U.S. first quarter bank income down 2%, energy sector contributes to ‘mixed’ results

by June 1, 2016 4:20 pm 180 views

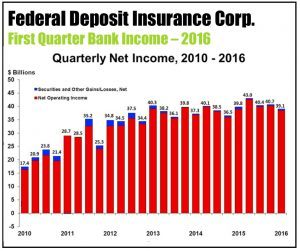

Net income at the 6,122 banks and savings operations insured by the Federal Deposit Insurance Corp. (FDIC) fell 2% in the first quarter, with higher provisions for loan losses a factor in the decline and resulting in a warning from the FDIC chief.

The nation’s agency that insures bank deposits reported Wednesday (June 1) that net income of the insured banks was $39.1 billion in the first quarter of 2016, down 2%. Loan loss reserves and lower non-interest income – primarily fees – fell $765 million in the quarter, a 1.9% dip compared to the first quarter of 2016.

And while net operating revenue for the banks rose 2.7% to $173 billion in the quarter, noncurrent loans rose $9.3 billion – with the recession in the energy sector cited by the FDIC as contributing to the increase.

FDIC Chairman Martin Gruenberg noted in the report that banks continue to face a “challenging environment.”

“Overall, the banking industry reported mixed results for the first quarter. By many measures, the industry had a positive quarter. Revenue increased from a year earlier, loan balances grew at the fastest 12-month rate since 2008, the share of unprofitable banks fell to an 18-year low, and the number of ‘problem banks’ continued to decline,” Gruenberg noted in a statement. “However, banks are operating in a challenging environment. Net income declined in the first quarter, noncurrent loans to the oil and gas industry rose sharply, trading income was down, and net interest margins remained low by historical standards.”

Gruenberg said low interest rates and low energy prices have pressured margins for many banks, especially some of the larger banks with energy sector exposure.

“A prolonged period of low interest rates has narrowed margins and caused some institutions to reach for yield. … The full impact of low energy prices on the banking industry remains to be seen, particularly for consumer and business loans in energy-producing regions of the country,” he said.

COMMUNITY BANK PERFORMANCE

Smaller community banks had good quarter, with combined net income of $5.2 billion in the category, up 7.4%. Of the 6,122 banks insured by the FDIC, 5,664 are classified as community banks.

“Community banks reported another solid quarter, as most of the industry’s trading operations and direct loans to oil and gas producers are in larger institutions,” Gruenberg said. “Net income at community banks grew considerably from a year earlier. And revenue growth, loan growth and net interest margins at community banks were appreciably higher than the overall industry.”

A negative for the community bank sector was another quarter of increases loan charge-offs. Quarterly net charge-offs (NCOs) totaled $10.1 billion, up $1.1 billion, or 12.3%, compared with a year earlier. It was the second consecutive quarter the charge-offs posted a year-over-year increase, following 21 quarters in a row in which such losses fell.

REPORT HIGHLIGHTS

Following are other notes in the lengthy FDIC quarterly report.

• The decline in earnings at all banks during the first quarter was mainly attributable to a $4.2 billion increase in provisions for loan losses set aside to recognize potential future loan losses and a $2.2 billion decline in noninterest income.

• Of the 6,122 insured institutions reporting first quarter financial results, more than half (61.4%) reported year-over-year growth in quarterly earnings. The proportion of banks that were unprofitable in the first quarter fell from 5.7% a year earlier to 5, the lowest level since the first quarter of 1998.

• Loan growth helped lift revenue at most banks. Net interest income rose $6.7 billion (6.4%) compared to the first quarter of 2015. Noninterest income was $2.2 billion (3.4%) lower.

• The amount of loans and leases that were noncurrent – 90 days or more past due or in nonaccrual status – rose $3.3 billion (2.4%) during the first three months of 2016. Noncurrent loans to commercial and industrial borrowers increased $9.3 billion (65.1%) during the quarter, primarily as a result of weakness in loans to the energy sector.

• Total loan and lease balances increased $99.7 billion (1.1%) during the first quarter. For the 12 months ended March 31, loans and leases increased $577.1 billion (6.9%). This is the largest 12-month growth rate since mid-2007 to mid-2008. At community banks, loan balances rose 1.5% during the first quarter and increased 8.9% during the past 12 months.

• The number of banks on the FDIC’s Problem List fell from 183 to 165 during the first quarter. This is the smallest number of problem banks in more than seven years and is down dramatically from the peak of 888 in the first quarter of 2011. Total assets of problem banks fell from $46.8 billion to $30.9 billion during the first quarter.