Arkansas costs reportedly lower for Medicare and privately insured

by December 29, 2015 12:08 pm 194 views

Costs for Medicare and privately insured patients are generally lower in Arkansas than in the rest of the country, the New York Times reported earlier this month.

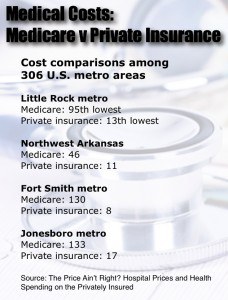

Citing a study, “The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured,” the Times recently reported that costs for the Little Rock region are the 95th lowest out of 306 regions in the country, while costs for private insurance are the 13th lowest. The Springdale region had the 46th lowest for Medicare and the 11th lowest for private insurance. The Fort Smith region had the 130th lowest spending for Medicare and the eighth lowest for private insurance. The Jonesboro region had the 133rd lowest spending for Medicare and the 17th lowest for private insurance. Texarkana ranked 115th in Medicare and 122nd in private insurance.

The study and the report found little relationship between price levels among Medicare patients and the privately insured. Some regions had high costs among both groups, some had lower prices among both groups, and some had high prices in one group and lower prices in the other.

Medicare has relatively standard rates, while private insurers negotiate prices with hospitals that can lead to wide variations in price. The cheapest price for one type of knee replacement nationwide was $3,400, while that same procedure cost $55,800 elsewhere. In the Little Rock area, prices among five hospitals ranged from $11,300 to $19,800 for that procedure.

The Times reported that mergers of hospital systems, which were encouraged by the Affordable Care Act, can result in lower Medicare costs because large systems can avoid duplicative services. But those mergers also reduce competition, potentially leading to higher costs for the privately insured.

As to the potential for higher prices in markets with just one hospital system, the study noted: “Finally, hospital prices are positively associated with indicators of hospital market power. Even after conditioning on many demand and cost factors, hospital prices in monopoly markets are 15.3 percent higher than those in markets with four or more hospitals.”

As to the potential for higher prices in markets with just one hospital system, the study noted: “Finally, hospital prices are positively associated with indicators of hospital market power. Even after conditioning on many demand and cost factors, hospital prices in monopoly markets are 15.3 percent higher than those in markets with four or more hospitals.”

The study also included the following information.

• U.S. healthcare accounted for 17.4% of U.S. GDP in 2013.

• Medicare spending covers 16% of the U.S. population and is 20% of total health care spending.

• 60% of the U.S. population has private health insurance, which pays for one-third of all U.S. healthcare spending.

• Hospitals account for 31% of healthcare spending and 5.6% of GDP.

• The average inpatient admission price in 2011 was $12,976.