U.S. Marshals Museum Foundation donates $24,200 to sales tax campaign

by March 7, 2019 7:45 pm 1,852 views

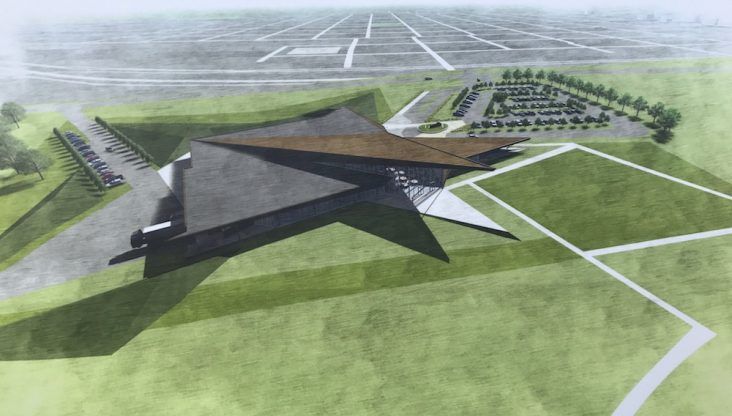

Rendering of aerial view of the planned U.S. Marshals Museum in downtown Fort Smith.

A pre-election filing required by the Arkansas Ethics Commission shows that the committee campaigning for a nine-month, one-cent sales tax increase to fund the U.S. Marshals Museum has raised $24,200 and spent $23,966.

The Fort Smith Board of Directors in December approved an ordinance for a March 12 election on the tax. Early voting began March 5. The ordinance governing the special election for the sales tax requires that the tax is imposed for only nine months. The museum foundation will pay the city’s cost of the special election. If passed, the sales tax will raise around $16 million of the remaining $17 million needed to complete the museum. The museum has raised enough money to pay for the construction of the facility, which began in July 2018. The remaining funds are needed to build the exhibits and “experience” of the museum.

A local-option ballot question committee is formed with the Arkansas Ethics Commission when a group receives contributions or spends more than $500 to advocate for or against a local ballot issue.

The March 5 pre-election filing by “Building the Future Committee” shows that all the money for the campaign was donated by the U.S. Marshals Museum Foundation. As to expenses, $23,678 was paid to Paris Marketing & Public Relations for “campaign marketing services,” and $287.38 was paid to U.S. Marshals Museum employee Alice Alt as reimbursement for stamps, supplies and mileage.

The committee was filed Jan. 10 with the Arkansas Ethics Commission to campaign for the tax. Jim Dunn, president of the U.S. Marshals Museum Foundation, serves as committee president and Bob Hornberger is listed as treasurer. Other committee members listed were: Patrick Weeks, president of the U.S. Marshals Museum; Alice Alt, USMM vice president of development; Jennifer Seaton-Rambo; Robert A. Young III; Doug Babb; Jim Spears; Rusty Myers; Fred Williams; and Philip Merry.

Opposing the tax is the “Citizens Against Unfair Taxation” committee which filed Feb. 7 with the commission. Committee officers are Frank Glidewell, president; Robbie Wilson, treasurer; Melissa O’Neal, campaign manager; and Eddie Zeiler, secretary. Committee members listed are Mark McCourt, Maryanne Meyerriecks, Jack Swink, and Larry Wilson.

A financial report was not included with the committee’s Feb. 7 filing, but the group has 15 days to report finances following the month in which it collected or spent more than $500. The group also was required to file a pre-election report no later than seven days before March 12, and a financial report within 30 days after the election.

Citizens Against Unfair Taxation did not file a pre-election report by the March 5 deadline.