Survey: Wal-Mart ranks the least favored overall, but first in grocery pickup

by May 10, 2017 12:11 pm 1,220 views

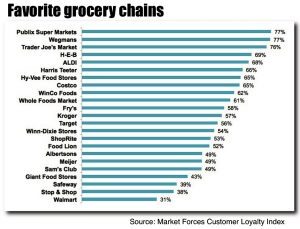

Wal-Mart Stores competitors Publix and Wegmans ranked as America’s favorite grocery retailers in a recent survey conducted by Market Force Information. Trader Joe’s was a close second and H-E-B ranked third among 12,700 U.S. shoppers surveyed.

Publix and Wegman’s tied, scoring 77% on Market Forces Customer Loyalty Index. Publix located in the Southeast moved up to first place from second which it held for the past four years. This is the second year New York-based Wegman’s earned the top grade after it unseated Trader Joe’s last year. Consumers gave Trader Joe’s a loyalty score of 76%. Texas-based H-E-B moved into the top three for the first time with 69%. ALDI and Harris Teeter rounded out the top five at 68% and 66%, respectively.

Bentonville-based Wal-Mart was at the bottom of the favorite list with a loyalty metric of 31%. Sam’s Club fared better at 49%. Kroger and Target were in the middle of the pack with loyalty metrics at 58% and 57%, respectively.

The survey asked shoppers to rank stores on their cleanliness and courtesy of workers. Publix ranked the cleanest and Trader Joe’s was deemed the most courteous. Despite Walmart U.S. CEO Greg Foran’s mission to rate stores on “Clean, Fast & Friendly” scores for the past three years, Wal-Mart did not rank in the top 15 any of those three areas.

Publix ranked first in four of the seven metrics shoppers measured: Fast checkouts, item availability, ease of finding items and store cleanliness. ALDI won the top spot on value by 87% of those surveyed. Wal-Mart ranked sixth in the value area at 58%, and Sam’s Club was fifth at 69%.

Trader Joe’s took the top spot in cashier courtesy at 82% and Publix was next at 77%, Wegman’s was third at 70% and Whole Foods and ALDI tied for fourth place at 68%.

Market Force also asked shoppers to rank retailers on new trends in grocery shopping. More than half (58%) said they prefer shopping for local and organic choices of meat, produce and dairy products. Half also said they prefer organic when given a choice and 93% had purchased organic products in the past month. The most popular organic purchase is produce, followed by meat and dairy.

Market Force also asked shoppers to rank retailers on new trends in grocery shopping. More than half (58%) said they prefer shopping for local and organic choices of meat, produce and dairy products. Half also said they prefer organic when given a choice and 93% had purchased organic products in the past month. The most popular organic purchase is produce, followed by meat and dairy.

Walmart U.S. has expanded its organic produce offerings over the past two year and re-configured produce areas of new stores and remodels so the expanded organic items are easily spotted by shoppers.

Another area consumers say is important to them is convenience. Increasingly, shoppers are filling up their shopping carts online rather than in the store. Market Force found services such as click-and-collect (buy online and pick up at store) and online ordering with home delivery are being embraced across all age groups, particularly millennials.

Wal-Mart came out on top in this area, followed by Kroger, Sam’s Club and Harris Teeter. The use of click-and-collect has more than doubled since 2016, with 9% saying they’ve tried it, compared to 4% in 2016. Of those, 78% were satisfied or very satisfied with the experience.

About 26% of the shoppers using click and collect are frequent users, taking advantage of the service at least monthly. Home delivery services are also growing in popularity – 18% said they’ve used grocery home delivery, compared to 15% in 2016. Most are using the service through general online retailers such as Amazon and Jet (now owned by Wal-Mart). However, 20% were less than satisfied with the experience, leaving ample room for improvement.