Murphy USA revenue and income up in the first quarter, ‘well-positioned’ for COVID-19 impact

by April 17, 2020 12:25 pm 613 views

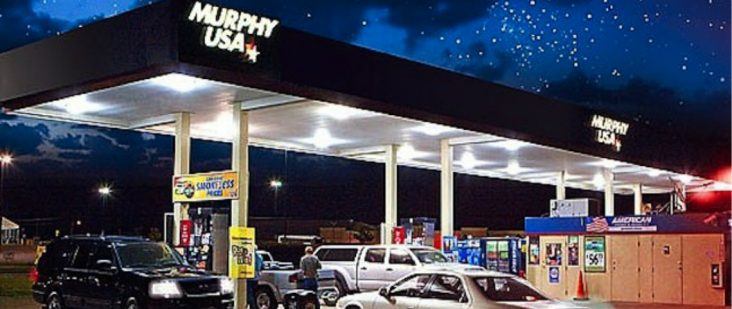

El Dorado-based Murphy USA beat revenue and earnings estimate on first quarter results, with the company CEO saying the fuel retailer is “well-positioned” to survive economic uncertainty arising from the COVID-19 global pandemic.

Revenue in the first quarter ended March 30 was $3.184 billion, ahead of the $3.116 billion in the same quarter of 2019 and above the consensus estimate of $3.16 billion. Earnings in the quarter totaled $89.3 million, well ahead of the $5.3 million in the same quarter of 2019. Earnings per share of $2.92 beat the consensus estimate of $2.50.

Wall Street liked the results, with the share price up more than 5% in mid-day trading.

“Despite exceptional first quarter performance, our business faces unprecedented risks and unknown challenges stemming from COVID-19 as the resiliency of our economy, our public health system, and our citizens are put to the test,” President and CEO Andrew Clyde said in the earnings statement.

However, Clyde said the company began to see COVID-19 impacts in mid-March – near the end of the quarter. He said the company is withdrawing guidance on fuel sales and not updating guidance on full-year 2020 income.

“As the COVID-19 pandemic impacts all sectors of the global economy, beginning in mid-March we have seen a reduction in customer count that has impacted our business. Most notably, fuel volumes have declined below our previously issued 2020 guidance range of 250,000 to 255,000 average gallons per store month. For this reason, we are withdrawing our 2020 retail fuel volume guidance. The commodity environment for crude oil and refined gasoline and distillates remains volatile and while the current retail fuel margin is significantly higher than our 5 year historical averages, we cannot forecast when that margin environment will decline. Therefore, we are unable to provide any updated assumptions for modeling purposes for net income or Adjusted EBITDA for the remainder of 2020 at this time. Our other 2020 guidance metrics regarding organic growth, fuel breakeven, corporate costs and capital allocation remain unchanged.”

The company had $2.48 billion in fuel sales during the quarter, below the $2.499 million in the same quarter of 2019. Merchandise sales totaled $687.5 million in the quarter, better than the $606.2 million in the same quarter of 2019.

Murphy USA opened two new retail locations in the first quarter, bringing the store count to 1,491, consisting of 1,161 Murphy USA sites and 330 Murphy Express sites. There are 15 stores under construction and include 5 new retail locations and 10 kiosks undergoing raze-and-rebuild that will return to operation as 1,400 square-foot stores.

“In times of crisis, companies with robust business models will successfully navigate through the uncertainty and we believe Murphy USA is well-positioned to continue serving our customers, our employees, and our shareholders in this environment. While near-term demand remains uncertain, our customers continue to rely on us for their core fuel and merchandise needs and we remain committed to serving them,” Clyde said.

Murphy shares (NYSE: MUSA) were at $108.50 in mid-day trading, up from the previous close of $102.86. During the past 52 weeks the share price has ranged between $121.24 and $78.75.