The Compass Report: Arkansas’ three large metro areas end 2015 with positive economic trends

by April 20, 2016 10:38 am 693 views

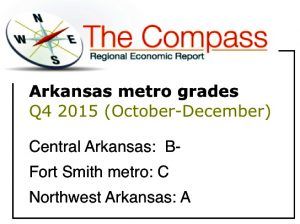

Most key economic indicators in Arkansas’ three largest metro areas – central Arkansas, Fort Smith metro, and Northwest Arkansas – were moving in the right direction during the fourth quarter of 2015, according to The Compass Report.

Compared to the fourth quarter of 2015, economic conditions were better in Central Arkansas, were significantly better in Northwest Arkansas, and showed signs of improvement in the Fort Smith metro.

The quarterly Compass Report is managed by Talk Business & Politics, and is sponsored in the Fort Smith area by Arvest Bank. The report is the only independent analysis of economic conditions in Arkansas’ three largest metro areas.

To underscore the impact of the three largest metro areas, for the fourth quarter of this year the unemployment rate for the rest of the state was 6%. The statewide unemployment rate with the three largest metros added back in was 4.7% December-on-December.

Nonfarm jobs in central Arkansas grew by 1.1% between December 2014 and December 2014, was up 4.9% in Northwest Arkansas and fell 0.1% in the Fort Smith metro. The labor force grew December-on-December in Northwest Arkansas by roughly 3.7%, was up 2.8% in central Arkansas, and up 1.6% in the Fort Smith.

Jeff Collins, the economist for Talk Business & Politics who gathers data used in The Compass Report, said national economic conditions should remain positive in 2016 thanks to rising consumer demand and continued growth in the housing sector. He said barring any unusual state factor, the national economy should help Arkansas’ economy grow in 2016.

“Despite dire warnings from some quarters of impending recession, the U.S. economy is expected to grow at a steady pace over the next four quarters as low inflation and improving labor markets persist,” Collins noted. “Despite the gridlock in Washington, economic meltdown in China, terrorist attacks in Europe, and ongoing unrest in the Middle East, Americans are doing what they do best, spend. This is evident in the consumption and retail data as well as historically low household debt payments as a percentage of disposable income.”

“Despite dire warnings from some quarters of impending recession, the U.S. economy is expected to grow at a steady pace over the next four quarters as low inflation and improving labor markets persist,” Collins noted. “Despite the gridlock in Washington, economic meltdown in China, terrorist attacks in Europe, and ongoing unrest in the Middle East, Americans are doing what they do best, spend. This is evident in the consumption and retail data as well as historically low household debt payments as a percentage of disposable income.”

Collins, a former director of the Center for Business and Economic Research at the University of Arkansas, also believes household budgets will benefit from income growth and low fuel prices.

“As labor markets tighten, income growth should accelerate. Consistent economic growth will increase the pressure on the Fed to raise short-term rates again. In the meantime, most Americans will enjoy lower gas prices, better employment prospects, and rebounding real estate values. As has been the case for some time, the greatest risks appear to come from the international shocks,” Collins wrote.

FORT SMITH REGION

The Compass Report for the Fort Smith area posted a C grade for the fourth quarter, better than the C- from the third quarter of 2015 but down from the C+ in the fourth quarter of 2014.

Although the region’s jobless number declined (5.1% in December 2015, compared to 5.5% in December 2014), the number of jobs were relatively flat. Non-farm employment in the metro area ended December at 114,200, down from 114,300 in December 2014. However, the number of unemployed moved in the right direction. There were 6,132 unemployed in December, down from 6,502 in December 2014.

Sales tax collections in the metro area were up slightly, with $4.292 million reported in December in four regional counties, up from $4.284 million in December 2014.

The metro hospitality (tourism) sector returned to a growth trend. The sector had 9,100 jobs in December, better than the 8,900 jobs in December 2014.

Mike Jacimore, sales manager for Arvest Bank in Fort Smith and the River Valley Region, said bank officials are seeing clear signs of consumer spending.

“We are very pleased to see the Compass grade improve from the previous quarter, and we are hopeful the increased demand for mortgage and commercial loans we’ve seen over the past three months in the Fort Smith region is an indication consumers and business owners believe the economy is improving as well,” Jacimore said.

Collins said the Fort Smith metro will still struggle to maintain a growth trend through the remainder of 2016.

“Despite weak jobs data, the unemployment rate in the Fort Smith area December-on-December was down 0.4 percent. The reason for the decrease was a significant increase in the number of employed (2,309) relative to the increase in the labor force (1,939). .. (T)he metro area economy is likely to struggle through the next four to six quarters despite the forecast for continued growth at the state and national level,” Collins noted.

NORTHWEST ARKANSAS

The first ever grade of A was captured by the Northwest Arkansas metro in the fourth quarter. The grade was up from the B+ in the third quarter of 2015 and up from a B in the fourth quarter of 2014. The consistent pace of job growth, tax revenue gains and building activity pushed conditions higher for the A grade in the Northwest Arkansas economy during the fourth quarter.

The metro economy added 11,300 jobs, rising to 243,000 in December. Sales tax revenues also grew, with $8.649 million collected in Benton, Madison and Washington counties in December, up from $8.195 million in December 2014.

Sales and use tax collection data indicate that Bentonville, Fayetteville, Springdale, and Rogers have experienced solid growth quarter-on-quarter. In percentage terms, Bentonville experienced the strongest growth in collections (22.9%) while Fayetteville collected the most tax dollars of any of the four major municipalities – $11.2 million in the fourth quarter.

“By comparison, the Northwest Arkansas regional economy had sales and use tax collections totaling roughly $24.3 million in the fourth quarter while the Central Arkansas regional economy had collections for the same period of roughly $27.2 million. This is startling considering the difference in population,” Collins noted in the report.

CENTRAL ARKANSAS

Economic conditions in central Arkansas, the state’s largest metro area, received a grade of B- in the fourth quarter, better than the C+ in the third quarter of 2015 and the C+ in the fourth quarter of 2014.

“Of all the economic indicators, unemployment rates at or near the full employment rate of 4.0 percent stand out. Growth has been solid if not spectacular but given the weak performance of construction, manufacturing, and government the overall performance of the regional economy was surprisingly strong,” Collins said.

Job gains and continued gains in sales tax revenue were again economic drivers for the metro area in the fourth quarter. There were 355,100 non-farm jobs in the region in December, ahead of the 351,300 in December 2014.

Government services and trade, transportation, and utilities comprise the two largest sectors of the Central Arkansas economy. December-on-December government services employment was up 200 jobs while trade, transportation, and utilities gained 2,400 jobs.

Sales tax revenue in the five-county area totaled $10.481 million in December, better than the $10.183 million in December 2014. Little Rock had December sales tax revenue of $7.914 million, better than the $7.584 million in December 2014.

U.S. ECONOMIC RISKS

Consumer spending coupled with an improving labor market were key growth factors for the U.S. economy in the fourth quarter, and are the leading indicators for future economic activity.

“At the national level, declining oil prices coupled with slowing global growth, particularly in China have many economists revising their forecasts for growth over the next four quarters,” Collins noted in the report. “However the consumer remains king representing two-thirds of U.S. economic activity. For most consumers, declining oil prices and rising incomes have them feeling fairly bullish. According to the University of Michigan Consumer Sentiment index, consumer confidence has been trending up. This coupled with retail sales data provides a strong indicator of consumer behavior in the coming months.”

Other risks to the national and state economies include:

• Consumer confidence has improved significantly but terrorism in Europe could induce consumers to pull back. This is particularly true to the extent that international events impact the equity markets.

• Globally, growth has softened as regional economies in Asia and Europe struggle. This has impacted demand for U.S. goods abroad and stimulated demand in the U.S. for imports as the dollar strengthens against other currencies. Somewhat surprisingly, imports declined in the fourth quarter.

• The political season is unlikely to lead to meaningful action on economic issues as both parties posture. This may be good news given some of the policy ideas being debated in the press.

• While the unemployment rate has improved, it does not adequately tell the entire story. Reduced labor force participation, high unemployment rates for young and minority workers remain persistent problems.

• The Federal Reserve has significantly reduced monetary stimulus in response to stabilized growth. However many economists continue to be concerned about the impact on inflation of prolonged easy money.

DATA AND REPORT DOCUMENTS

Link here for the raw data used to prepare The Compass Report for the three metro areas.

Link here for more narrative about regional and national economic conditions.

UNDERSTANDING THE COMPASS REPORT GRADES

A key factor in understanding The Compass is in understanding the “grading” approach used to measure the current and leading economic indicators.

The strategy is to place the most recent data in historical context. Average values for the percent change over the referenced time period were calculated, as were standard deviations for each measure.

The more similar current values are to historic averages the more likely the indicator grade is to be a “C.”

The farther away the observed value, as measured by the standard deviation of the data, the more divergent the grade from “C.” In other words, “C” reflects no change in economic activity. The grades “B” or “A” indicate improvement above the historical average, and “D” and “F” indicate a decline in economic activity compared to the historical average.

REGIONAL GRADE HISTORY

FORT SMITH REGION – Fort Smith regional economy

4Q 2015: C

3Q 2015: C-

2Q 2015: C-

1Q 2015: B

4Q 2014: C+

3Q 2014: C+

2Q 2014: C

1Q 2014: C

4Q 2013: C+

3Q 2013: C+

2Q 2013: C

1Q 2013: C-

4Q 2012: C

3Q 2012: C-

2Q 2012: C-

1Q 2012: C-

4Q 2011: C-

3Q 2011: C

2Q 2011: C

1Q 2011: C-

4Q 2010: C-/D+

3Q 2010: C-

2Q 2010: C-

1Q 2010: C-

4Q 2009: D

3Q 2009: D

2Q 2009: D-

1Q 2009: D+

NORTHWEST ARKANSAS – Northwest Arkansas regional economy

4Q 2015: A

3Q 2015: B+

2Q 2015: B+

1Q 2015: B

4Q 2014: B

3Q 2014: B+

2Q 2014: B

1Q 2014: B-

4Q 2013: B+

3Q 2013: B+

2Q 2013: B

1Q 2013: B

4Q 2012: C

3Q 2012: B+

2Q 2012: B-

1Q 2012: B-

CENTRAL ARKANSAS – Central Arkansas regional economy

4Q 2015: B-

3Q 2015: C+

2Q 2015: C+

1Q 2015: C+

4Q 2014: C+

3Q 2014: C

2Q 2014: C

1Q 2014: C-

4Q 2013: C-

3Q 2013: C-

2Q 2013: C-

1Q 2013: C-

4Q 2012: B-

3Q 2012: C-

2Q 2012: C+

1Q 2012: C-