Home prices rise, multifamily vacancy rate falls in Northwest Arkansas

by October 9, 2018 10:01 am 1,630 views

Average home prices continued to rise and reached record highs in the first half of 2018 in Northwest Arkansas as construction costs increased and lot availability declined, according to a new real estate report. Also, the vacancy rate of the Northwest Arkansas multifamily market fell to 3.9%, from 4.2% in the same period in 2017, as apartments were added and rents rose.

Fayetteville-chartered Arvest Bank on Tuesday (Oct. 9) released the Skyline Reports on residential and multifamily real estate for Benton and Washington counties. The biannual reports are completed by researchers at the Center for Business and Economic Research (CBER) in the Sam M. Walton College of Business at the University of Arkansas.

In the first half of 2018, average home prices in Washington County rose 12.3% to $235,618, from the same period in 2017. In Benton County, the prices rose 4.9% to $238,098. Over the past five years, average home prices have risen 35.4%, from $173,979 in the first half of 2013, in Washington County and 28.4%, from $185,000, in Benton County.

Johneese Adams, senior vice president and mortgage manager with Arvest Bank in Fayetteville, said the average cost of homes is going up quickly, and she doesn’t see that changing as people continue to move to the region. Homes sales have moderated recently, and prospective buyers are tentative with the rising prices. They are looking in the price range of between $195,000 and $260,000.

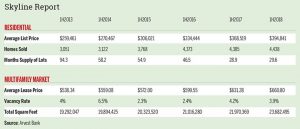

Between 2013 and 2018, the average list price for a Northwest Arkansas home has risen 52.2%, from $259,461 to $394,841. Over the same period, home sales have increased 45.5%, from 3,051 homes sold to 4,438 homes sold. In the first half of 2018, home sales in Northwest Arkansas rose 1.2%, from the same period in 2017.

CBER Director Mervin Jebaraj said several factors have caused home prices to rise, including labor and material costs and the declining number of lots on which to build new homes. The supply of remaining lots in active subdivisions rose to 29.6 months in the first half of 2018, from 28.9 months in the first half of 2017. However, over the past five years, the supply has fallen 68.6%, from 94.3 months in the first half of 2013.

More people are leasing apartments instead of buying homes because apartments are often closer to amenities and considered to be more affordable, Jebaraj said. As a result, the multifamily real estate market continues to add more multifamily developments while the vacancy rate of the properties doesn’t increase.

The lack of lots has prospective buyers who want new homes are looking to buy in areas further from amenities. Adams said one thing possibly leading buyers to lease instead is the myth that buyers must have a large down payment in order to buy a home. But, she said, there are options that don’t require large down payments.

Over the past five years, the square footage of Northwest Arkansas’ multifamily market has increased 22.8% to 23.68 million square feet. Over the same period, the vacancy rate has fallen from 4%. Since the second half of 2017, the vacancy rate has declined from 4.5%.

Between 2013 and 2018, the average lease price for apartments has risen 22.7%, from $538.34 to $660.80 per month. The average price includes studio, by-the-bed and one- to four-bedroom units. The price has risen 4.7%, from $631.28 in the first half of 2017. From the second half of 2017, the price has risen 2.4%, from $645.62.

Adams said Arvest Bank is working with residential and multifamily developers to meet the rising housing demand as Northwest Arkansas continues to grow at a steady and healthy rate. She added that “at the same time, our mortgage department continues to see strong demand from consumers. The tighter supply of homes, coupled with this continued strong demand, makes it increasingly important for homebuyers to get pre-qualified for mortgages so they can act quickly.”

The bank will soon release a mobile app that allows customers to apply for a home loan in the app and receive a quicker response on whether they are approved for the loan.

In August, Arvest released a Skyline Report on the commercial market for the first half of 2018.