Manufacturing sector growth slows in March, prices continue to rise

by April 1, 2022 10:48 am 547 views

The manufacturing sector grew at a slower pace in March as the index that tracks the growth fell to the lowest level since September 2020, according to the Institute for Supply Management (ISM).

The ISM released Friday (April 1) the Manufacturing ISM Report on Business that shows the Purchasing Managers’ Index (PMI) fell by 1.5 percentage points to 57.1% in March, from February. It was the lowest reading since the 55.4% in September 2020. A PMI above 50% indicates the manufacturing sector is growing.

According to the report, new orders, production and employment increased, while supplier deliveries slowed at a slower rate. Order backlogs and raw material inventories rose. However, customers’ inventories remained low, and prices increased. Also, exports and imports rose.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment,” said Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee.

“In March, progress was made to solve the labor shortage problems at all tiers of the supply chain, which will result in improved factory throughput and supplier deliveries. Panelists reported lower rates of quits and early retirements compared to previous months, as well as improving internal and supplier labor positions. March brought back increasing rates of price expansion, due primarily to instability in global energy markets. Suppliers are not waiting to experience the full impacts of price increases before negotiating with their customers.

“Panel sentiment remained strongly optimistic regarding demand, with six positive growth comments for every cautious comment, down from February’s ratio of 12-to-1,” Fiore added.

Panelists said their ability to hire continues to improve and to a greater degree compared to February. They continued to struggle with turnover, which has affected their ability to adequately staff their organizations, but to a lesser degree than in February. Fiore pointed to timing issues as to why production expanded “at disappointing levels.” He noted that prices have risen for the 22nd consecutive month, “at a dramatically higher rate compared to February.”

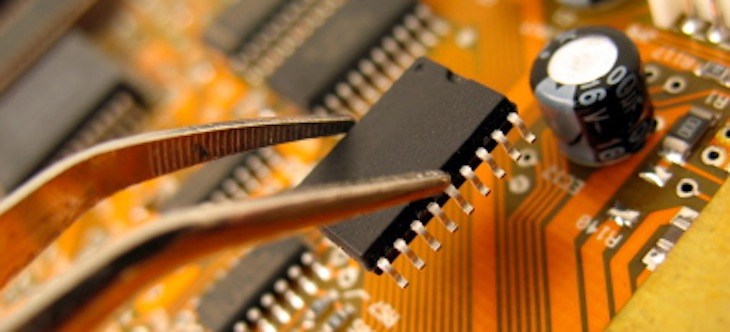

Following manufacturing industries reported moderate to strong growth in March: food, beverage and tobacco products; machinery; transportation equipment; chemical products; and computer and electronic products.

“Manufacturing performed well for the 22nd straight month, with demand registering slower month-over-month growth likely due to extended lead times and consumption softening slighting due to labor force improvement,” Fiore said. “Omicron impacts are being felt by overseas partners, and the impact to the manufacturing community is a potential headwind.”

A respondent in the computer and electronic products industry said supply chain challenges have yet to letup, especially in electronic components, and are relying more on the broker market. In the chemical products industry, a respondent said “customer orders are brisk in the face of significant price increases, while we continue to struggle with inbound supplier service and raw materials availability issues.”

A respondent in the transportation equipment industry said business for aerospace component manufacturers is slowly improving. Purchasing continues to be busy amid supply chain disruptions and extended lead times. This has led the company to reevaluate its 2022 business plan and cost estimates. In the food, beverage and tobacco products industry, a respondent said the Russian invasion of Ukraine has “created uncertainty in the grain markets, causing upward pricing pressure. In addition, inflationary pressures across all categories have made it challenging to manage cost and profitability.”

A respondent in the furniture and related products industry was still determining the impact of the Russian invasion of Ukraine. Other respondents highlighted the continued challenges related to the supply chain, labor and inflation.

“The supply situation is getting worse, with lead times extending over 12 months, material not available, and suppliers not quoting or taking orders,” according to a respondent in miscellaneous manufacturing. “Prices on the rise daily.”