Arkansas sets new record for ‘disposable income,’ workers seeing more from paycheck, federal data shows

by July 6, 2016 3:38 pm 391 views

As the state’s labor pool continues to grow and the jobless rate seeks new lows, U.S. workforce data shows Arkansas workers are taking home more money out of their paycheck than they ever have at any time in the past.

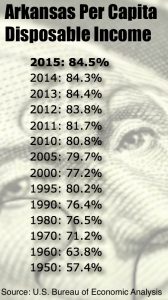

In 2015, Arkansas set a new record for per capita disposable income, which is the amount the workers receive from their paychecks after all taxes are deducted from their salaries. The U.S. Bureau of Economic Analysis (BEA) calculates the so-called per capita disposable income, or “DPI,” as the total personal income of the residents of a state divided by the population of the state, which the Census Bureau now puts at 2,985,310.

At the end of 2015, Arkansas’ per capita disposal income compared to the U.S. average was listed at 84.5%. According to the BEA calculations, the annual per capita disposable income for the average Arkansas worker in 2015 was $35,187, up 3.1% from $34,136 in 2014 and a healthy 39% improvement from $25,336 a decade ago. Nationally, U.S. workers saw an average of $41,624 in per capital disposable income, up 2.8% from $40,471 in the previous year.

Greg Kaza, economist and executive director of the Arkansas Policy Foundation, said state policymakers have long sought to achieve 100% income parity with the U.S., pursuing various strategies including sales tax increases to fund more educational spending.

“Hillary Clinton’s Educational Standards Committee advanced the policy in 1983,” Kaza said. “The idea was revisited in the early 21st century after the state Supreme Court’s decision in the Lake View school finance case.”

Despite the improved spending power of the state’s fast-growing labor force, Arkansas still ranks in the bottom 10 states for DPI growth at 42nd. But. Kaza noted, Arkansas’ position versus the rest of the U.S. has improved slightly over the past 25 years.

Despite the improved spending power of the state’s fast-growing labor force, Arkansas still ranks in the bottom 10 states for DPI growth at 42nd. But. Kaza noted, Arkansas’ position versus the rest of the U.S. has improved slightly over the past 25 years.

TAX CUTS PUT MORE IN WORKER POCKETS

There are a number of factors for years of steady improvement since the early 1990s, Kaza said. One reason is economic growth generated by public companies in Benton, Union and Pulaski counties, which lead the state in personal income growth.

“Another factor are tax cuts that took effect in 2007, 2009, 2013 and 2015,” said the conservative economist. “The grocery tax was cut in 2007 and again in 2009, falling from 6% to 1.5%. Income tax rates were cut in 2013 and 2015. These put more disposable income in Arkansans’ pockets.”

Kaza said Arkansas per capita disposable income has grown from 80.5% in 2007 to 84.5% in 2015 because of the tax policies, noting last year’s growth set an all-time high for Arkansas over the previous record (84.4%) set in 2013.

“That’s still a far cry from 100%, but it’s worth noting that Arkansas’ rank in the metric was 42nd in the nation in 2015, ahead of states such as Arizona, New Mexico, Kentucky, Utah, South Carolina, Idaho and West Virginia,” Kaza said. “The days when ‘Thank God for Mississippi’ was Arkansas’ unofficial economic slogan are gone.”

The local economist said if the income growth path continues, Arkansas will soon remove itself from another “worst states” business list.

“Arkansas trailed Alabama (41st) … by a mere 1/100th of 1.0% in 2015, so we could soon be at the 40th spot and out of the bottom ten,” he said.

As noted by Kaza, Mississippi ranks last in disposable income ranking at 77.9% of the national average, followed by Utah (83.1%), South Carolina (82%), Idaho (80.8%) and West Virginia at 80.3%. On the other end of the scale, Washington, D.C. was well ahead of the rest of the nation with per capita disposable income of 145.3%. Connecticut (133.5%), New Jersey (123.2%), Massachusetts (122.5%) and Alaska (121.9%) rounded out the top five.

New England has the highest per capita disposable income by region at 119.8%, followed by the Mideast (113.6%), the Plains (98.2%) and Southwest (96.2). The Southeast U.S., which includes Arkansas, ranks at the bottom at 90.5%, along with the Great Lakes (94.4%), and Rocky Mountain (95.2%).

ARKANSAS 6TH IN PERSONAL INCOME GROWTH

Nationally, the BEA also reported on June 22 that personal income increased $37.1 billion, or 0.2%. That compares personal income growth at 0.5% or $75.4 billion in April. Personal income, the most used widely-used metric for economic data, includes the total of an individual’s earnings, wages, dividends and other sources of before-tax income over a given period.

That same report shows that Arkansas personal income expanded 1.2% in the first quarter of 2016, the sixth-highest growth among the 50 states. State personal income grew 1% on average in the first quarter of 2016, the same pace as in the fourth quarter of 2015, the BEA report shows. Personal income grew in every state except Wyoming and North Dakota with first-quarter personal income growth rates ranging from a decline of 1.3% in North Dakota to a 1.5% gain in Washington State.

In a blog post concerning the BEA’s June report, University of Arkansas at Little economist Michael Pakko writes that Arkansas’ strong performance is largely attributable to the gain in better farm income. Pakko, chief economist at UALR’s Institute for Economic Advancement, also noted that mining income had experienced its 5th consecutive quarterly decline, falling 15.8% nationally since the fourth quarter of 2014.

“Over the same period, mining income in Arkansas contracted by 17.4%. Arkansas’ growth outpaced the nations in most sectors, particularly in service-providing sectors,” Pakko wrote. “However, earnings in durable goods manufacturing declined slightly in Arkansas, in contrast to a small gain nationwide.”

According to the latest BEA forecast, per capita disposable income for U.S. workers is expected to grow at an annual rate of 1.5% through 2021.

“A greater number of Americans returning to work will combine with improved housing and stock values to make consumers willing to spend on purchases delayed during the recession,” the BEA predicted. “However, future growth will be tempered relative to the boom leading up to the recent downturn.”