Arkansas consumers using more credit, debt rising but below national levels

by January 6, 2016 7:21 pm 400 views

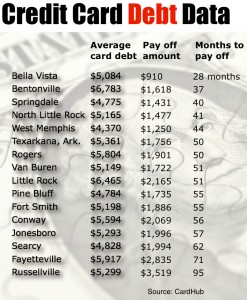

Consumers in key metro areas around the Natural State are carrying an average credit card debt ranging between $4,700 in Springdale and Pine Bluff to a high of $6,783 in Bentonville, according to a recent report from CardHub. The lowest debt in the state was found in West Memphis at $4,370, according to the study.

Credit card debt rose steadily in 2015 as consumers began to feel better about the overall economy. While showing a wide range of credit card debt, consumers in Arkansas cities still owe less on average than consumers in surrounding states.

The average credit card debt per U.S. adult, excluding zero-balance cards and store cards was $5,232 as of November 2015. The average debt per credit card that usually carries a balance was a whopping $7,494, according to creditcards.com. That same statistic among Arkansans is around $5,000 per person.

That said, credit counselors agree that could be a combination of a conservative mindset as well as lower wage earners likely resulting in lower overall credit limits. The cities in the country with the highest overall earning potential such as Cupertino, Calif., and much of the Silicon Valley region earned the ranking for having the most sustainable credit-card debts.

Bella Vista was the one city in the report that ranked near the top 100 most sustainable for credit card debts. At No. 103, Bella Vista consumers had an average credit card debt of $5,084, with a payoff cost of $910 for just 28 months, based on ability to pay early. Bentonville was only other city in the report to rank near the top 600 for sustainable credit card balances among its consumers. At No. 654 Bentonville residents owed an average of $6,783 in credit card debt with a payoff cost of $1,618, or 37 months given their ability to repay the debt early.

A number of Arkansas cities were much closer to the unsustainable ranking for credit card debt, an indication consumers could be near dangerous fiscal territory.

A number of Arkansas cities were much closer to the unsustainable ranking for credit card debt, an indication consumers could be near dangerous fiscal territory.

“As we enter 2016, many consumers will unfortunately be walking into a financial hailstorm. The holidays are commonly known to give Americans a spending hangover, after financing gifts and festivities with costly plastic. According to CardHub’s estimates, Americans will have exceeded $900 billion in credit-card debt as of year-end 2015, the highest amount recorded since the economic downturn,” noted CardHub CEO Odysseas Papadimitriou.

The problem he said is that many consumers are out of touch with reality, or rather in a state of denial about how much they really owe. He referenced a report from the Federal Reserve Bank of New York that found the amount of credit-card debt U.S. consumers claim to have is 37% lower than the figure lenders have reported.

“Without an accurate knowledge of our balances, it’s impossible to create a realistic credit-card payoff plan,” he added.

The CardHub study found that Beverly Hills, Calif., has the highest average credit-card debt, which is five times greater than in Clarkston, Ga., the city with the lowest. They found Scarsdale, N.Y., has the highest median earnings for workers, which are 10 times greater than in Carbondale, Ill., the city with the lowest. The report also indicates it takes consumers in College Station, Texas, 47 times longer to repay their debt, compared to those in Cupertino, Calif. who have the ability to retire their debt in just 10 months.

Roderic Hewlett, dean of the College of Business at Bellevue University, said misunderstanding the power of compounding is a problem for borrowers over time. He said if one would only realize that credit is a claim on future income, and actually reduces a future standard of living, they would appreciate the saving versus consumption trade-off.

For every $1,000 in credit card debt at a 15% interest rate, consumers would have to repay $94 a month for one year to retire the debt. The interest cost would be $84. The average interest rate on credit card debt was 15.13% this week, according to creditcards.com.