Roz Brewer: We Want To Be Less of a Walmart

by August 31, 2015 12:00 am 424 views

Over the past few years, Sam’s Club, owned by Wal-Mart Stores Inc. of Bentonville, has worked hard to meet several challenges, including slow sales and aggressive competition from other membership warehouses, such as Costco.

The warehouse-club retailer has initiated a variety of programs and services to meet consumer needs, including travel booking, free health screenings for community members and small business advice.

Still, Sam’s Club’s growth has remained slow, particularly when compared to that of Costco. According to a story from Digiday, Sam’s Club’s “… year-over-year revenue inched up by 0.5 percent in 2014, while Costco’s jumped 6 percent in the same time period.”

The reasons for the lag? Digiday seems to think the problem rests with Sam’s Club’s lack of e-commerce and social media savvy. While Walmart earns high praise from analysts for its social media engagement, Sam’s Club hasn’t even verified its Instagram account. This makes it harder for Sam’s to connect with current and potential members.

“One look at Sam’s Club’s official (but unverified) Instagram account puts this low engagement on harsh display,” Hilary Milnes wrote for Digiday, a media company and community for digital media, marketing and advertising professionals. “The account has 3,500 followers, compared to Walmart’s 191,000, and its posts lack that certain curated je ne sais quoi that has become run of the mill for brands on the platform.”

Milnes also cites reports from L2 Inc. that note a significant difference between Walmart’s omnichannel efforts and those of Sam’s Club.

“However, the parent store’s success comes not only from the products it sells, but also from digital prowess,” Elizabeth Rosen reported recently for L2, a benchmarking and education firm that helps member brands shape their digital roadmap and achieve greater ROI. “Walmart placed second in L2’s 2014 Digital IQ Index for Big Box stores, achieving a ranking of Genius thanks to its thorough investments in digital, from pioneering click-and-collect services to innovative mobile offerings. In contrast, Sam’s Club ranked No. 20, earning a spot in the Average category.”

Still, however, not everyone is convinced that Sam’s woes are due to technology or social media failures. Instead, some believe that Sam’s Club has failed to differentiate itself from its parent company. As a result, the consumer may feel that there is little point in paying an annual membership fee for the privilege of shopping at Sam’s when he or she can just as easily pick up items at Walmart.

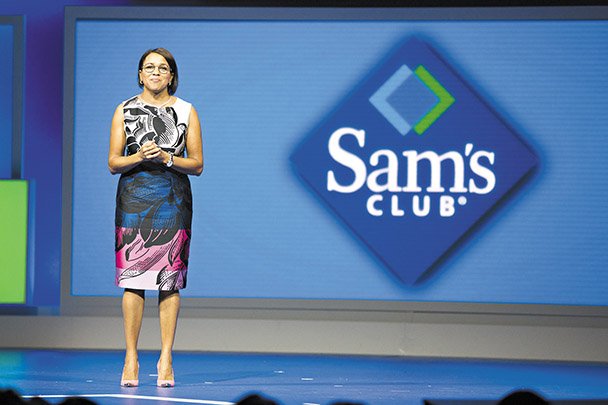

Recently, Sam’s Club president and CEO Rosalind Brewer announced a plan to shake things up a bit. In a statement to The Wall Street Journal (pay wall) Brewer said: “We want to be less of a Walmart.”

In fact, USA Today reports that Sam’s Club leadership is interested in taking the brand the way of Costco by offering premium products instead of low-cost basics.

“… Brewer is trying to direct her brand to go more upscale with products like organic food and name-brand clothing,” USA Today reported.

This project, however, may prove easier said than done. USA Today noted that, of the 650 Sam’s Clubs in the United States, 200 of them are attached or next to a Walmart store. In fact, over 80 percent of Sam’s members have also shopped at a Walmart within the past month. As some analysts have noted, these close ties may result in the cannibalization of Sam’s Club’s profits by Walmart’s customers.

Improvement Possibilities

Still, there are some real possibilities for improving things at Sam’s. In addition to more innovation in the areas of e-commerce and mobile apps, greater attention to social media could make a huge difference in how the public perceives Sam’s Club. In fact, a stronger social media effort could further differentiate Sam’s from Walmart, potentially attracting a new and different demographic.

Another consideration is real estate. As the USA Today article noted, Sam’s Club warehouses are primarily located in rural Mid-America. Costco, on the other hand, has ventured onto the coasts and has managed also to penetrate several upscale suburbs and city neighborhoods, such as Chicago’s South Loop and Lincoln Park neighborhoods.

A more affluent clientele may be more willing to spend money up front for a membership. This demographic may also be interested in saving money on bulk organics or designer fashion. Young entrepreneurs may also take a keen interest in Sam’s bulk offerings and small business services.

One strategy may be moving Sam’s Club into more affluent areas, including urban locations. Walmart has already had some success with its Neighborhood Markets in larger cities, and Sam’s Club may be able to tap into those connections to test new clubs in new markets.

Sam’s Club may also have some leverage with socially conscious shoppers. Over the past several years, parent company Walmart has strengthened its position on ethical, sustainable sourcing of the products it sells. There’s been a particular focus on compliance within the food supply chain. Recently, Costco has received media attention for a lawsuit involving labor practices in its supply chain.

Bloomberg News reported in August that Costco is being sued over claims it was selling shrimp that was harvested using slave labor.

“Issaquah, Washington-based Costco’s purchases of Thailand’s farmed prawns, which are fed a diet of cheap fish caught at sea with unpaid, forced labor, helps prop up an industry whose practices are ignored by local authorities, according to the complaint filed [Aug. 19],” Bloomberg reported.

By redoubling its social media efforts, Sam’s Club could reach out to consumers with information about Walmart’s sustainability and compliance practices. This might encourage social media users to consider the advantages of a Sam’s Club membership.

While Sam’s Club certainly has its work cut out, striking out on its own and forging its own brand may prove to be a wise strategy. A lot is changed since Sam’s Club opened its first warehouse, including the way small business owners actually do business.

By learning where its natural membership is, reaching out more through online channels, and making use of the data it generates, Sam’s Club may well be able to pull ahead and lead the membership club pack once again.