Arkansas gas tax below national average, other states look to hike fuel taxes as pump prices fall

by April 19, 2016 12:14 pm 2,176 views

State-level taxes and fees on motor fuels in the U.S. averaged 26.5 cents per gallon as of Jan. 1, 2016, and officials with some states are considering raising or lowering gas taxes while regions are seeing pump prices below $2 per gallon for regulator unleaded.

According to a report published Tuesday (April 19) by the U.S. Energy Information Administration (EIA), fuel taxes and fees ranged from a low of 8.95 cents per gallon in Alaska to a high of 51.4 cents per gallon in Pennsylvania, in addition to the federal tax of 18.4 cents per gallon.

State taxes on diesel are slightly higher – averaging 27.4 cents per gallon, and ranging from 8.95 cents per gallon in Alaska to 65.1 cents per gallon in Pennsylvania – and are in addition to the 24.4 cents per gallon federal tax. EIA collects information on state gasoline and diesel fuel taxes twice a year, and recently released data for state tax rates in effect as of Jan. 1, 2016.

In Arkansas, the state’s motor fuel tax now stands at 21.5 cents per gallon, about five cents below the national average and among the 15 states with the lowest tax on gasoline and diesel fuels.

The tax on diesel is one cent higher at 22.5 cents per gallon compared to the national average at 27.4 cents per gallon, according to the state Department of Finance and Administration. Arkansas has not raised its motor fuels tax since 2001.

Following passage of the federal highway bill at the end of 2015, the Arkansas Highway Department is now accepting public comments until May 2 on its new Statewide Transportation Improvement Program (STIP), which outlines all of the proposed highway projects under consideration for the next five years. There are almost 700 projects listed at an estimated cost is about $4.8 billion.

The statewide plan estimates that the Highway Department will generate about $356 million in motor fuels taxes and registration fees on trucks. Some of that revenue will be used to match federal funds, which will amount to more than $800 million in fiscal year 2016. The total funding of projects in the highway department’s statewide plan will be almost $4.9 billion over the next five years.

GOV. HUTCHINSON SAYS NO TO FUEL TAX HIKES

In January, Gov. Asa Hutchinson announced a plan to increase highway funding by $750 million over the next 10 years, making the state eligible for $2 billion in federal matching funds over that time period thanks to a federal highway bill passed by Congress in December.

The new funding primarily will come from $40 million in unallocated surplus funds – $20 million of it from fiscal year 2015 unobligated surplus funds and $20 million from the governor’s rainy day fund. In the following years, 25% of unallocated surpluses will transfer to the Highway Department. Hutchinson said the average surplus over the past 10 years has been about $48 million a year.

The plan also generates money by transferring from general revenues to highways the sales taxes generated from purchases of new and used vehicles, capping out at $25 million a year at the end of a five-year phase-in period. Hutchinson said the money would be offset by finding efficiencies in government and said he has specific ideas in mind for doing that.

The state needs $46.1 million by Sept. 30 of this year and an average of $50 million in future years to be eligible for $200 million annually in matching federal funds provided by the Fixing America’s Surface Transportation Act, or the FAST Act, passed by Congress and signed by President Barack Obama in December.

Recommendations by the Governor’s Working Group on HIghway Funding in the fall to consider raising the motor and diesel fuels tax by 10 cents were opposed by Hutchinson and most top legislative leaders. Other similar plans, including an inflation-based index for raising the state’s 15-year old gas tax standard, also have received little support at the State Capitol.

A week ago, Hutchinson said failure to pass his Arkansas Works program could lead to the cancellation of a planned special session for highways. Lawmakers are expected to take up amended legislation to expand the state’s Medicaid expansion this week through a line-item veto strategy for continued funding.

FUEL TAX REVENUE FALLS IN MANY STATES

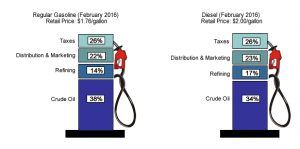

According to the EIA, a variety of taxes and fees are levied on motor fuels by all levels of government in the United States. Although these charges often include comparatively small fees that provide revenue for environmental protection and other dedicated funds, governments use the largest portion of the taxes the average consumer pays to build transportation infrastructure and maintain roads, effectively making them road user fees.

Many states allow localities or municipalities to impose additional taxes on motor fuels. These local option taxes may apply in all local jurisdictions across the state, as in Florida and Hawaii, or more selectively, as in Mississippi where the state imposes a seawall tax on gasoline in just three counties that border the Gulf of Mexico.

Some municipalities, such as Chicago, also impose taxes in addition to state and local taxes. Although many local option taxes are cents-per-gallon taxes, some are percentages of the purchase price. In California, most local jurisdictions have district sales and use taxes ranging from 0.10% to 2% in addition to the 2.25% state sales tax on gasoline and the 9.25% state sales tax on diesel fuel. Some areas may have more than one district tax in effect.

Revenue from motor fuel taxes has declined because increased vehicle fuel economy has slowed the growth in gasoline and diesel consumption, EIA data shows. Further, most states have fixed per-gallon rates that have not kept up with changes in inflation. These issues leave many jurisdictions with reduced funding for highway construction and maintenance projects.

In an effort to mitigate the effect of these factors on revenue, many states now index all or a portion of their motor fuel excise taxes. Recently, Georgia passed legislation to index the state-level excise tax based on corporate average fuel economy standards and the U.S. consumer price index. Other states index sales taxes that apply to motor fuels and allow indexing at the local-government level.

In response to declining fuel tax revenues, many states are looking at road usage fees as a way to pay for road maintenance. After running a pilot program to test the feasibility of such a plan, Oregon implemented the voluntary OreGo program in July 2015. Participating drivers install a device (some of which employ global positioning system (GPS) devices) and pay a per-mile fee of 1.5 cents. Users receive credits for fuel-based taxes paid at the retail fueling pump. California, the state with the highest level of motor fuel consumption, plans to begin a nine-month pilot program to study taxes based on road usage in summer 2016.