COVID-19 prompts Fannie Mae, Freddie Mac to adopt alternative appraisal methods

by March 25, 2020 10:39 am 6,854 views

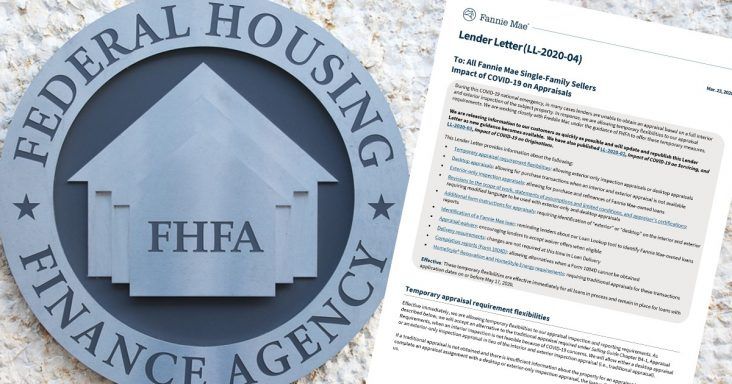

The Federal Housing Finance Agency (FHFA) on Monday (March 23) directed Fannie Mae and Freddie Mac to ease their standards for both property appraisals and verification of employment. The agency said the reason for the decision is the “extraordinary circumstances” the country is facing during the COVID-19 (coronavirus) pandemic.

Among the changes to some of the underwriting guidelines will be to allow exterior-only inspection appraisals or desktop appraisals. The FHFA says the measures are aimed at supporting immediate needs for liquidity in the secondary mortgage market. The agency will continue to monitor development and update its policies when necessary.

The went into effect immediately for all loans in process. They will remain in place for loans with application dates on or before May 17, 2020. A PDF of the letter with information on the guideline adjustments is available here.

The FHFA has taken other action in response to the national emergency, including a suspension of foreclosures and evictions for at least 60 days and offering forbearance for borrowers facing hardship due to coronavirus.

Steven Plaisance is president and chief executive officer of Arvest Bank’s mortgage division, the largest mortgage lender in Arkansas currently serving more than 310,000 mortgage loans, totaling more than $59 billion.

Plaisance also serves on the Residential Board of Governors of the national industry trade association Mortgage Bankers Association (MBA). The board is responsible for establishing legislative and regulatory policies and positions for the MBA on residential lending issues. Plaisance and others provided early input and have been in regular communication for several weeks with FHFA and other housing agencies affected by the COVID-19 pandemic.

“We were very pleased to see prompt action by the FHFA and subsequent announcements by Fannie Mae and Freddie Mac, who provide liquidity for the majority of conventional financing in the United States,” Plaisance said. “We are all in this together, trying to help our families improve their financial situations through refinancing and buying homes, so we are pleased to see our valuable appraisal partners assisted at this time.”

Plaisance expects the temporary flexibilities in the traditional appraisal process will help mortgage lenders get loans closed and through the pipeline more efficiently. But the mortgage industry, he said, was already flooded with business in a very short period of time. A new report from California-based Attom Data Solutions, which tracks national housing and foreclosure data, said the total number of loan originations in the U.S. rose 40% annually during the fourth quarter of 2019 to 2.27 million, which is the highest point since the third quarter of 2016.

“Capacity overtook the industry quickly, so customers should be patient and expect delays for a variety of reasons,” Plaisance said. “Now the effects of COVID-19 are impacting appraisals, employment for borrowers, documentation efforts, ancillary services, county and city clerk offices, potentially title and closing companies, and many other partners in the home loan process.

“For now, all lenders are trying to close as many loans as quickly as they can.”

Plaisance said there’s been no indication — other than they are monitoring the situation — that other secondary market loan programs such as the Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA) or U.S. Department of Agriculture (USDA) will institute similar measures. Those loan programs are generally higher risk, starting with low to no down payments, and often consist of more purchase-money transactions so collateral relief may be difficult.

“The conventional loan market is predominantly refinancing with these low rates, which made some of their relief on appraisals much easier to apply,” he said. “It would be a surprise to see much, if any, relief from [FHA/VA/USDA].

“The same can be said for jumbo investors, where loans of more than $510,400 are categorized. The collateral risk is too important to shortcut and we don’t anticipate relief from the secondary market investors.”

Plaisance said Arvest recently suspended interior home inspections on nearly all of the bank’s in-house portfolio loans.

“That was a welcome relief to our appraiser partners during a very challenging time for all,” he said.