Energy In-depth: Murphy USA opens 1,400th store location, now ranks 258th on Fortune 500 list

by January 6, 2017 7:09 am 239 views

Editor’s note: Each Friday, Talk Business & Politics provides “Energy In-depth,” a round-up of energy and regulatory news.

–––––––––––––––––

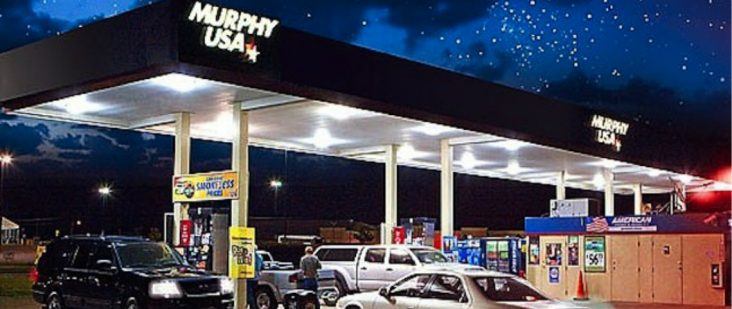

MURPHY USA OPENS 1,400 STORE LOCATION, NOW RANKS 258TH ON FORTUNE 500 LIST

El Dorado-based Murphy USA on Tuesday (Jan. 3) announced the grand opening of its 1,400th location, this one in Lafayette, La. Murphy USA President and CEO Andrew Clyde said the new location in Louisiana represents another important milestone for the company’s goal of growing its branded network by more than 60 stores in 2016.

Murphy USA now has nearly 10,000 employees that serve an estimated 1.6 million customers each day through a network of retail gasoline stations in 26 states, with the majority of the locations near Walmart stores. The El Dorado-based publicly traded concern now ranks 258th among Fortune 500 companies, well ahead of its former parent Murphy Oil Corp. in the 662nd spot.

CHEVRON TO SPEND NEARLY $20 BILLION CAPITAL INVESTMENT IN 2017, 15% BELOW YEAR AGO LEVELS

Although crude oil and natural gas prices are expected to rise in 2017, U.S. oil giant Chevron Corp. has announced the 2016 capital outlays will still be 15% lower than 2016 and 42% below 2015 levels. Chairman and CEO John Watson said spending for Chevron, which will likely serve as a precursor for other global oil and gas companies, will target shorter-cycle time, high-return investments and major projects under construction. In the company’s fourth straight year of reduced capital spending, 70% of Chevron’s outlays are planned for upstream investment that are expected to generate production within two years.

Overall, Chevron plans a $19.8 billion capital and exploratory investment program for 2017, including $4.7 billion of planned affiliate expenditures. In its upstream business, nearly $8.5 billion of planned capital spending relates to base-producing assets, including about $2.5 billion for shale and tight investments mainly in the Permian Basin developments in Texas and New Mexico. Another $7 billion of the planned upstream program is related to major capital projects currently underway, including nearly $2 billion toward the completion of the Gorgon and Wheatstone LNG projects in Australia and $3 billion for projects associated with the Tengiz field in Kazakhstan.

BAKER HUGHES AND EQUITY GROUPS FORM NEW PURE-PLAY ‘FRACKING’ COMPANY

Oilfield giant Baker Hughes Inc., CSL Capital Management and West Street Energy Partners, a fund managed by the Merchant Banking Division of Goldman Sachs, have completed their pending transaction to create the new BJ Services, a pure-play North American land pressure pumping company providing hydraulic fracturing and cementing services.

Baker Hughes is a leading supplier of oilfield services, products, technology and systems to the worldwide oil and natural gas industry, employing over 34,000 across the globe.

The new entity, which was first announced on Nov. 29, 2016, does not include Baker Hughes’ international pressure pumping businesses or its Gulf of Mexico offshore pressure pumping operations, which Baker Hughes will continue to operate.