Group forms to oppose Marshals Museum tax, says project could be a ‘white elephant’

by January 30, 2019 6:40 pm 2,157 views

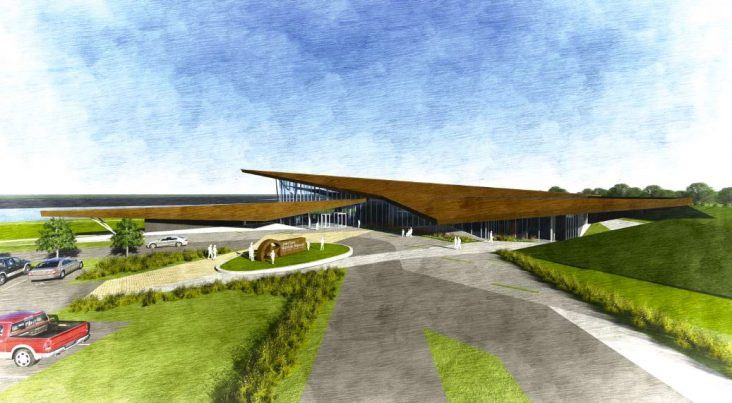

A view of the U.S. Marshals Museum in downtown Fort Smith.

An organized effort has formed to oppose a one-time, one-cent sales tax to benefit the U.S. Marshals Museum in Fort Smith.

The Fort Smith Board of Directors in December approved an ordinance for a March 12 election. The ordinance governing the special election for the sales tax requires that the tax is imposed for only nine months. The museum foundation will pay the city’s cost of the special election.

The sales tax will raise the remaining $17 million needed to complete the museum. The museum has raised enough money to pay for the construction of the facility, which began in July 2018. The remaining funds are needed to build the exhibits and “experience” of the museum. Revenue from the sales tax will complete the museum’s capital needs, the museum states on its website, where they also note that museum officials will not ask for a tax extension.

Fort Smith attorney Joey McCutchen, founder of the Transparency In Government Group of Western Arkansas, and Robbie Wilson, one of the lead organizers of Citizens Against Unfair Taxation, held a press conference Wednesday (Jan. 30) to state their reasons for opposition to the proposed Marshal Museum tax.

McCutchen said the museum concept was “sold to the voters of Fort Smith as a privately funded enterprise, and that seeking a tax to fund this museum is a betrayal of the trust of the citizens of Fort Smith.” McCutchen said members of the U.S. Marshals Museum Foundation have said the tax is necessary for the museum to open on time (summer of 2020) and that they have no Plan B if the tax fails. That assertion, McCutchen said, is false.

“They have a Plan B. That is just a threat. There are numerous options. They can wait. If it takes two years to raise the funds, wait two years. If it takes three years, wait three years. They also can downsize. That’s what private industry does. If you only have $35 million, you build for $35 million. They also can take out a loan to pay for it,” McCutchen said. “It is not right. It is not fair to create this false sense of urgency, to have started a building before they raised all the money for it and then call for special election.

If passed, the tax would be highly detrimental to those struggling to live paycheck to paycheck, Wilson said.

“Arkansas ranks as the most regressive tax system in America, according to a recent study conducted by the Institute on Taxation and Economic Policy. The people of Fort Smith are struggling with high utility bills, a low median income and we have already been subsidizing this project for years, yet these developers are asking for more,” Wilson said.

McCutchen said his goal is to “educate voters and shed sunlight on this project which could quickly become a white elephant just like the River Valley Sport Complex and Fort Smith Convention Center.”

“We are seeing the same blueprint with the Marshals Museum. If it is owned by (the Public Facilities Board) and it goes belly up, what happens? If it doesn’t make money, will those five citizens (members of the PFB) have any responsibility for the project?” McCutchen asked.

According to information on the tax, an independent PFB will be created by the Fort Smith mayor with Fort Smith citizens appointed to it by the Fort Smith Board of Directors. This PFB will own the facility and grounds, however, the USMM, not the City, will manage the museum.

“The Arkansas Constitution and laws enacted by the Arkansas Legislature require that public funds (proceeds from a Gross Receipts or Sales Tax) be expended for public purposes. In this case, Fort Smith’s Board of Directors will establish an independent PFB, governed by five citizens, who will use Sales Tax receipts from the temporary penny sales tax to purchase the Museum’s building and grounds,” notes the Marshals Museum website.

The PFB will lease the building and grounds to the USMM, which will be solely responsible for the operation of the museum, including all operational expenses,” the museum’s site states.

This PFB will not be responsible for the museum’s sustainability, said Jim Dunn, president of the U.S. Marshals Museum Foundation.

“The ordinance (that calls for the sales tax election) as it was drafted, specifically provides that neither the PFB nor the city has any financial responsibility for the museum except for the tax revenue,” Dunn said. “It will be the responsibility of the museum board to find a way to make certain the museum runs within its means.”

The museum is governed by up to 22 members of the board of directors, 12 of whom are of the area and three who are representatives of the U.S. Marshals Service. The remainder are from elsewhere in the country. There are 20 members of the board, the museum’s site states.

McCutchen also questioned who would serve on the PFB board and if it would be the same group of “downtown elitists who control every development in Fort Smith.” Geffken said citizens would apply for the PFB, and the board of directors would appoint the members.

Those opposed to the tax will host a panel discussion at 6:30 p.m. Thursday (Jan. 31) in the community room of the Fort Smith Public, 3201 Rogers Ave. Panel members will include former State Sen. Frank Glidewell, Fort Smith Director George Catsavis and McCutchen and possibly others. Wilson will serve as moderator.