Arkansas’ untried medical cannabis market projected to see sales of $67 million by 2025

by June 27, 2017 5:37 pm 2,505 views

Although Arkansas’ fledgling cannabis sector will not bring in one penny of revenue until early 2018, a highly-cited key industry research report forecasts there are huge growth opportunities for the state’s newest industry that could generate millions of dollars in new revenue over the next several years.

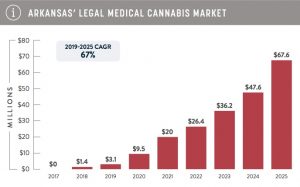

The state’s market is expected to surpass $67 million by 2025. Arkansas will represent a relatively small portion of total U.S. market sales amid other, larger states activating medical and adult use programs over the coming years. By 2025, Arkansas is projected to account for just 0.3% of all legal cannabis sales in the U.S.

On Friday, Arkansas’ cannabis industry will reach its first major milestones when the state Medical Marijuana Commission begins taking applications for the state’s first cultivation facilities. On the same day, consumers can also begin signing up with the state Health Department to receive ID cards to obtain pot prescription for certain medical purposes beginning in early 2018.

According to a recently released market outlook on the legal cannabis industry by Washington, D.C.-based New Frontier Data, medical marijuana use in Arkansas is projected to grow at a compound annual rate (CAGR) of 67% over the first full six years of sales from an estimated $3.1 million in 2019 to over $67 million by 2025.

Nationwide, for Arkansas and other states that have entered the medical marijuana sector, that segment of the cannabis industry is projected to grow annually at a rate of 12% through 2025, from $4.7 billion in 2016 to an estimated $13.2 billion in 2025. During the same period, adult or recreational use sales are projected to grow at a 21% CAGR, from $1.9 billion to $10.9 billion.

ISSUE ‘TRANSCENDS POLITICAL BOUNDARIES’

John Kagia, executive vice president of industry analytics for the D.C.-based data and analytics firm for the cannabis industry, told Talk Business & Politics that the “phenomenal” results from the 2016 election represented “a watershed achievement” for the legal marijuana industry in Arkansas and across the U.S.

“In watching the 2016 election run-up, there were a lot of people who were very surprised by the passage of Arkansas’ (medical marijuana) measure in terms of the recognition that it is a conservative state, and one that as recently as 10 or 15 years ago there was not a lot of appetite in the state for marijuana legalization,” said Kagia, noting that New Frontier does engage in advocacy issues related to the legal marijuana industry.

On Nov. 8, 2016, Americans successfully voted to legalize medical cannabis use in Florida, North Dakota, and Arkansas, while Montana reinstated its medical cannabis program. Voters in California, Massachusetts, Nevada and Maine passed measures for adult or recreational pot use, and the states of Louisiana, Ohio and Pennsylvania each advanced medical bills through their legislatures.

Though many of the state programs will not be operational until 2018, New Frontier’s 431-page analysis notes that legalization of cannabis for adult use in the heavily populated states of California and Massachusetts carries major implications for the evolution of the national market.

Kagia said Arkansas’ voter referendum reflects broader trends that have taken place across the U.S. First, Arkansas voters’ support of medical marijuana shows how quickly public opinion on the legalization of marijuana in the U.S. has changed in the past few years, he said. Secondly, Arkansans overwhelming approval of Issue 6 in November underscores how past political results can no longer predict voter outcomes on medical marijuana.

“The old political divisions that used to make it so easy to tell how support for legalization might fall really don’t apply as much as they use to,” Kagia said. “So, even in red states that supported (President) Trump saw strong support for medical marijuana legalization, (which) … is really now an issue that transcends political boundaries.”

ARKANSAS A POSSIBLE REGULATORY MODEL

Kagia said Arkansas could serve as a prototype for surrounding states looking to enter the medical cannabis marketplace. He said Arkansas’ regulatory model is likely to result in a more streamlined path to market operationalization than has been experienced in Louisiana, which still does not have a functional market. The other five surrounding states, Missouri, Tennessee, Mississippi, Texas and Oklahoma, have not approved measures legalizing pot for medical or adult use but some are considering.

“Arkansas may not provide the largest market opportunity, but its high rate of projected growth and the location of the state will provide an entry point for medical cannabis into the region, fueling calls for reform among neighboring states and providing a regulatory framework on which its neighbors can build,” said the New Frontier analyst.

Other advantages Arkansas’ medical cannabis market will have over other states is that patients from outside of Arkansas with qualifying conditions and medical cards from jurisdictions with similar medical laws may purchase from Arkansas dispensaries during a visit to the state for up to 30 days.

“This represents a significant potential driver for growth in Arkansas’ market, as it is the only state in the region to allow for reciprocity,” the report states.

Arkansas operators also stand to enjoy first movers’ advantages, as they are unlikely to face any competition from neighboring states in the near term as social perceptions will likely drive broader reform down the road throughout the region, according to New Frontier.

“Arkansas’ relative geographic isolation from other legalized markets and the historically lower rates of cannabis use relative to other major medical cannabis markets, there remains the prospect for relatively slower patient registration and thus delayed growth in the first year of the program,” the report states.

On the negative side, Arkansas’ cannabis marketplace could be impacted by regulation that only allows doctors of medicine or osteopathic medicine who hold valid licenses in the state to issue medical marijuana recommendations. Thus, the rate of patient growth may be negatively impacted if the number of physicians willing to participate in the program remains low.

NATIONWIDE MARIJUANA SALES, JOBS PREDICTIONS

Besides the growth projections for all 50 states, New Frontier forecasts medical and adult use cannabis sales will generate $745 million in tax revenue in 2017, $609 million of which will come from cannabis-specific taxes such as the 37% excise tax in Washington state. The remaining $136 million will be earned from state sales taxes applied to all retail sales.

By 2020, tax revenues from cannabis will grow to $2.3 billion, of which $1.8 billion is projected to come from cannabis-specific taxes.

“These forecasts underscore the important role that cannabis taxes will play in driving new revenue for the government, generating funds to cover the costs of administering the cannabis programs, and supplementing states’ general tax funds,” the New Frontier report states.

In state-by-state comparisons, California generated $2.7 billion in medical marijuana sales in 2016, easily exceeding all other states and accounting for 57% of all legal medical cannabis sales. Michigan and Colorado, the second and third top revenue producers, generated sales of $500 million and $439 million, respectively. Arizona and Oregon rounded out the top five with sales of $303 million and $283 million in 2016.

Colorado is the largest adult use state market and was roughly 48% of all adult-use cannabis sales in the country in 2016. By 2020, however, the adult use market will be largely controlled by California, which legalized an adult use market in 2016, and is projected to see over $3 billion in annual adult use sales in 2020.

Another key national trend noted by New Frontier is the estimate for the number of jobs that could be created nationally in legal medical and adult use markets as of 2017. Based on this modeling, New Frontier Data estimates that by 2020 the legal cannabis industry could potentially create over 280,000 jobs in states which now have medical or adult use laws on the books.

“It is also worth noting that, if the number of states with medical or adult use law increases significantly over the next few years, or if there is accelerated large-scale industrialization of hemp in the U.S., the total number of jobs that could be created by the industry could be significantly higher than these estimates,” the report states.

––––––––––––––––––––

Editor’s note: This story is the third in a series of stories on implementation of medical marijuana in Arkansas. The stories are scheduled to be published prior to June 30. Link here for the first story in the series, and link here for the second story.