Despite Lingering Problems, Arkansas Banking Environment Improves

by June 13, 2012 3:11 pm 97 views

It looks like Arkansas banks are off to their best start in three years, despite lackluster loan demand and looming regulatory costs.

That's the lede from Kim Souza with our content partner, The City Wire. She reports that with the downturn in the economy in late 2008, most banks spent the next three years recognizing, downgrading (proper “risk grading”), and “reserving” (for loan losses), their loan portfolios.

Tim Yeager, Arkansas Bankers Chair at the University of Arkansas, said banks across the state and the region are posting healthier balance sheets which is also translating to more retained profits as they have fewer problem loans than in past years.

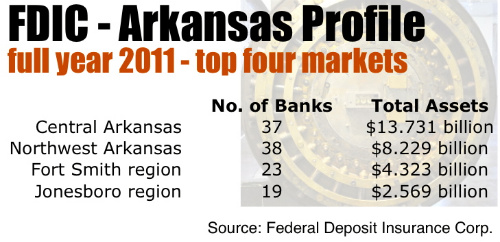

Statewide, the percentage of non-accrual loans averaged 3.4% of the total loans as of March 31, down from 3.86% the year before, according the state banking profile released last week by the Federal Deposit Insurance Corp.

Yeager said the balance sheet improvement

only addresses part of the overall problem.

“Demand for new loans remains weak and the economy is still expected to grow at a slow pace into 2013 — that’s if we don’t slip into recession — which I think is unlikely, but possible,” said Yeager.

You can read more detailed reporting from Souza concerning the northwest Arkansas banking market here and insight from the Fort Smith market at this link.