Start of a New Day

by April 14, 2014 12:00 am 192 views

It was time for a change, so First State Bank of Northwest Arkansas traded in its old name for a new one — Today’s Bank — and is now looking to expand its footprint from here south to the River Valley and one day meet the $300-million threshold for total assets.

The only bank in the state chartered in Huntsville, Today’s Bank is opening a new branch at the former Simmons First National Bank location at Fiesta Square in Fayetteville, and in the first quarter of the coming year, looks to have a third bank in Washington County.

All this with a new color, orange, and a new mantra that pays homage to the bank’s community roots: “It’s the same bank, the same people and the same ownership, but a shorter name,” said Larry Olson, president and CEO of Today’s. “First State Bank of Northwest Arkansas was geographically restrictive and the name was a mouthful.”

Today’s has announced its intentions in the wake of huge shifts in the state’s banking landscape that took place last year and have affected this region. In November, Simmons First National Bank of Pine Bluff completed the $56-million acquisition of Little Rock-based Metropolitan National Bank. In October, the $280-million acquisition of Jonesboro-based Liberty Bancshares Inc. by Conway-based Home Bancshares Inc., the holding company for Centennial Bank, was approved by federal regulators.

Simmons emerged as the state’s fifth largest bank with $3.1 billion in total assets while Centennial emerged as the second largest with $6.8 billion, according to the Federal Deposit Insurance Corp. With such assets at their command, both Simmons and Centennial — and Fayetteville-chartered Arvest Bank, the state’s largest with $14 billion in total assets — have a competitive advantage here and in other markets. But that doesn’t mean a much smaller bank like Today’s can’t find room to grow in a region that continues to prosper.

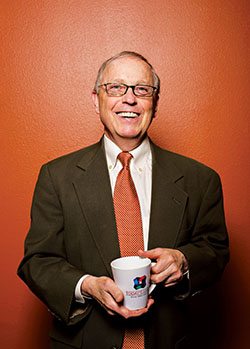

And Olson, 60, said he doesn’t have plans to sit back and relax in his post at Today’s, currently the 88th largest of the state’s 118 banks. To the contrary, he will lead the institution as it heads for the milestone of $300 million in assets. Sitting at $100 million, there’s plenty of work to be done, but Sam Mathias, owner of the bank’s holding company, Mathias Bancshares Inc. of Springdale, has embraced expansion.

“I don’t think Sam has the desire to be a gigantic bank, but he wants to grow,” Olson said. “We’re always keeping our eyes and ears open for opportunities if they make sense.”

While Olson admits that the next decade will be fraught with obstacles, he also sees opportunity.

“It’s going to be tough for community banks to compete with the larger regional banks,” he said. “But I do believe there’s a continued need for smaller community banks.”

Suitable Climate

Today’s Bank is growing at a time when banks can, and need, to expand. In Northwest Arkansas, financial performance has stabilized after years of high losses and low profitability, and the weighted average for return on assets was 1.17 percent for all of 2013, a strong ratio, said Tim Yeager, the Arkansas Bankers Association chair in banking at the Sam M. Walton College of Business at the University of Arkansas.

But even though this region’s climate is good for growth, banks like Today’s still face a hefty challenge in executing an ambitious plan like reaching the $300-million milestone.

“Organically growing from $100 million to $300 million is a pretty aggressive goal,” Yeager said. “The key is to make sound loan decisions along the way and not grow simply to get bigger. The question is whether the loan opportunities will be there to achieve that growth.”

Even in the face of such a challenge, banks have to achieve a certain level of assets to compete with big, regional powers like Arvest and others. And as the future unfolds, and in the face of increased regulation like that enshrined in the Consumer Financial Protection Bureau and the Dodd Frank Act, Today’s won’t be the only institution trying to enlarge its footprint.

“Community banks are under enormous competition in this area,” Yeager said. “And it’s difficult to imagine that we will have the same number of banks in Northwest Arkansas five years from now. We are already seeing a lot of consolidation occurring in the state … The minimum required scale of operations is increasing. That is, banks have to grow larger than $100 million in order to be able to afford the compliance costs and earn a reasonable return for shareholders.”

Yeager said the performance of community banks like Today’s typically follow real estate trends, and the trend in this region has been on a sustained, upward line. According to the Arvest-sponsored Skyline Report, which tracks all aspects of the region’s real estate, commercial space is being absorbed and people are buying homes. In the latest residential report issued for the last six months of 2013, sales of existing houses increased in both Benton and Washington counties for a collective total of 14.3 percent, from 2,982 to 3,407, over the same timeframe in 2012. That means more home loans and more revenue on interest, the lifeblood of banks.

“Because we have just recovered from a steep downturn, my guess is that real estate and bank performance in Northwest Arkansas will be strong over the next decade,” Yeager said. “If that is the case, banks should expect to do OK, even in this competitive environment.”

Community Based

Chartered in 1991, Today’s ended its first full year in operation with $13.8 million in total assets. While the bank has enjoyed growth throughout its existence, the last decade has been particularly good for the bank. From Dec. 31, 2003, to Dec. 31, 2013, the bank’s total assets grew by 66 percent, from $60.7 million in total assets to $100.7, according to the FDIC.

With the addition of the Fiesta Square location, Today’s currently has four branches, two in Huntsville and two in Fayetteville. The bank has about 2,000 customers, employs about 30 people and at its core works with individual depositors, small businesses and commercial real estate.

The bank writes the majority of its loans out of the Fayetteville location, while in Huntsville, deposits are predominant. As Today’s attempts to expand, it will also try and build its business in farming and agriculture, Olson said.

Today’s was born in the wake of a failed savings and loan, which was scooped up by a partnership that included Mathias, who eventually bought out his partners. Ten years after the Main Street location in Huntsville was founded, the bank opened a second location in Fayetteville and moved to its current spot on the northeast corner of the intersection of College Avenue and Dickson Street in 2004.

A second Huntsville bank was added on U.S. 412, which is now right next to the upcoming Walmart Supercenter, and adjacent to five commercial lots owned by Today’s. With the continued widening of 412, the area is expected to be built out in the near future, Olson said.

Last Stop

Olson, a native of Clark, South Dakota, got his degree from Drury University in Springfield, Mo., and then obtained his master’s in professional banking from Louisiana State University. A series of jobs, including that of being a regulator with the Office of the Comptroller of the Currency, eventually led him to Northwest Arkansas. Notably, the 38-year veteran of the banking industry was president of the Washington County operations of Metropolitan National Bank when the Great Recession arrived.

“The bust came and everything hit the wall,” he said.

MNB tried to salvage itself, but the bank, under siege from angry and aggrieved developers like Tom Terminella and Gary Combs, and with its balance sheet loaded with toxic foreclosures, was eventually sold to Simmons.

“It was a given they were not going to be able to work out their problems and that they would have to sell,” Olson said.

Looking back on MNB’s demise and the legal fallout that followed, Olson said: “No banker likes being sued. I don’t think I got a black eye from all that, but people throw stones.”

At the behest of Mathias, an old friend, Olson joined Today’s in late 2010 and replaced longtime bank president Curtis Hutchins. The marching orders were simple: rebrand and grow.

“It was the perfect opportunity for my last 10 years before I retire,” Olson said.