Manufacturing sector contracts for first time in more than 2 years, ISM says

by December 1, 2022 3:01 pm 667 views

Economic activity in the manufacturing sector contracted in November for the first time since May 2020 after 29 consecutive months of growth, according to the Institute for Supply Management (ISM).

The ISM released Thursday (Dec. 1) the November Manufacturing ISM Report on Business that shows the Purchasing Managers’ Index (PMI) fell by 1.2 percentage points to 49% in November, from October. A reading below 50% indicates the manufacturing sector is contracting. Still, the PMI figure indicated the overall economy expanded for the 30th consecutive month.

According to the November report, new orders declined, but production rose. Order backlogs decreased, while supplier deliveries accelerated. Raw materials inventories rose, and customers’ inventories were in “just right territory.” Prices declined, and exports and imports fell.

“The U.S. manufacturing sector dipped into contraction, with the Manufacturing PMI at its lowest level since the coronavirus pandemic recovery began,” said Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee. “With Business Survey Committee panelists reporting softening new order rates over the previous six months, the November composite index reading reflects companies’ preparing for future lower output.”

The report shows that panelists’ companies have been managing labor through a combination of hiring freezes, employee attrition “and now layoffs.”

“Panelists’ companies continue to judiciously manage hiring,” Fiore said. “Other than October 2022, the month-over-month supplier delivery performance was the best since February 2012, where it registered 47%, and material lead times declined approximately 9% from the prior month, approximately 18% over the last four months. Managing head counts and total supply chain inventories remain primary goals. Order backlogs, prices and now lead times are declining rapidly, which should bring buyers and sellers back to the table to refill order books based on 2023 business plans.”

The following two manufacturing industries reported weak-to-moderate growth in November: petroleum and coal products and transportation equipment. Four other manufacturing industries reported growth in November: apparel, leather and allied products; nonmetallic mineral products; primary metals; and miscellaneous manufacturing.

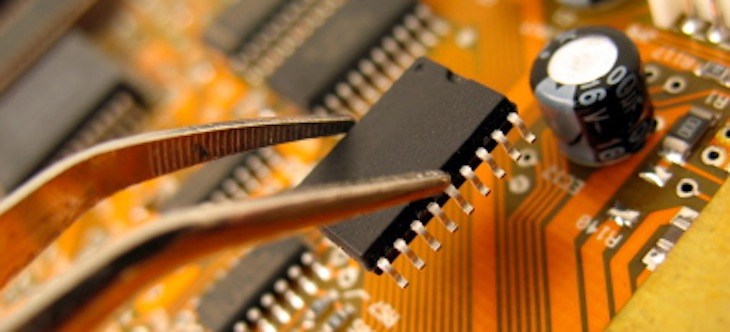

In the computer and electronic products industry, a respondent said “customer demand is softening, yet suppliers are maintaining high prices and record profits. Pushing for cost reductions based on market evidence has been surprisingly successful.” A respondent in the transportation equipment industry said orders for transportation equipment remain strong. Supply chain issues continue but have had little effect on output.

Multiple respondents noted a decline in customer order volumes amid concerns about economic uncertainty. A chemical products industry respondent said “future volumes are on a downward trend for the next 60 days.” In the food, beverage and tobacco products industry, a respondent said “consumer goods are slowing down in several of our markets, although the U.S. economy seems decent. Cannot say the same for the European economy.”

A respondent in the machinery industry said “many of our key customers are reducing their capital expenditures spend.” A respondent in the electrical equipment, appliances and components industry said “overall, things are worsening. Housing starts are down. We’re doing well against our competitors, but the industry overall is down. We’re sitting on cash (that is) tied up in inventory.”

In miscellaneous manufacturing, a respondent said “inflation seems to have peaked, but commodity price decreases have not been passed through to us. Lots of unknowns regarding impact to the European Union from the Russia-Ukraine war and questions about customer behavior in 2023.”

A respondent in the nonmetallic mineral products industry noted caution going into 2023 but said “the commercial section of construction seems to still be going strong.” And in the primary metals industry, a respondent said overall business conditions improved slightly from the previous month.