Fayetteville’s The Cabana Group is the fastest-growing private company in Arkansas

by October 22, 2019 1:51 pm 3,939 views

Chadd Mason is the CEO and co-founder of Cabana Asset Management, a fee-only Registered Investment Adviser (RIA) and a wholly-owned subsidiary of The Cabana Group LLC.

Chadd Mason has a passion for helping people. It’s a trait that helped him build a successful law practice in Northwest Arkansas as a plaintiff’s attorney. It’s also a quality that’s serving him well in his second career, quietly building one of the fastest-growing boutique financial advisory firms in the country.

Mason combines the specialized knowledge of both professions as the chief executive and co-founder of Cabana Asset Management, a fee-only Registered Investment Adviser (RIA) and a wholly-owned subsidiary of The Cabana Group LLC.

Launched a decade ago, the company’s rapid growth of late has gained the attention of some third-party rankings. In July, Cabana Asset Management was once again recognized by Financial Advisor (FA) magazine as one of the fastest-growing RIAs in the country.

With more than $600 million in assets under management at the end of 2018, Cabana’s 102% growth year-over-year ranked No. 2 among all RIAs with $300 million or more under management.

The firm ranked No. 1 on FA’s fastest-growing list in 2018. That landed Mason and his business partner Louis Shaff on the cover of the August issue of the monthly publication, which boasts a circulation of 110,000. Shaff is a college friend with a finance background and also a law practice in Dallas.

The company’s success also earned The Cabana Group a spot on Inc. magazine’s well-regarded annual list of the 5,000 fastest-growing private companies in America. Rankings for 2019 — published in September — were based on how fast a business’ revenue grew from 2015 to 2018. Cabana grew revenue 652% during that time, making it the fastest-growing private company in Arkansas. It also put the company at No. 25 among all financial services companies in the U.S.

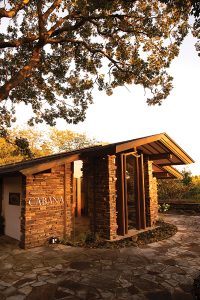

During a recent interview inside the company’s headquarters — in an E. Fay Jones-designed building on School Avenue in south Fayetteville — Mason said he never envisioned the kind of success the company has enjoyed.

“From day one, our mission has been to reliably help individuals, small businesses and major institutions reach their long-term financial goals by improving their overall experience as an investor,” he said. “Our steady growth tells me we’re having some degree of success in doing just that.”

PORTFOLIO RISK ANALYSIS

With offices in Arkansas, Texas and Colorado, Cabana Asset Management provides portfolio construction and sub-advisory money management services to nearly 6,800 clients nationwide.

It is the largest locally owned independent wealth management firm in Northwest Arkansas, according to the annual list published by the Northwest Arkansas Business Journal in the Oct. 14 issue.

Cabana offers a unique investment approach that numerically quantifies expected risk in the construction of its target drawdown series of portfolios. The maximum amount an investment can be expected to fall from peak to trough is the drawdown.

The portfolios use a proprietary algorithm, developed by Mason, his uncle, James Mason (who has a doctorate in statistics) and David Covington (who also has a doctorate), a quantitative analyst and former University of Arkansas professor.

The algorithm is designed to help protect investors from risk by actively allocating assets to the current market environment. Cabana numerically quantifies acceptable risk levels by identifying a target drawdown percentage at the beginning of the investment process, intending to stay within that range.

The strategy, Mason said, allows clients to remain fully invested at all times, to minimize drawdown, while still actively participating in favorable market conditions. The investment approach has been so successful among advisers and investors that the firm’s assets under management are now approximately $1 billion.

“We’re particularly proud to have introduced what we believe is a better way of quantifying and managing risk to thousands of individuals across the country,” Mason said. “I look forward to continuing our growth by changing the way advisers and their clients view the investment process.”

The portfolios are available to individual investors and advisers through several industry-leading custodians, including TD Ameritrade, Charles Schwab and Fidelity.

Though Cabana does work with a number of high-net-worth individuals and business owners, much of the company’s growth can be attributed to providing portfolio management to institutions and advisers around the country.

The firm’s services also include financial planning, retirement planning, tax services, workplace benefits and legacy planning. Cabana also has a law group that offers legal services, including asset protection and securities litigation. The holistic business model lets Mason and his team address both clients’ legal and financial needs.

PATH TO FINANCE

Mason, who is a Fayetteville native, earned a psychology degree from the University of Arkansas. A background in finance did not come naturally.

“I squeaked by college algebra,” he joked.

Mason’s post-graduate degrees include a law degree from the University of Denver and a Master of Laws from Thomas Jefferson School of Law, a private law school in San Diego. He started his legal career in Northwest Arkansas in 1993 with Martin, Trumbo and Sterling before hanging his shingle two years later.

It was a series of events — including a family misfortune — that sparked Mason’s passion for investment management. Mason’s grandfather, a successful businessman and investor, died in 1997 with a sizeable estate. His grandmother died less than a year later. Mason was close to his grandparents, spending most of his childhood summers with them in south Arkansas.

His grandfather’s estate ended up in the trust department of a large national bank.

“Then the tech bubble burst in 2000,” Mason recalled. “My granddad’s funds had been sold and put into other assets of the bank. By 2002, about 50% of his money was wiped out. I tried to get to the bottom of it, and in doing so, I realized that’s just how the industry worked. I kept hearing, ‘If you invest and the market goes down 50[%] or 60%, you lose 50[%] or 60%.’

“At that moment, I thought to myself, ‘If what I am understanding about the investment industry is the truth, then this is crazy.’ And as a lawyer, you are trained to do something. You don’t sit there and take it. You do something.”

While that was happening, Mason was still immersed in his law practice and was involved with a significant injury case in North Carolina. More than 100 NASCAR fans were hurt at then-Lowe’s Motor Speedway when the pedestrian bridge they were crossing collapsed on May 20, 2000. Mason represented one of the injured families and was the first case filed in federal court. Two years later, Mason won a sizable fee in the damage suit.

With the payout, Mason used the opportunity to step back from “living in a courtroom for a decade,” and pivot to a finance career.

He immersed himself in that, too.

“I went and bought the book ‘Investing for Dummies.’ Literally,” he said. “I learned the difference between a stock and a bond and the fundamentals of how investing works. I became obsessed to a large degree. There are a lot of similarities, analytically, between building portfolios and investing to what I did as a lawyer.”

For the next two years, he read more books: math books on option strategies and other topics. By 2005 he had become interested enough that he decided to start a hedge fund with Shaff. In 2007, it was converted to an RIA and named Cabana, a homage to their penchant for family beach vacations.

“What I enjoyed about the law was being on the side of the little guy,” Mason said. “That is something you will find with most plaintiffs’ lawyers. My background was in psychology, and I have a certain ‘social worker’ mentality, so I could always find something good about any of my clients.

“I decided I wanted to be able to offer whatever insight I had in investing to everyday people. You can’t do that in a hedge fund. With a hedge fund, you are only able to work with accredited investors. That didn’t resonate with me to the extent of being able to help clients that are everyday people. Those are the people who don’t have access to the trust departments or stockbrokers.”

Mason said developing strategic distribution partnerships will be a significant part of the company’s growth story in the next few years.

“It goes back to that dream I had in 2008 and 2009, [of] trying to make it more efficient and easier for people to access,” he said. “We’re going to make it easier for advisers and the public at large to access our models.”