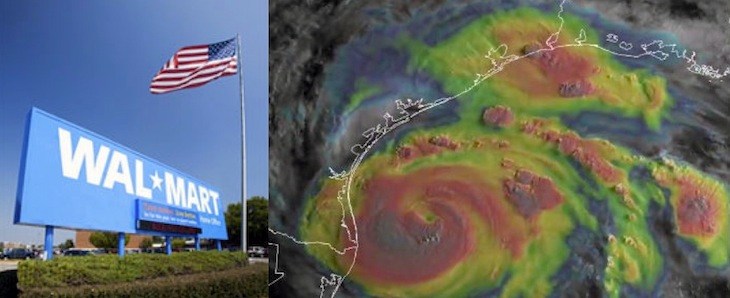

Retail losses mixed following Hurricanes Harvey and Irma

by September 19, 2017 6:16 pm 775 views

Hurricanes Harvey and Irma ravaged the Texas Gulf coast and much of Florida, respectively, where Wal-Mart and Publix have dozens of stores that closed briefly during flooding and the storms’ aftermath.

Robert Moscow, analyst with Credit Suisse, reported Tuesday an informal survey in Florida indicates the weather events most likely had a neutral impact on grocery and food sales in that region. That may not be the case in Texas.

Moskow noted there was a flurry of “panicky buying” before Irma which likely offset the impact of stores having to close during the storm. Moskow surveyed 40 stores in Florida run by Wal-Mart and its competitor Publix. He said 75% of those stores reported higher traffic both before and after the storm passed.

Moskow said in the past week 40% of the stores surveyed report traffic has normalized. Part of the losses associated with retailers is power outages which keeps them from reopening sooner. He noted in Florida power was restored soon with the majority of stores in his survey indicating power was out an average 2.5 days.

Power outages often wreak havoc on frozen and refrigerated inventory and his survey found several stores in Florida had to purge their entire frozen and refrigerated products.

“We see this as a potential catalyst for a short-term spike in sales as stores restock inventory,” Moskow notes.

In Florida, inventory shipments resumed soon after the storm, but Moskow said some stores reported slow traffic because of limited inventory. Dairy, water, personal hygiene and bread were among those products in most demand and in least supply.

Ahead of Hurricane Irma, Wal-Mart closed more than 350 of its Florida stores. Roughly 27% of Wal-Mart’s stores, including Sam’s Club were in the path of Irma ahead of landfall. The last time Wal-Mart noted a hurricane impact to bottom-line earnings was in 2005 when it took a one-cent charge related to Katrina.

Planalytics projected lost retail sales in the consumer/retail sector to be $1.45 billion from Irma. Target and Costco also had considerable store exposure in Florida at 19% and 12%, respectively.

As bad as Irma was, the losses related to Harvey are expected to be greater. Moody’s estimated Harvey devastation between $86 billion and $108 billion. Thousands were relocated in shelters for days and were being fed by charity. However, Moody’s expects apparel stores to be impacted more than grocery stores.

Dunkin Donuts said it stood to lose $17 million in sales if all of its stores in Florida and Texas were closed for a week. That would be about 10% of the chain’s quarterly U.S. sales, according to Oliver Chen, analyst with Cowen & Company.

Wal-Mart had dozens of stores closed in Texas and hundreds in Florida during the two storms. Analysts expect there to be some material impact on mass marketers like Wal-Mart that might have sold more food at the expense of apparel and other higher margin items over the past couple of weeks.

Chen also said supply chains are expected to be disrupted across the board, which could lead to delays in delivery of holiday inventories for some retailers. That said, Chen expects Home Depot and Lowe’s to benefit in the next quarter or so as homes have to be repaired.