Banking professor, officers expect no major changes with new Fed Chair

by November 2, 2017 4:54 pm 567 views

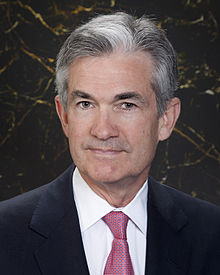

The new boss will be the same as the old boss. That’s the consensus of bankers and industry watchers who responded to Talk Business & Politics about the nomination of Jerome “Jay” Powell as the next chair of the Federal Reserve Board of Governors.

Powell, who is set to replace Fed Chair Janet Yellen if confirmed by the U.S. Senate, was named Thursday (Nov. 2) by President Donald Trump. Yellen, the first and only woman to be Fed Chair, was appointed by President Barack Obama and began her service Feb. 1, 2014. If Powell is confirmed to his four-year term, he will be the 16th to serve in the job since Charles Hamlin who began the first term on Aug. 10, 1914.

In addition to almost 30 years of private sector experience, Powell served as Under Secretary at the Department of Treasury in the administration of President George H.W. Bush. He received a bachelor’s degree in politics from Princeton University in 1975 and completed law school at Georgetown University.

“As a member of the Federal Reserve’s Board of Governors since May 2012, Mr. Powell has demonstrated steady leadership, sound judgment, and policy expertise. Mr. Powell will bring to the Federal Reserve a unique background of Government service and business experience,” noted a White House statement.

In keeping with the tradition of Fed Chairs avoiding specifics, Powell was vague on his leadership goals and priorities.

“In the years since the global financial crisis ended, our economy has made substantial progress toward full recovery. By many measures we are close to full employment, and inflation has gradually moved up toward our target,” Powell noted in a statement. “Our financial system is without doubt far stronger and more resilient than it was before the crisis. Our banks have much higher capital and liquidity, are more aware of the risks they run, and are better able to manage those risks. While post-crisis improvements in regulation and supervision have helped us to achieve these gains, I will continue to work with my colleagues to ensure that the Federal Reserve remains vigilant and prepared to respond to changes in markets and evolving risks.”

INDEPENDENT VOICE

Tim Yeager, professor of finance and the Arkansas Bankers Association Chair in Banking at the University of Arkansas, said Powell’s moderate political views should protect the Federal Reserve. He also predicted Powell would not bring massive changes to the important monetary control body.

“Mr. Powell seems to represent a continuation of current Fed monetary and regulatory policies, which maintains stability at the Federal Reserve. Mr. Powell seems to have moderate political views, which is ideal for a Fed Chair because it keeps the Fed more insulated from politicians so he/she can focus on what is best for the economy in an independent manner,” Yeager told Talk Business & Politics.

Sam T. Sicard, president and CEO of First National Bank of Fort Smith and the bank holding company that owns First National Bank of NWA, echoed Yeager’s note on stability.

“I don’t foresee any significant change in the trajectory of monetary policy if Mr. Powell is appointed the next Federal Reserve Chair. Mr. Powell is strongly believed to be in support of the current plan to gradually increase the fed fund rates over time and gradually reduce the size of the Federal Reserve’s asset holdings,” Sicard said.

Jim Huntzinger, chief investment officer for BOK Financial, the publicly-traded parent company of Bank of Arkansas, with Bentonville and Fayetteville branches, doesn’t expect Powell’s nomination to indicate a shift in Federal Reserve policy. Huntzinger also praised the Powell pick.

“He is not a trained economist. That was probably a plus in President Trump’s eyes. However, he clearly has a thorough knowledge of the economy, markets and monetary policy.”

Huntzinger said Powell has been a member of the Board of Governors of the Federal Reserve since 2012 and during that time has not dissented on any policy matters and his public statements would put him in the middle Federal Reserve Open Market Committee’s opinions.

TIME TO RAISE INTEREST RATES

Yeager did offer a few opinions on what actions Powell might consider if approved by the U.S. Senate.

“On regulation, I believe that the Fed should not ease up on Wall Street banks. The damage from the financial crisis is still fresh in our minds, and many of the Dodd-Frank reforms have forced the largest banks to operate in a much safer manner. However, the Fed needs to continue to look for ways to relieve the regulatory burden on community banks because the legalistic paperwork is making it difficult for smaller community banks to survive. Many bankers have stories about how the well-intended regulations have increased costs for them and their borrowers,” Yeager noted in his response.

It’s also overdue to begin raising interest rates, Yeager believes.

“The trade-off between inflation and unemployment has been very weak for some time for reasons that nobody fully understands. The concern that modestly higher rates will lead to deflation seems silly given that the inflation rate hasn’t budged despite the Fed’s injection of more than $4 trillion into the economy,” Yeager said.

Yeager said “modestly higher interest” could contain what he sees as “excesses” in equity (stock) markets and the real estate sector. That would be, in Yeager’s view, a stabilizing factor on the economy.

“Also, modestly higher rates will boost community bank’s net interest margins, and will provide some relief to savers dependent on fixed incomes.”