The Compass Report: Economic resiliency continues in Arkansas’ top metro areas

by December 15, 2023 10:16 am 1,141 views

Resilience in most key economic factors resulted in Arkansas and the state’s four top metro areas continuing positive trends, with broad job gains being a primary growth driver, according to analysis in the third quarter 2023 The Compass Report.

The Compass Report is a partnership between the University of Arkansas at Fort Smith and Talk Business & Politics. First National Bank of Fort Smith sponsors the statewide report.

The report measures four leading and four current economic indicators to provide a grade for a regional economy. The eight categories measured to determine The Compass Report grade in the Central Arkansas, Fort Smith and Northwest Arkansas areas are total nonfarm jobs, unemployment rate, building permits, sales tax revenue, manufacturing jobs, service sector jobs, construction jobs, tourism jobs and concentration of manufacturing jobs. Because the data is not available, construction and tourism jobs are not included in the Jonesboro metro grade.

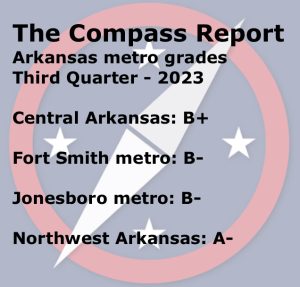

In the third quarter 2023 report, Central Arkansas received a “B+” grade, the Fort Smith metro had a “B-” grade, the Jonesboro area received a “B-” grade, and Northwest Arkansas had an “A-” grade.

A key factor in understanding the report is in understanding the “grading” approach used to measure the current and leading economic indicators. For example, a grade of “C” reflects no change in economic activity. The grades “B” or “A” indicate improvement above the historical average, and “D” and “F” indicate a decline in economic activity compared to the historical average.

‘HEALTHY LABOR MARKET’

Kendall Ross, executive director of the University of Arkansas at Fort Smith Center for Economic Development, said the U.S. economy remained robust but down slightly from the second quarter.

“The third quarter of 2023 saw continued economic growth, albeit slightly slower than the previous quarter. Consumer spending remained strong, supported by rising wages and a healthy labor market. Businesses continued to invest but more cautiously as interest rates began to rise. Inflation remained elevated but showed signs of cooling,” Ross noted.

“The third quarter of 2023 saw continued economic growth, albeit slightly slower than the previous quarter. Consumer spending remained strong, supported by rising wages and a healthy labor market. Businesses continued to invest but more cautiously as interest rates began to rise. Inflation remained elevated but showed signs of cooling,” Ross noted.

Ross also added an analysis of the overall Arkansas economy in the third quarter report.

“Arkansas displayed economic resilience with notable increases in non-farm employment and remarkable drops in the unemployment rate. Although sectors like construction and hospitality showed consistent growth, fluctuations in housing permit valuations and minor declines in manufacturing employment signal challenges in specific sectors. The varied performance across industries suggests a requirement for vigilant monitoring to navigate market fluctuations and sustain growth,” noted part of the statewide review.

Greg Kaza, an economist and executive director of the Arkansas Policy Foundation, said job growth was the primary driver of economic health in the state and four metro areas.

“Nonfarm payroll employment, the broadest local level economic indicator, expanded in all four Arkansas regions analyzed in the report. How to characterize this growth? Robust in Northwest. Resilient in Central Arkansas, Fort Smith, and Jonesboro. Overall, employment expanded by 19,700 jobs, a 1.46% year-over-year increase, according to the report, while the unemployment rate recorded an impressive decline,” Kaza noted.

He also noted that the recent decline in inflation bodes well for the overall economy.

“Inflation, a problem identified in earlier reports, remained elevated but shows recent signs of cooling, another positive sign. A decline in inflationary expectations is one key to the ‘soft’ economic

landing that avoids recession,” he said.

KEY TAKEAWAYS

Following are some of Ross’ key takeaways in the four metro areas.

Central Arkansas

Sectors like trade, transportation, and utilities experienced minor declines, while leisure and hospitality saw a remarkable 9.82% increase in employment. Robust growth in gross sales and use tax collections underscores a thriving economy. Overall, the region’s varied sector employment growth and minimal unemployment rate position it well, despite potential challenges in construction.

Northwest Arkansas

Although the unemployment rate saw a minor uptick from 2.3% to 2.5% in September 2023, it remains at or below pre-pandemic levels, while the labor force expanded by 4.2%. Gross sales and use tax collections showcased substantial growth, particularly in August, marking the region’s second-highest value for the year, indicating a flourishing economic expansion and heightened commercial activity across Benton, Madison, and Washington counties.

Fort Smith region

The labor force expanded by 2%, with 120,500 individuals engaged in employment or actively seeking work in September 2023. Of the 10 sectors measured, five showed employment increases, including construction, education and health services, leisure and hospitality, other services, and government, while transportation and utilities, manufacturing, and professional and business services faced declines.

Jonesboro

Building permit valuations generally decreased, notably in July and September, despite a rise in August 2023, reflecting fluctuations in this sector. The area received a commendable B+ grade for gross sales and use tax collections highlighting robust commercial activity.

DATA AND MORE ANALYSIS

Link here for the third-quarter 2023 raw data gathered by the University of Arkansas at Fort Smith Center for Economic Development.

Link here for the quarterly narrative.

Also, link here for the first-quarter report and link here for the second-quarter report.