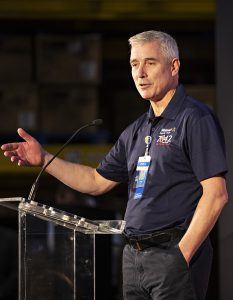

Walmart U.S. CEO Foran shares insights on growth opportunities, challenges, competitors

by March 6, 2019 6:22 pm 4,242 views

It’s been nearly five years since Greg Foran took over as CEO of some 4,700 Walmart U.S. stores. Speaking to investors at the UBS Consumer and Retail Conference in Boston on Wednesday (March 6), Foran said the retail giant has made progress to grow comp sales, reduce inventory and improve assortment and quality, but there is more work to be done.

Foran said Walmart is not close to where it needs to be when he looks at metrics like Net Promoter Scores for customer experience.

“For sure we are doing better, but we haven’t come close to arriving,” he said. “There are more opportunities to take the business further in areas like quality of fresh, in-stock rates and quality of private brands. I am excited about the opportunity.”

He pegs Walmart at 50% of where it needs to be but added it will never reach 100% as the bar will continue to move. Foran said the transformation has taken shape and while the vast majority of stores are performing better, there are still laggards. Foran said much of the delay lies in the size and scale of Walmart with roughly 1.2 million employees. He said the focus has narrowed in recent months toward raising the performance of the bottom cohort. Foran said additional pressures have been applied to store managers and their market managers who each oversee 10 stores to get the units to a better profitability standpoint.

USING TECHNOLOGY

Foran also said Walmart continues to test technology in the stores to increase efficiencies in things like improving out of stocks, better customer experience and reduced shrinkage. He said Walmart is always looking to connect the technology it uses back into the ecosystem. For instance, the robotic floor cleaners also scan end cap displays and record inventory shortfalls which are communicated back to store management.

The fast unloader has proven to be worth the cost and Walmart plans to put the backroom sorting machines in 1,400 stores. Foran said it’s no fun unloading a full truck but that’s been the way Walmart ships because the freight bill is more than the cost of running an entire distribution center. He said Walmart is also working to create pile-ready pallets that can be delivered straight to the stores.

He said the fast unloader helps drive higher in-stocks – more products on shelves – because the machine knows which items need to get to the floor the fastest. Under the old system, he said the shelf would stay empty until the night stocker came to work, found the items and restocked. Now items go straight to the store for stocking as soon as the truck is unloaded.

He said the retailer will continue to work around self-checkout to become smarter and identify the item being scanned to help Walmart reduce shrinkage. Walmart is also going to offer customer refunds at the front door with help from the host that is replacing the greeter. He said that includes cash refunds which will be rung up at the self-checkout. He said that will keep customers from having to walk through the store to the service desk and should create a better customer experience.

“How to take friction out and improve the experience for customers and reduce our costs,” is how Foran said Walmart continues to look at employing technology. He said the cadence at which Walmart is rolling out new technology feels right but the pace will increase.

As a merchant, Foran said more work needs to be done to simplify the assortment.

“When I walk with buyers through a store, I often pick on Ritz Crackers because there are nine different variants of this item,” Foran said. “What are we doing here? Fresh is a big deal and we haven’t totally got this right. Meat has improved. OTIF – On-Time-In-Full- which we have worked on closely with suppliers is better today. But, you would be horrified if I told you what it was a few years ago. If we don’t get the order on time, then nothing else works.”

ONLINE GROCERY

Foran said online grocery is part of the muscle Walmart has built over the past three years and the retailer continues to learn how to do this better. He said the work has been staggering to add online pickup to 1,000 stores this year.

“With just over 1,000 stores added this year, that’s 20 stores a week, each and every week,” he said. “It’s a big deal. It takes a lot of work. We don’t just show up at the store and say ‘you’re in online grocery.'”

Foran said eight employees have to be trained, permits must be obtained for the store remodel, part of the building requires new paint, refrigeration and freezers have to be added, staging areas have to be made, and part of the parking lots have to be reconfigured.

“We have to do that 20 times a week, every single week,” Foran said. “We have become better at it over time and I love the way associates have jumped into this. The most coveted job in a Walmart store is to be on the online grocery team.”

Foran said stores that offer online grocery outperform stores that don’t. He said online grocery creates a halo effect for the entire store as personal shoppers become customers. He said a critical statistic is the first-time pick rate, which is an indication of how efficient the store is performing with respect to fresh quality, and substitution items because of out-of-stock.

“These stores have better visibility into their own inventory and processes than ever before and this raises total performance,” Foran said.

Walmart said it is adding more general merchandise to the online grocery option with items like back-to-school or other seasonal fares. The retailer must also make sure it makes sense from a profit and efficiency standpoint given the personal shopper has to cover the 200,000 square-foot box which requires more time. With more consumers using online grocery pickup, it is creating some congestion in the aisles of stores which Walmart is working to address.

“We had this discussion on Monday at our officer’s meeting,” he said. “… We pick eight orders at once and if the store is doing X orders a week that is quite different from the store that is doing 4X orders a week. We are looking at what happens when we are starting to cap this thing out. Is there some automation that can be put in and added on the store and not disadvantage our most profitable customer which is the one who drives to the store and does all the work themselves?”

He said the Supercenter format continues to be reimagined to more resemble a hybrid retail store and fulfillment center. Foran said Walmart is experimenting with store reconfiguration in some of its remodels. He said one area being discussed is the amount of square footage allowed for greeting cards and photo processing. Foran said getting the blend right continues to be a work in progress to be efficient for online grocery and pickup, provide adequate services and the relevant assortment of general merchandise for those who shop brick-and-mortar.

He said in plenty of towns around the country the Walmart and the Baptist church are likely to be the two nicest places in town. He quickly said that’s not true of Boston or Long Island, but it is true in other areas like Meridian, Miss., or Muskogee, Okla., or the south side of Chicago. He said in those communities Walmart is a large employer and it provides clothes and food to the majority of the citizens.

“Walmart is a big conglomerate, but it is really 4,700 neighborhoods each different from the other. We are in many ways the fabric of this country.” Foran said.

CHASING COMPETITORS

Foran was candid about how Walmart thinks about its competition. He said of Amazon’s plans to delve more heavily into grocery formats, there is plenty to learn.

“I love competing,” he said. “Bring it on because I think competition makes us better. Believe me, when we heard Lidl was coming, that was a galvanizing moment for the stores on the eastern seaboard in states like North Carolina and Virginia. Walmart people got fired up in this region, remodeled stores, we invested in price and wages and took the challenge.”

As a long-time competitor with Aldi, another German-based hard discounter, Foran said he never underestimates them.

“They are fierce and they are good,” he said. “They have done a good job remodeling stores, adding more organic and improved their offering … People love saving money on staples. The best Aldi stores are often in the highest income areas of the city serving smart shoppers who want to save money where they can.”

He said Lidl is about to turn on its store openings now with three distribution centers in the U.S. He said Walmart is ready to compete with whomever it faces. At some point, Walmart became Goliath and it has plenty of Davids throwing stones its way, Foran said.

“We have about six Davids we think about, people that attack us such as drug stores, traditional supermarkets, Amazon, hard discounters and other discount stores,” Foran said. “We sit on large acreage and at any given time, there are multiple Davids in that proximity. We don’t try and combat every aspect they do. We try and sit down to figure out what are the 20% of the things that are worth 80% of what they do which we need to deal with. That’s how we think about it.”