As FDIC bank failures ebb, Arkansas banks search for other growth opportunities

by December 19, 2016 12:00 am 1,052 views

Editor’s note: First in a series of stories based on FDIC data analysis of Arkansas-based banks.

As the number of bank failures across the U.S. has slowed following the Great Recession, Arkansas’ largest financial institutions can no longer find easy and cheap pickings from the menu of distressed community banks that collapsed after the worst financial crisis since the 1930s.

During the height of the nation’s post-recession banking crisis between 2009-2012, Arkansas’ largest banks participated in more than 110 auctions conducted by the Federal Deposit Insurance Corp. (FDIC), seeking to purchase distressed banks with assets exceeding $52 billion in more than a dozen states, according to an analysis of the FDIC’s “Failed Bank” bid summaries by Talk Business & Politics and the Northwest Arkansas Business Journal.

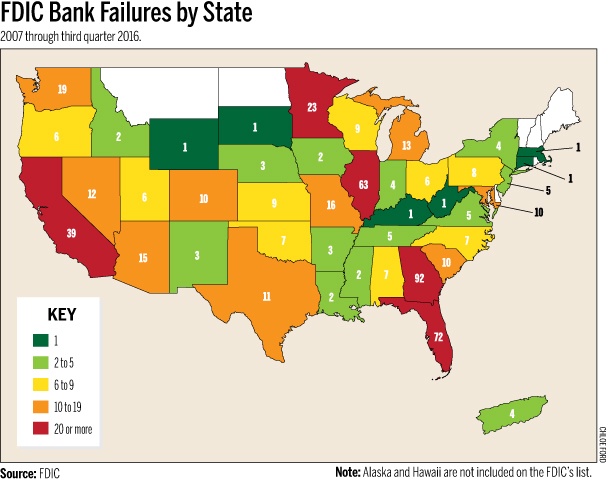

Altogether, a total of 524 financial concerns in the U.S. have landed on the FDIC’s notorious list since the official beginning of the recession. Florida and Georgia had the most bank failures by state with 92 and 72, respectively. Illinois (63), California (39) and Minnesota (23) round out the top five in the past decade.

Of that total, the state’s four largest financial concerns have submitted 20 winning bids that have collectively added $7.75 billion in assets and more than $7 billion in new deposits to their financial portfolios, the analysis shows.

The number of banks landing on the federal regulatory agency’s infamous “Failed Bank” list has dwindled to only five. Still, Arkansas has the distinction of having the last U.S. bank seized, shut down and then auctioned off by federal regulators. On Sept. 23, the Arkansas State Bank Department took possession of Mulberry-based Allied Bank and entered into an agreement with Huntsville-based Today’s Bank to acquire all of the troubled bank’s assets and deposits, which amounted to $66 million and $65 million, respectively.

“This transaction in no way reflects a weakened condition of the Arkansas banking system or the Arkansas economy,” Arkansas Bank Commissioner Candace Franks said.

As noted by Franks, Arkansas’ banking sector has emerged from the Great Recession largely unscathed. Since the highly-publicized failure on May 9, 2008, of Bentonville’s ANB Financial, which had $1.9 billion in assets, the Allied closing and FDIC seizure of First Southern Bank of Batesville on Dec. 17, 2010, are the only other Arkansas bank failures in the last decade.

National Bank Trends

Created in 1933 in response to the thousands of bank failures that occurred in the 1920s and early 1930s, the FDIC covers the depositors of a failed FDIC-insured depository institution dollar-for-dollar, principal plus any interest accrued or due to the depositor, through the date of default, up to at least $250,000. Generally speaking, a bank is closed when it is unable to meet its obligations to depositors and others.

According to agency spokeswoman Julianne Breitbeil, the FDIC acts in two capacities. First, as the insurer of the bank’s deposits, the FDIC pays insurance to the depositors up to the insurance limit. Second, the FDIC, as the “receiver” of the failed bank, assumes the task of selling and collecting the assets of the failed bank and settling its debts, including claims for deposits in excess of the insured $250,000 limit.

Nationally, the number of FDIC failures reached a peak in 2009 and 2010 when a total of 297 distressed banks across the U.S. were sold to the highest bidders by FDIC. Since then, U.S. bank failures have steadily declined through November of this year. In the FDIC’s recent quarterly report, where member banks and savings institutions saw aggregate net income jump 12.9% to $45.6 billion, FDIC Chairman Martin Gruenberg noted that the number of “problem banks” fell from 147 to 132 for the three-month period, and that total assets of problem banks fell from $29 billion to $24.9 billion during the third quarter.

Although the FDIC does not reveal the names of the banks that are on its confidential problem list, a bank must receive a so-called CAMELS (Capital, Assets, Management, Earnings and Liquidity) rating by examiners on a 1 to 5 numerical scale – with 1 being the best and 5 the worst. A composite rating is then assigned, and banks in the two lowest categories are placed on the FDIC’s problem bank list, Breitbeil said.

Arkansas-based Bank Growth

The state’s largest financial institutions have found a haven of growth through the highly competitive federal auctions. Since the recession, Arvest Bank, Bank of the Ozarks, Home BancShares Inc. and Simmons First National Corp. have submitted 20 winning bids that have ballooned their respective balance sheets with billions of dollars in new deposits and assets, and branch offices spread across the South and Southeast U.S.

Following the ANB Financial failure in 2008, the next winning bid from an Arkansas bank came 19 months later on Dec. 11, 2009. Arvest outbid Bank of the Ozarks and five other auction participants to acquire SolutionsBank of Overland Park, Kan., which had $511 million in assets. Since then, Arvest has participated in only three other auctions – all losing bids for failing banks in Kansas and Missouri.

However, Little Rock-based Bank of the Ozarks and Conway-based Home BancShares’ operating subsidiary, Centennial Bank, have emerged as dominant FDIC auction participants, with a total of more than 75 bids between the two banks since the recession. Centennial has submitted eight winning bids, purchasing near-bankrupt community banks in west Florida stretching all the way from Key West, just north of Cuba, to the Sunshine State’s Panhandle area in Panama City Beach and Pensacola.

Like Centennial’s foray into the Florida Gulf Coast, the FDIC auction has also allowed Bank of the Ozarks to grow its Southeast U.S. footprint with the purchase of five Georgia banks and one each in Florida and South Carolina for pennies on the dollar. Altogether, those distressed banks had deposits of more than $2 billion and assets of more than $2.6 billion, including a portfolio of pricey residential and commercial real estate properties.

Although nearly 18 months late to the FDIC acquisition party, Simmons First, the Pine Bluff-based holding company of Simmons Bank, has also seen its asset base grow through the FDIC’s process with four successful bids for three failing banks in Missouri and one in Kansas. Simmons’ last acquisition came on Oct. 19, 2012, after state and federal bank regulators seized the assets and deposit of Sedalia, Mo.-based Excel Bank.

Although none of Arkansas’ publicly-held banks have found much bidding success in FDIC auctions in the past five years, analysts say their aggressive acquisition programs provided a foundation for each bank to close in on the $10 billion asset mark – the key financial touchstone established by the Dodd-Frank Wall Street Reform and Consumer Protection act as the regulatory baseline between super-community banks and larger regional banking groups.

In fact, publicly-traded Simmons, Centennial and Bank of the Ozarks – all based in central Arkansas – have closed the competitive and size gap between Arvest, the Fayetteville-chartered lender which has held the position as the state’s largest bank over the past decade.

However, according to the third-quarter ranking by Banks Street Partners (BSP) LLC, Bank of the Ozarks is now the largest bank in Arkansas with $18.4 billion in assets. Arvest is the state’s second-largest bank with $17 billion in assets and 267 branches. Centennial Bank and Simmons are third and fourth in the quarterly BSP ranking with assets of $9.7 billion and $7.6 billion, respectively.

Simmons, though, is expected to top the $10 billion asset mark next year when its acquisition of Stillwater, Okla.-based Southwest Bancorp Inc., announced Dec. 14, officially closes.