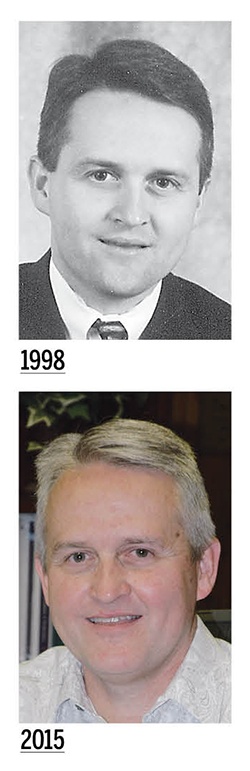

Gairhan Zeroes In On 25 Years in NWA Bank Market

by January 4, 2016 12:00 am 267 views

When Nathan Gairhan was honored by the Northwest Arkansas Business Journal as a member of the 1998 Forty Under 40 class, he was working for a strong, family-owned community bank.

He still works for one today, only the name of the family has changed.

Gairhan, 53, is the president and CEO of Springdale-based United Bank, a $146 million-asset lender with two full-service branches in Springdale, one in Fayetteville and one in Rogers, as well as loan-production offices in Fort Smith and Conway. The bank was started in 1978 by Don Pitts, and has had the same ownership since it was founded.

In a recent interview, Gairhan said: “The Pitts family has provided ownership stability for going on 38 years, and it’s something we certainly don’t take for granted. It’s very important.”

In 1998, Gairhan was working for the Hampton family-led First Western Bank. He joined the Booneville-chartered lender in December 1991, just a few months after the bank entered the Northwest Arkansas market, and worked for the company in Rogers for more than 20 years.

Gairhan eventually became the bank’s Northwest Arkansas regional president, but when the opportunity to join UB came in the spring of 2012, he felt the time was right to take the job.

“Knowing the ownership group and what their vision was to grow the bank, and continue to grow the market share, was exciting to me,” he explained. “We had a good team at First Western and we did some good things, but it was a good time in my career to take on additional responsibilities.”

One of Gairhan’s primary concerns, initially, was to guide UB out of a cease-and-desist order issued in Nov. 2010 by its federal regulator, the Office of the Comptroller of the Currency (OCC).

Aided by an affable demeanor, he seemed to have the necessary mix of experience to deal with those unique issues. Before joining First Western in Rogers, Gairhan worked as a bank examiner for the Arkansas State Bank Department from 1986 to 1991.

UB did, eventually, emerge from the federal scrutiny with a clean bill of health in November 2013. The following summer, Gairhan oversaw another key moment in UB’s history when it received approval for a conversion to a state-chartered, Fed member bank. UB had previously been a thrift, or federal savings bank, since its founding.

Looking forward, Gairhan said UB will have a place in the evolving bank landscape, and has no plans to sell, a fate that similar-sized institutions have resigned themselves to in recent years.

The bank’s problem assets are consistently lower than peer lenders, Gairhan said, and good asset quality continues to drive profitability. The bank’s net income for 2011-2014 was a combined $9.4 million.

“We want to expand our footprint, and with the excess capital we have, we’re looking for opportunities to maybe purchase another institution,” he said. “We’ve kept our eyes open and are willing to take a look if there’s a bank that has an interest [in selling] for one reason or another.”

In addition to his professional duties, Gairhan does what any good community banker does — gets involved.

He has served on numerous boards in the past, including the Rogers-Lowell Area Chamber of Commerce and the United Way of Benton County. He has been a member of the Rogers Parks and Recreation Commission for 15 years and is past president of the Rogers Noon Rotary Club.

He and his wife Teresa — who have two sons ages 21 and 18 — also teach Sunday school at First Baptist Church of Rogers, where they’ve belonged since moving to Northwest Arkansas, and Gairhan is a deacon.

As he closes in on 25 years of community banking, Gairhan says it’s incredible to see how far Northwest Arkansas has come, but he’s even more excited to see what lies ahead.

“This area has become a destination, and as a community banker, that is exciting,” he said. “That makes me excited for the future and where we are going and where our bank can grow.

“As a banker, we always talk about competition. It’s not going away and we will continue to see new [banks] come and want to be a part of this. We’ve just got to keep getting better every day.”