Governor’s highway bill will create trust fund; drops vehicle sales taxes

by May 16, 2016 7:41 pm 327 views

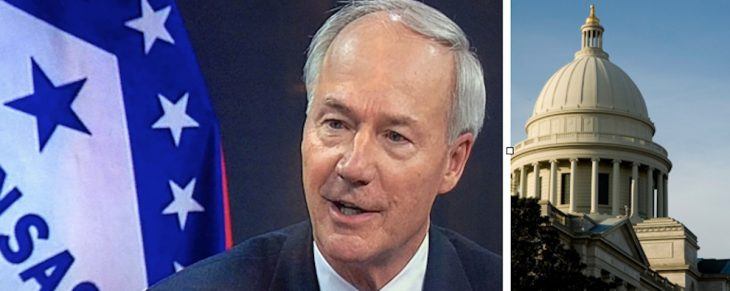

Gov. Asa Hutchinson is calling on legislators to approve more highway spending but no longer is asking them to partially rely on sales taxes on the purchases of new and used vehicles.

Hutchinson is calling legislators into special session May 19. The “call” includes an item “To increase funding for repair, construction and proper maintenance of Arkansas bridges and roads and to address legislative review of proposed rules of the State Highway Commission.”

Hutchinson’s plan would raise about $50 million a year in order to make the state eligible for $200 million in federal funds as part of the federal Fixing America’s Surface Transportation Act.

The governor’s plan raises the necessary funds in fiscal year 2017 by using $40 million in rainy day funds; $5.9 million in money raised from a half-cent sales tax for highways that goes into the State Central Services Fund; and $1.5 million from investment earnings generated by the Arkansas treasurer’s office.

The next year, the governor’s plan expects the treasurer’s office’s investment earnings to rise to $20 million. The rest would come from 25% of surplus funds and $2.7 million in diesel taxes that are flowing into the state’s general revenues.

The bill would create a highway trust fund using the surplus funds and investment earnings. The trust fund would be accessed through a request by the Arkansas Highway and Transportation Department of the governor. The governor would have to approve the request, as would the Legislative Council, which is the partial legislative body that meets between sessions. Hutchinson’s spokesman, J.R. Davis, said that process provides increased oversight.

Earlier, Hutchinson had planned to fund the highway program by transferring out of general revenues part of the sales taxes generated by the purchases of new and used cars. That part of the program was dropped, Davis said, because the money was found elsewhere and because some legislators were concerned about dipping into that source of general revenues, which pays for other state needs.

The governor can structure his call so narrowly that little besides his favored legislation will be considered unless two-thirds of the Legislature agrees to add an item. The call item related to highways is broad enough to include other items. A group of four Republican senators has proposed increasing motor fuels taxes up to eight cents for highways while seeking revenue reductions elsewhere, but that measure involves a tax increase and requires a three-fourths majority to pass.

One of those legislators, Sen. Jimmy Hickey, R-Texarkana, said Monday that the four have not decided if they will try to pass their bill.

“We have not made a decision about our bill,” he said in a text. “We said that we were going to provide an intermediate solution to the highway deferred maintenance issue. We have done that with our written bill and we still believe that it is the best plan currently available to accomplish that.”

Hutchinson’s spokesman, Davis, said the administration is confident that its own bill, which doesn’t raise taxes, “is the most responsible approach.”

The agenda item also would “address legislative review of proposed rules of the State Highway Commission.” That measure is being pushed in a bill by Rep. Andy Davis, R-Little Rock. Davis said Monday that his bill likely will be merged into the governor’s funding bill. The bill requires the Highway Commission to present its funding rules to the Highway Commission Oversight Committee, a new subcommittee of the Legislative Council. The subcommittee also would receive quarterly updates on construction projects worth more than $5 million.