The Compass Report: Growth slows, but remains healthy in Arkansas’ top metro areas

by March 13, 2024 4:46 pm 1,114 views

Data from the fourth quarter The Compass Report shows that building activity, sales tax revenue and slightly muted job growth helped support healthy economies in Arkansas and the state’s top four metro areas during the final quarter of 2023.

The Compass Report is a partnership between the University of Arkansas at Fort Smith and Talk Business & Politics. First National Bank of Fort Smith sponsors the statewide report.

The report measures four leading and four current economic indicators to provide a grade for a regional economy. The eight categories measured to determine The Compass Report grade in the Central Arkansas, Fort Smith and Northwest Arkansas areas are total nonfarm jobs, unemployment rate, building permits, sales tax revenue, manufacturing jobs, service sector jobs, construction jobs, tourism jobs and concentration of manufacturing jobs. Because the data is not available, construction and tourism jobs are not included in the Jonesboro metro grade.

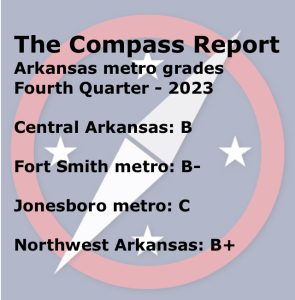

In the fourth quarter 2023 report, Central Arkansas received a “B” grade, the Fort Smith metro had an “B-” grade, the Jonesboro area received a “C” grade, and Northwest Arkansas had an “B+” grade.

A key factor in understanding the report is understanding the “grading” approach used to measure the current and leading economic indicators. For example, a grade of “C” reflects no change in economic activity. The grades “B” or “A” indicate improvement above the historical average, and “D” and “F” indicate a decline in economic activity compared to the historical average.

SUSTAINED GROWTH

Kendall Ross, executive director of the University of Arkansas at Fort Smith Center for Economic Development, said data analysis gave the Arkansas economy a B+ grade in the fourth quarter.

Troy Rodriguez, an intern in the UAFS Center for Economic Development who helps compile, manage, and review the data, said regional, state and national economies did well despite some headwinds.

“Despite heightened interest rates and increases in unemployment, the fourth quarter of 2023 witnessed sustained economic growth. Gross Use and Sales Tax are holding steady over the regions, signaling strong consumer confidence, while positive developments in building permits and overall non-farm employment back this. Businesses and consumers alike both play a role in sustaining a healthy economic environment,” Rodriguez wrote.

Mixed messages are part of the state and national economies, but most indicators are stable, according to Greg Kaza, an economist and executive director of the Arkansas Policy Foundation.

“Arkansas’ economy is sending mixed signals, with growth in local jobs and building permit valuations but higher unemployment rates aligning with, mirroring or nearing pre-pandemic levels. The exception is Northwest Arkansas, with above-average jobs and an unemployment rate low by historical standards. Overall, Arkansas’ economy is stable, with growth in the construction sector and building permits suggesting the economic expansion will enter its fifth year in May,” Kaza noted.

TOP TAKEAWAYS

Following are some of the key takeaways from Ross and Rodriguez included in The Compass Report.

Central Arkansas witnessed a modest uptick in the unemployment rate compared to the previous year, reflecting a stabilization of economic conditions post-pandemic. Despite this, the region experienced growth in non-farm employment, indicating resilience and recovery in the labor market.

Northwest Arkansas

The valuation of building permits for housing witnessed a noteworthy surge from the fourth quarter of 2022 to the fourth quarter of 2023. The total valuation for the fourth quarter of 2023 amounted to $423.4 million, marking a substantial increase compared to the $322.2 million valuation in the fourth quarter of 2022, representing a 31% rise.

Fort Smith Metro

Non-farm employment experienced a growth of 0.86% year-over-year, adding 1,100 jobs from December 2022 to December 2023, reaching an estimated 117,000 positions compared to 116,000 in the corresponding month of the previous year. When analyzed quarter-on-quarter, the metro area showed consistent non-farm employment trends, albeit with a slight decrease observed in Q2 2023.

Jonesboro Metro

Economic conditions in the Jonesboro MSA from December 2022 to December 2023 showed a mixed outlook. While the average unemployment rate increased slightly, it remained consistent with pre-pandemic levels observed in 2019. The labor force experienced a slight decline, and non-farm employment remained stable, with a minor decrease compared to the previous year.

DATA AND MORE ANALYSIS

Link here for the third quarter 2023 raw data gathered by the University of Arkansas at Fort Smith Center for Economic Development.

Link here for the quarterly narrative.

Also, link here for the first quarter report, link here for the second quarter report, and link here for the third quarter report.