Southwestern Energy CEO says cash-rich Fayetteville Shale still part of future plans

by August 10, 2017 2:57 pm 1,405 views

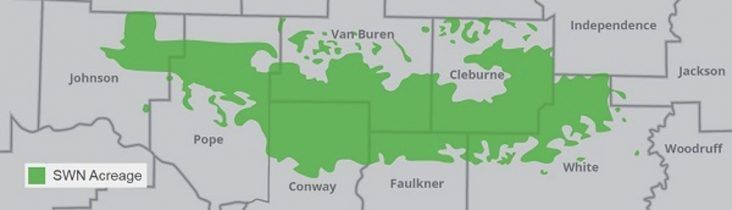

Arkansas' Fayetteville Shale Play.

Although Southwestern Energy has largely halted its exploration and development activities in the Fayetteville Shale play, the company’s top executive said in a recent conference call with Wall Street analysts that the Houston-based drilling still has its eye re-investing in the Arkansas play again once the economics are better.

In an Aug. 4 conference call with top oil and gas analyst, Southwestern CEO Bill Way offered new insight into the company’s plans for the unconventional shale formation when asked about the underlying outlook for the expansive acreage across north-central Arkansas.

Way said the Southwestern overall corporate strategy is to allocate capital based on economics. To do that in the Arkansas play, the company’s goal is to unlock additional value in the Arkansas play by lowering operating costs. That includes improving drilling, natural gas flow and water handling techniques, as well as renegotiating transport agreements that will allow the company to hit its near-term financial targets, said the Southwestern CEO.

“All of those things are designed to drive economic value for Fayetteville up and continue to try to work to position it to attract investment from our investing within cash flow mandate,” said Way, who took over the reins of the company in early 2016.

\Way said Southwestern will use that same strategy in its larger exploration and production operations in northeast and southwest Appalachia to enhance well productivity and improve capital efficiency. In the Fayetteville Shale, where the Houston-based oil and gas producer owns 918,535 net acres, Way said the operations team there is incentivized to chase key performance objectives before the Texas driller makes a major investment again in the region.

“And so, the Fayetteville is an incredible source of cash flow that drives our business going forward in the Northeast and in testing opportunities like the Moorefield and other ventures that are present there,” Way said. “And so, it has a significant value to us in terms of driving our agenda going forward of economic value growth.”

Way’s comments to the Wall Street forecasters came one day after Southwestern pocketed a second quarter net income of $224 million, rebounding from a net loss of$620 million in the same quarter of 2016 when natural gas prices had plummeted below $2 per million British thermal units (MMBtu) on the New York Mercantile Exchange.

Over the past year, Southwestern has upped its capital spending and exploration is in the emerging Moorefield development of the Fayetteville Shale, located largely in the Arkoma Basin in White County. In the first quarter, Southwestern Energy said it planned to increase drilling test wells in undeveloped play to assess the potential of the deep shale reservoir that sits beneath the larger Fayetteville Shale. During last week’s conference call, Way said the untested Moorefield shale development is part of the company’s overall strategy to make the Fayetteville Shale a key driver of the company’s operations again.

For the first half of 2016, Southwestern said it has invested a total of $615 million, including the lion’s share of nearly $601 million invested in its exploration and production business. In the second quarter, $318 million was invested companywide, with a scant $27 million spent on mostly workover activities in the Arkansas play.

Still, Southwestern’s Fayetteville Shale operations saw 82 Bcf (billion cubic feet) of production in the second quarter, compared to 81 Bcf in the first quarter of 2017. Company officials also said the Arkansas play generated another quarter of positive cash flow of more than $425 million, helping to support the growth of its less mature Appalachian basin in the Northeast U.S.

Additionally, Southwestern placed eight already-drilled wells into production in the Fayetteville Shale as natural gas prices continue to improve, rising to nearly $3.235 per million British thermal units (MMBtu) on the New York Mercantile Exchange in the second quarter. Six of the wells placed online targeted the legacy Fayetteville shale and two came online in the emerging Moorefield play.

Way said the learnings from these two wells have been incorporated into the company’s geologic model, with plans to continue testing of the Moorefield with additional results expected in the second half of 2017.