Ascena Retail bankruptcy results in nine store closings in Arkansas

by July 27, 2020 12:28 pm 5,449 views

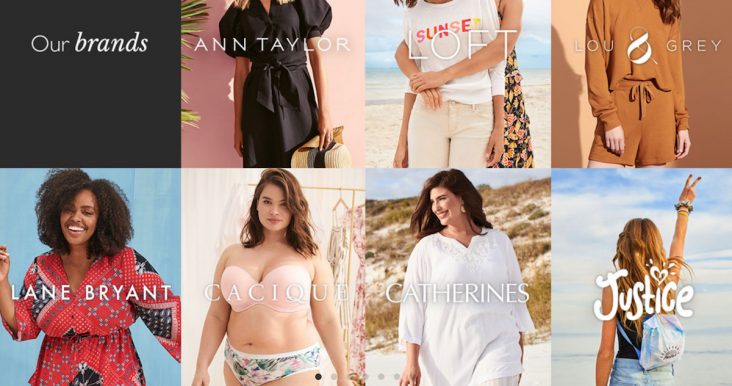

Ascena Retail Group, parent of Ann Taylor, LOFT, Lane Bryant, Catherines, Justice and Lou Grey stores, filed bankruptcy July 24 and plans to close more than half of its nearly 3,000 retail stores. There are nine stores in Arkansas slated for closure.

Following are the store closures in Arkansas.

• Justice — NWA Mall in Fayetteville

• Catherines— Massard Farms Shopping Center in Fort Smith

• Justice — Central Mall in Fort Smith

• Catherines — Ashley Square Shopping Center in Little Rock

• Justice — Park Plaza Mall in Little Rock

• Justice — Promenade at Chenal in Little Rock

• Catherines — Lakewood Village Shopping Center in Little Rock

• Justice — Pinnacle Hills Promenade in Rogers

• Lane Bryant — Pinnacle Hills Promenade in Rogers

The Mayway, N.J.-based retailer was recently given access to more than $430 million in cash by the bankruptcy court. The retailer said the funds were necessary to manage its day-to-ay operations.

Among the 1,100 store closures, all of the Catherines stores, that sells plus size clothing, will shutter. Also, a significant number of Justice stores for girls and some Ann Taylor and Loft stores in non-performing locations. It’s been less than a year since Ascena liquidated its Dressbarn business and sold off the Maurices chain. Ascena has agreed to sell the intellectual property of the Catherines business unit to plus-size retail City Chic, who has been the stalking-horse bidder for Catherines’ assets.

“We are pleased to have received prompt approval of these first-day motions, which will enable us to continue providing our associates with wages and benefits, maintain our outstanding relationship with our vendor community and serve our customers across our brand portfolio with fashion, inspiration and meaningful experiences every day. We are appreciative of the strong support from our lenders to help mark a new start for our company. By entering into a comprehensive plan to deleverage our balance sheet, right-size our operations and inject new capital into the business, we will be better positioned to deliver profitable growth of our iconic brands and drive value for all of our stakeholders,” said Gary Muto, Ascena’s CEO.

Ascena entered into a restructuring support agreement with more than 68% of its secured term lenders. The prearranged financial restructuring plan is expected to significantly reduce Ascena’s debt by about $1 billion. The next hearing is when Ascena hopes to get approval on the $150 million term loan from existing lenders. This financing, plus the company’s cash flow from its businesses, according to the company, is seen as sufficient to meet its operational and restructuring needs. The company also reached an agreement with creditors to reduce its debt by $1 billion during the restructuring.

Ascena has Kirkland & Ellis LLP serving as legal counsel, Alvarez and Marsal Holdings LLC serving as restructuring adviser and Guggenheim Securities LLC serving as financial adviser.

According to the company, COVID-19 cut short progress the company was making in turnaround efforts last year and up until the outbreak. However, Ascena has long suffered from weak sales and profits and was hampered by large debt. All all closing stores will feature storewide discounts on all merchandise.

“Because of the compelling discounts and the highly desirable merchandise, we expect this will be a short sale across all stores,” said Aaron Miller, executive vice president of SB360. “Customers are encouraged to shop early while quantities last as many of their favorite styles may go quickly.”