balance sheet to accelerate our share repurchase activity in the third quarter, jumpstarting the benefits we expect from our previously announced up to $400 million share repurchase program,” added.

Murphy USA reported total fuel contributions in the third quarter rose 30.6%, or $52.9 million, to $206.4 million, compared to $151.4 million a year ago. Company officials said strong retail fuel margins, combined with higher same-store sales volumes contributed to the improved earnings.

In the same three-month period, total merchandise contribution and sales were $111.2 million and $681.1 million, respectively, compared to $104.5 million and $623.7 million in 2018. The continued higher contribution from the lower-margin tobacco categories and enhanced promotional activities lowered the average unit margins by 50 basis points versus the prior year quarter to 16.3%, company officials said. In addition, total merchandise contribution dollars per store increased 6% to $25,700 on a same-store sales basis.

Lastly, total station and operating expenses grew by 1.7% to $143.4 million, compared to $139.7 million a year ago. Murphy USA officials said the higher gas station costs were primarily due to employee-related costs, including higher professional fees and incentive award expenses.

During the third quarter, the El Dorado convenience store chain opened five new retail locations, bringing the store count to 1,479, consisting of 1,160 Murphy USA sites and 319 Murphy Express sites. A total of 21 stores are currently under construction, including eleven new retail locations and ten kiosks undergoing raze-and-rebuild construction that will return to operation as 1,400 sq. ft. stores. All but three of the new retail locations are expected to be in operation in the fourth quarter, company officials said.

As highlighted by Clyde, Murphy USA also repurchased nearly 1.2 million of its common shares for $109.0 million, including 1.1 million shares for about $98.4 million under the company’s $400 million stock buyback program approved by the board in July. The Arkansas gas station operator, which has 30,759,651 shares outstanding, has $301.6 million remaining in the plan at the end of the third quarter.

In late August, Murphy USA also amended its credit agreement that provides for asset-based (ABL) borrowing availability of up to $325 million. The ABL facility is scheduled to mature in August 2024, while the credit agreement provides for a $250 million term facility that will mature in August 2023.

Murphy USA shares closed Wednesday up $1.24 at $94.84, a yearly high for the Arkansas publicly traded concern. The stock jumped more than 7% to $102 per share in after-hours activity. The company’s shares have traded in the range of $69.98 as a low and today’s 52-week high on the New York Stock Exchange.