Two controversial energy projects running through Arkansas on opposite paths in 2018

by January 25, 2018 3:42 pm 2,611 views

Two long-planned, controversial and expensive multistate energy projects with similar routes across Arkansas – one high-wire and the other underground – appear to be at opposite ends of their life cycles entering the new year.

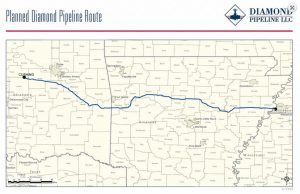

And while Arkansas lawmakers loudly called for a halt to Houston-based Plains and Eastern Clean Line Energy’s $2.5 billion wind energy project in the past week, another Texas partnership in the same city has quietly begun shipping crude oil in a 20-inch pipeline project that spans 300 miles through the center of Arkansas.

According to a quarterly 10Q filings with the federal Securities and Exchange Commission (SEC) by San Antonio-based Valero Energy Corp. and Plains All American Pipeline of Houston, construction on the $925 million Diamond Pipeline project was substantially completed in late October. The 50-50 joint venture between Plains and Valero finished line-fill operations in early to mid-November, and commercial operations were expected to start up in December, SEC filings show.

Diamond Pipeline spokesman Karen Rugaard confirmed with Talk Business & Politics the Houston-based joint venture began operations sometime in December, not specifying the date or volume of crude oil now flowing through the dirt-covered pipeline due to competitive reasons.

“Some of the market [information] we can’t discuss, but there may be more information in the earnings call,” Rugaard said of Plains’ fourth quarter and yearly financial report scheduled Feb. 7.

In August 2016, the controversial 440-mile crude oil pipeline project received approval from a state administrative law judge at the state Public Service Commission (PSC). Judge Susan D’Auteuil’s order said the project met all the statutory requirements to grant the Texas joint venture the right to build the controversial pipeline, despite eminent domain protest from landowners living near several pristine watersheds along the snaking route of the project.

According to recent SEC filings, the 200,000-barrel per day pipeline will deliver premium light, sweet crude from Plains’ facility at the world’s largest oil storage complex in Cushing, Okla., across Arkansas to Valero’s 195,000-barrel per day refinery in Memphis.

SEC filings also show the pipeline now has the ability into connect into the Capline Pipeline project, another 1.2 million-barrel per day crude oil line that transports refined products from Plains’ St. James, La.-based trading and refinery hub on the Gulf Coast into the Midwest fuel market near Chicago.

Like the Plains and Eastern Clean Line wind energy project, the route for the Diamond Pipeline project snakes west-to-east across several of the state’s critical water sources. They include the Arkansas River in Franklin County; the Illinois Bayou in Pope County; the White River in Prairie County; the Saint Francis River in Arkansas County; and the Mississippi River in Crittenden County.

CLEAN LINE UNWINDING?

Clean Line’s high-voltage transmission line to ship wind power from the Oklahoma panhandle also terminates in Memphis, home to FedEx Corp.’s global headquarters, the world’s airfreight terminal and one of the nation’s most important transportation hubs due to its location on the Mississippi River and convergence of several major rail and highway links.

Three weeks ago, however, Clean Line officials told Talk Business & Politics a recent decision by the Tennessee Valley Authority (TVA) to drop its six-year-old interconnection agreement with the Texas partnership has put the project on hiatus.

Also, the Midcontinent Independent System Operator (MISO) on Jan. 11 withdrew its study request on the Clean Line project that has been in the grid operator’s interconnection queue since December 2013, according to documents obtained by Talk Business & Politics from the Carmel, Ind.-based regional transmission group’s website.

Unlike the TVA pact, the MISO study only documents the impact of the 4,000-megawatt transmission line on the grid operator’s system once it enters Arkansas in Pope County and exits some 300 miles later in Crittenden County and connects to TVA’s 500,000-megawatt substation in Memphis. It does not, however, grant any interconnection or transmission rights on MISO’s system.

Company spokesman Mark Brown said MISO – which oversees power delivery from its Little Rock-based command center across a four-state region that includes Entergy Arkansas and its sister companies in Mississippi, Texas and Louisiana – does not publicly discuss details of interconnection requests.

“We can only share the information reflected in the public database. If projects are withdrawn, generally any related studies would also cease,” Brown said in response to a query about Clean Line’s connection request that expires on Nov. 1, 2018.

CLEAN LINE HISTORY

In March 2015, then-Department of Energy (DOE) Secretary Ernest Moniz used “Section 1222” of the 2005 Energy Policy Act to approve public-private partnership to deliver low-cost wind power from Oklahoma’s Panhandle region to utilities and customers in Tennessee, Arkansas and other markets in the Mid-South and Southeast.

Once operational, a power station in the Oklahoma Panhandle was supposed to convert the incoming alternating current (AC) power generated by new wind farms into direct current (DC) power. The converter stations in Pope County, Ark., and Shelby County, Tenn., would then convert DC power back into AC power to be delivered to customers through the power grid.

Earlier this week, Arkansas’ entire congressional delegation sent a letter to DOE Secretary Rick Perry outlining Clean Line’s failure to comply with the 2015 agreement. The group of six urged Perry to pause or terminate the project due to TVA’s change-of-heart and Clean Line’s decision last month to sell its Oklahoma assets for the project to Florida-based NextEra Energy.

In their letter to Perry, the Arkansas lawmakers blamed the Obama administration for pushing the project, saying Clean Line and the DOE should have first obtained state approval from the governor and the PSC before using federal eminent domain powers to acquire land for the project.

In November, a team of DOE and Department of Justice attorneys from President Donald Trump’s administration defended the project during a federal court hearing in Little Rock after a group of Arkansas landowners sought to halt the proposed 720-mile transmission line. However, U.S. District Judge D. Price Marshall Jr. struck down the complaint on Dec. 21.

Price’s 18-page order opened the door for Clean Line to begin construction on the project in early 2018, but the privately-held Texas partnership has since put the multistate development on hold. According to DOE officials, if Clean Line has not commenced construction by Dec. 31, 2018, the federal agency can end its participation, seek further study or choose other options to keep the high-voltage project intact.

DOE officials have not responded to several inquiries over the past week from Talk Business & Politics.