Solid quarter, year and decade for Murphy USA

by February 1, 2023 3:50 pm 830 views

It was a good quarter, a good year and a good decade for Murphy USA.

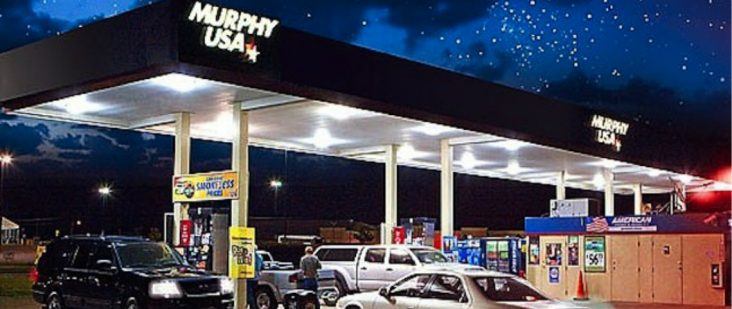

The El Dorado-based, publicly-traded gas and convenience store chain spun off into its own publicly-traded company in 2013 and leadership noted that the decade-long ride has been a good one filled with growth and strong earnings.

“Performance in 2022 demonstrates how far we have come in the nearly ten years since we first reported results as a public company in 2013,” said Murphy USA President and CEO Andrew Clyde. “We have invested in critical areas of the business to ensure our ongoing success, including assembling an engaged and experienced leadership team that has helped drive cultural and operational change. We have consistently executed against our clear and coherent strategy to grow the network, improve store performance, enhance differentiated capabilities, and optimize our cost structure to sustain and grow our competitive advantage in the market. We have allocated capital in a focused and disciplined manner, resulting in significant store growth and more than 50% reduction in outstanding shares since our spin.”

“Looking out over the next decade, we continue to see an equally attractive opportunity set of growth and capability building investments to further improve the business. With an attractive free cash flow profile, a healthy balance sheet, and strong momentum heading into 2023, we expect to continue our track record of value creation for long-term investors,” Clyde added.

Murphy USA reported Wednesday (Feb. 1) fourth quarter net income of $117.7 million, up from $108.8 million a year ago, while annual net income leaped nearly 70% year-over-year to $672.9 million.

Murphy USA reported fourth quarter revenue of $5.366 billion, up from $4.767 billion a year ago. Full year revenues topped $23.446 billion for Murphy USA compared to $17.360 billion in 2021.

Other financial highlights include:

- Total retail gallons increased 7.8% to 1.2 billion gallons in Q4 2022 compared to 1.1 billion gallons in Q4 2021;

- Volumes on a same store sales basis increased 4.0%. For the year 2022, total retail gallons increased 9.2% to 4.8 billion gallons and increased 5.4% on a same-store basis;

- Merchandise contribution dollars for Q4 2022 increased 4.2% to $189.0 million on average unit margins of 19.1%, compared to the prior-year quarter contribution dollars of $181.4 million on unit margins of 19.6%;

- For the full year 2022, merchandise contribution dollars increased 9.3% to $767.1 million and average unit margins were 19.7% in 2022 compared to 19.1% in 2021.

During the fourth quarter of 2022, Murphy USA repurchased approximately 800,000 common shares for $239.5 million at an average price of $283.05 per share. For the year 2022, the company repurchased 3.3 million shares for a total of $806.4 million at an average of $242.24 per share.

Murphy USA (NYSE:MUSA) shares closed trading Wednesday at $270.50. The company’s stock has traded between a low of $164.30 and a high of $323.00 per share over the last year.