Walmart not likely to see major shortages from Suez Canal issue, but retail inventories will be stressed

by March 31, 2021 1:21 pm 2,507 views

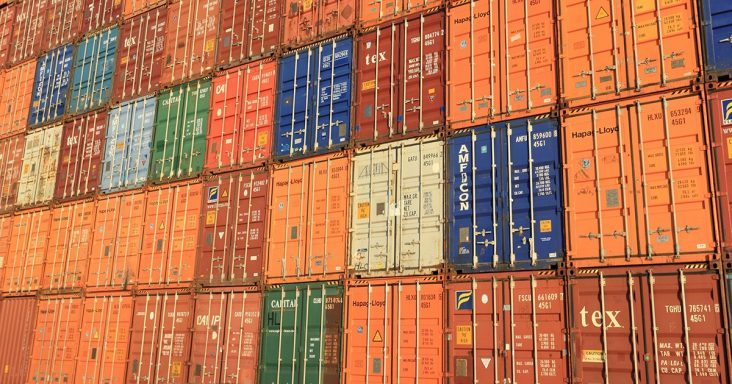

While the recent Suez Canal blockage grabbed headlines for several days, it merely adds more pressure to a global supply chain problem that hit almost every global economic sector after the COVID-19 pandemic hijacked economies and significantly shifted consumer behavior.

That’s the broad sentiment of Greg Forbis, senior vice president of strategy and business development at Woodridge, Ill.-based RJW Logistics Group, whose experience includes more than 30 years with product shipping at Walmart Inc.

Tugboats and other vessels recently freed the large cargo ship Ever Given after being stuck in the Suez Canal for six days. More than 350 cargo ships carrying everything from oil to cattle to furniture and manufacturing components could not use the strategic canal in Egypt. In 2020, more than 50 ships per day on average passed through the 120-mile long waterway, accounting for around 12% of global trade.

Logistics Consultant Jon Monroe told CNBC the canal blockage would hit a critical part of the global supply chain.

“Containers are already scarce in China, and the backup in the Suez will further stress the inventory,” Monroe said in this report. “We are back to a pre-Chinese New Year environment where factories are running at full steam and are struggling to find containers as well as space for their finished goods. Before the Suez Canal disruption, we were expecting the container situation to get worse in April because we were already seeing the scarcity of containers. This canal closure will not help. You will start to see product piling up on factory floors.”

INVENTORY SHORTAGES

Forbis, who is based in Bentonville, told Talk Business & Politics that Walmart uses a “multiple port split” to mitigate product delays resulting from supply chain problems such as the Suez problem. He said the Bentonville-based global retailer will see some product shortages and inventory issues, but not like most other retailers.

“They’ve limited their exposure to the west coast (ports) as much as possible. I think they will still experience delays, but it has helped them to mitigate a lot of what retailers that are only coming in through” west coast ports will see, Forbis said.

He also estimated any product shortages would take time to become an issue for consumers. He also said some of the items that could be delayed in getting to store shelves or see shortages include spring apparel, home goods, outdoor living products, and “hard goods” used to assemble other consumer products.

“You may not see the impact immediately. It may be two to three to four weeks before we see the impact of goods on the shelf at retailers,” Forbis said. “The port pressures on the west coast have not eased, and I don’t see them easing anytime soon.”

To that point, the National Retail Federation recently reported that 93% of retailers surveyed have inventory shortages and 52% estimated three weeks of delay in meeting inventory demands.

‘BIG UNKNOWN’

Forbis said most food sold by Walmart and other grocers is typically sourced domestically and is not likely to be part of inventory problems. It’s the same for toilet paper, of which much is produced in Canada and Mexico, he said.

Forbis cautiously estimated that global supply chain pressures could ease by the end of summer but said the “big unknown” is how consumers spend when the economy begins to open up as more Americans are vaccinated. If consumers shift from spending on goods and services like travel and entertainment, it will ease demand and the associated pressure on major ports and the overall supply chain.

“How does the economy return? I think that’s the big question,” Forbis said.

Walmart did not respond to several requests from Talk Business & Politics for comment about any Suez-related impacts on its supply chains. Judith McKenna, CEO of Walmart International, provided this statement to the NRF: “Walmart sources globally from countries around the world and we have an extremely diversified supply chain. We actually source many of our products locally. 93% of products we sell in Mexico are sourced from Mexico, for example, and nearly two-thirds of products purchased in the U.S. are made, grown, or assembled stateside. We have teams that are working hard to ensure supply chain events like this one have as little impact on our customers as possible. We are monitoring it closely.”

Springdale-based Tyson Foods, which depends on shipping to reach its global export markets, said the Suez Canal blockage did not disrupt its operations.

“The Suez Canal blockage has no immediate impact on our U.S. exports. The blockage primarily affected trade between Europe and Asia, two import regions within our global supply chain. We do not anticipate any material impacts to our business but will continue to monitor trade between the two regions and make adjustments accordingly,” the company noted in a statement to Talk Business & Politics.

Senior Talk Business & Politics reporter Kim Souza contributed to this report.