Amazon Expands Logistics; Warm Weather Hurts Apparel Sales

by January 4, 2016 12:00 am 203 views

Is Amazon the Next Delivery Disruptor?

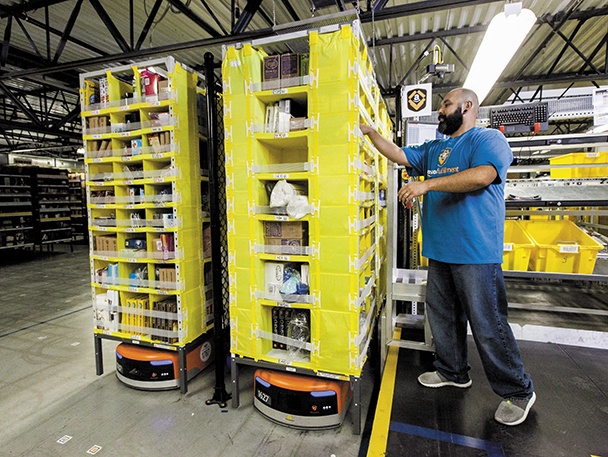

While Amazon has long used different shipping companies, its partnership with the United Parcel Service has been significant. All that may be changing, however, as Amazon continues to expand its logistics operations in response to the need for faster, more cost-efficient deliveries. The Wall Street Journal and other news outlets are reporting, however, that Amazon’s delivery innovations are straining its relationship with UPS (paywall).

Amazon already upped the shipment game when it began to offer free two-day shipping and inexpensive next-day delivery as part of its Prime loyalty program. That was back in 2005, and now 10 years later Amazon is likely realizing that third-party delivery has its limits.

According to a recent article by Forbes magazine’s Trefis Team, 12 percent of Amazon’s net sales go toward fulfillment costs.

Led by Massachusetts Institute of Technology engineers and Wall Street analysts, the Trefis Team uses extensive data to show a single snapshot of what drives the value of a company’s business.

According to the article, Prime memberships are major money-makers for Amazon, and keeping up with increased participation means providing fast delivery to a large number of users.

“Given the high fulfillment costs, the company needs to look at ways in which these can be reduced in the long term,” the Trefis Team said. “While huge investments in its own delivery chain could impact margins in the short term, the company can benefit from this investment in future as they drive additional revenue streams.”

Amazon is attacking the problem in multiple ways. It’s establishing a fleet of delivery vehicles, and there are rumors of talks with airport facilities and the launching of delivery drones. Nowadays, at least in major cities, it’s not unusual to see vans and trucks with the Amazon logo on the road. In fact, Prime Now, Amazon’s app driven, one-hour delivery service, relies on a network of independent contractors, using their own vehicles to deliver packages.

Clearly, the move toward omnichannel sales is proving not only to be a disruptor for retailers, but for shipping companies as well. Over the past couple of years, we’ve seen shakeups in how customers make buying decisions and how they pay for their products. 2016 may well be the year when delivery undergoes a revolution.

Apps Drive Holiday Sales

Digital retail isn’t just about viewing products anymore. With the ongoing evolution of retail apps, seeking the best products at the best prices has become commonplace among careful consumers.

“U.S. consumers have turned into digital shopping ninjas,” Adobe Systems Inc. analyst Tamara Gaffney recently told CNNMoney.

Online spending on Thanksgiving and Black Friday totaled a record $4.47 billion, according to Adobe.

IBM told CNNMoney that smartphones were the device-of-choice for browsing deals and accounted for nearly 45 percent of total traffic.

But, on average, tablet shoppers spent more. Tablet orders averaged $136, more than desktop, laptop or smartphone orders, according to the CNN report.

Consumers aren’t relying on single devices when making purchases, however. According to DigitasLBi, a marketing and technology agency, consumers are now using five different, but connected, devices when making a purchase.

Mobile may not simply be a matter of convenience for consumers who don’t have time to shop in-store. The 2015 Connected Commerce report showed that 85 percent of survey respondents use their devices while they are inside a retailer’s store. Wal-Mart Stores Inc. has made use of this habit by encouraging users of its app to create “wish lists” by scanning product bar codes as they shop.

The feature includes a built-in scanner. A search for the product brings up where the product can be found in the store and its price.

“You can scan all the items you want for Christmas, and your family members and friends can all log onto the Walmart app and see what you want,” Jamie McCain, a Walmart store manager in Houston, told a local news station.

These features, combined with new mobile payment options, made mobile shopping easier this past year, and may well contribute to a stronger 2016 holiday retail season.

Warm Weather Might Be Hurting Apparel Sales

Many Americans were thrilled with 2015’s slow progress from fall to winter. Instead of having to bundle up each day, many could head off to work in lighter clothes and fewer layers. Unfortunately for apparel retailers, the warm weather had a chilling effect on warm clothing sales.

According to industry trends site Retail Dive, major cities saw disappointing sales in late 2015.

Retail Dive cited data from weather planning and analytics firm Planalytics that showed outerwear sales were down nationwide in early December. In fact, sales were down 41 percent in Boston, 38 percent in Philadelphia, 36 percent in New York, 35 percent in Nashville and Atlanta, 34 percent in Chicago, and 18 percent in Houston, looking at the week that ended Dec. 12, compared to the previous year.

Weather presents challenges for retailers, particularly since it isn’t consistent from one year to the next. As the Retail Dive article notes, buyers will sometimes base purchasing decisions on the previous year’s sales. But this doesn’t take into consideration the factors that influenced those sales.

In a cold year, particularly if winter comes early, coats, scarves and sweaters fly off the racks. This is great for numbers, and everyone feels good about that quarter’s sales.

If the next year is comparatively balmy, however, consumers will be content to wear what they already own. Spending on fleece, wool and down only happens after the temperature changes and the snow starts to fall.

Some major retailers, such as Wal-Mart Stores Inc. and Target Corp., understand this and have climate departments that monitor the weather. There are also consulting firms that specialize in providing long-range weather predictions to businesses.

Unless the suppliers and retailers prepared for this possibility, sales plummet.