Trade wars with China look to raise consumer prices

by May 9, 2019 2:51 pm 409 views

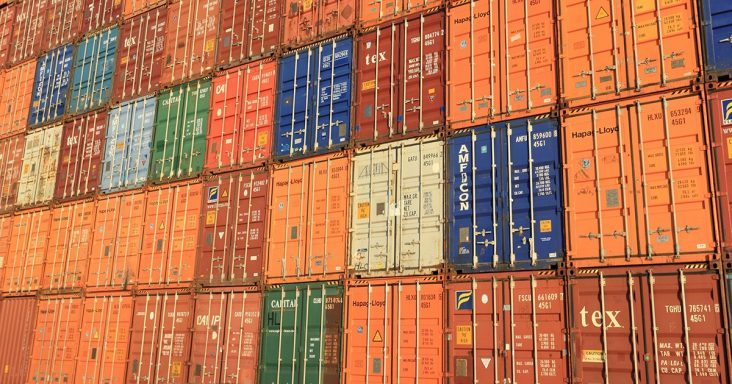

Escalating trade tensions with China are expected to hit some sectors harder than others. This week retail stocks have tumbled amid the threat of higher tariffs on $200 billion worth of Chinese goods from 10% to 25%.

President Donald Trump also said there will be an additional 25% tariff levied on $325 billion worth of Chinese goods not previously impacted.

A report from Princeton University analyst Kirill Borusyak estimated the average American family will see increased costs of $127 per year from the increased tariffs on Chinese goods. The impact varies based on what consumers purchase. The categories seeing the biggest impact include televisions, solar panels, apparel and electronics.

Retailers are feeling the impact of the increased tariffs. The Dow Jones Retail Index also fell on Thursday (May 9) to 1,138, down 4.55 points. Since Monday, the retail index has lost 35 points on trade tensions with China and the fallout of increased tariffs.

Walmart shares (NYSE: WMT) tumbled more than 3% in the past two days falling from $102.45 to $98.85 in the morning session on Thursday.

“The new tariff threat could cause soft lines [apparel retail] stocks to drop 40%,” wrote UBS analyst Jay Sole, who covers discounters like TJX Cos., Ross Stores and Burlington. “If 25% of tariffs are enacted, it could catalyze further US retail disruption. Many retailers are already struggling. New tariffs, plus the probable accompanying drop in demand, could accelerate the pace of store closures, which is already at a peak.”

Goldman Sachs also noted retailers Big Lots, Dollar Tree and Five Below could also see the most negative impact from these increased tariffs of consumer goods. The furniture sector is also expected to suffer from the jump from 10% to 25%, according to Goldman Sachs.

That said, home specialty retailer Williams Sonoma has been working for several months to mitigate the impact on these tariffs. In the company’s November earnings call executives outlined a plan to order ahead and also move some sourcing away from China, negotiating better prices with suppliers elsewhere on the globe. The company also worked to move some of the upholstery work to the U.S.

“Between all these moves and also some mix shifts and some selective price increases we’re prepared for the worst,” CEO Laura Alber said on the call.

Also in November, Target CEO Brian Cornell told analysts the retailer was looking at several levers to pull to minimize the impact. Walmart also told the media it has been tactical and did pull some orders forward ahead in anticipation of the increased tariffs.