Hutchinson releases highway funding plan, seeks $750 million over 10 years (Updated)

by January 19, 2016 1:48 pm 588 views

Gov. Asa Hutchinson on Tuesday (Jan. 19) presented his plan for future highway funding in Arkansas.

Gov. Asa Hutchinson Tuesday announced a plan to increase highway funding by $750 million over the next 10 years, making the state eligible for $2 billion in federal matching funds over that time period thanks to a federal highway bill passed by Congress in December.

Fiscal year 2017’s new funding primarily will come from $40 million in unallocated surplus funds – $20 million of it from fiscal year 2015’s unobligated surplus funds and $20 million from the governor’s rainy day fund. In the following years, 25% of unallocated surpluses will transfer to the Highway Department. Hutchinson said the average surplus over the past 10 years has been about $48 million a year.

The plan also generates money by transferring from general revenues to highways the sales taxes generated from purchases of new and used vehicles, capping out at $25 million a year at the end of a five-year phase-in period. Hutchinson said the money would be offset by finding efficiencies in government and said he has specific ideas in mind for doing that.

The state needs $46.1 million by Sept. 30 of this year and an average of $50 million in future years to be eligible for $200 million annually in matching federal funds provided by the Fixing America’s Surface Transportation Act, or the FAST Act, passed by Congress and signed by President Obama in December.

In a press conference announcing the plan Tuesday, Hutchinson emphasized that the plan does not raise taxes and would have “zero negative impact” on other programs.

“That means no increase in the gasoline tax, no increase in the diesel tax, no waiver of exemptions,” he said.

Another $4 million will come from general revenue funds generated by diesel tax collections. Of that amount, $2.7 million will go to the Arkansas Highway and Transportation Department and $1.3 million will go to cities and counties, reflecting the traditional 70-15-15 split between those entities and the state.

Another $5.4 million will come from state sales taxes collected from the 1/2-cent highway sales tax passed by voters in 2012 that currently is directed to the Central Services Fund, which funds government administrative activities.

Many of the changes will require legislative approval in a special session later this year – one of two special sessions, the other dealing with Medicaid reforms. That session will include a discussion of Medicaid expansion, which currently is accomplished through the private option, a program Hutchinson wants to replace with what he is calling Arkansas Works. Funding highways will require the expansion to continue, he said.

“This budget with the surplus funds that are available … is not workable if we do not have access to the federal funds that are part of the Medicaid expansion,” he said.

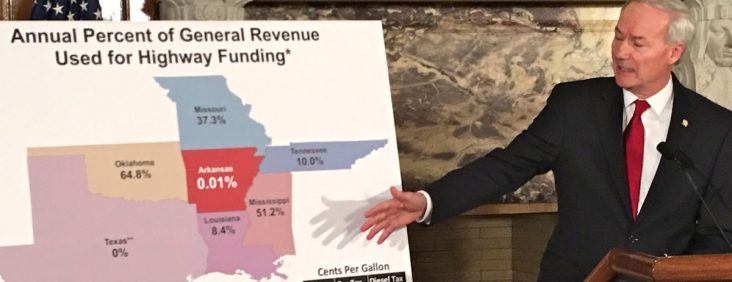

This is the first time general revenues have been used to pay for highways. Hutchinson pointed out that most of Arkansas’ surrounding states fund significant percentages of highway costs through general revenues.

Hutchinson said he had raised with the Highway Commission and the Arkansas Highway and Transportation Department the need for more transparency in exchange for the general revenues they will be receiving.

“They know full well what they’re doing and the reason for it,” he explained. “They’re actually transparent within themselves, but I think there’s just a lack of understanding on the public’s part and even on the policymakers’ part as to how they function and how the money is distributed. And so I just asked them to internally review that, to be open to suggestions and changes.”

AHTD Director Scott Bennett later said of that request, “It means we have to do a better job of telling our story” and pointed out that the department has one of the country’s lowest administrative costs per mile.

Bennett said the AHTD is pleased with the plan, which will allow it to access the federal funds it otherwise would have lost. Under the FAST Act, the state will be receiving $50 million a year more than under the previous funding mechanism, allowing the Highway Department to keep the state’s highways in their current overall condition. He said AHTD would continue to seek additional funding for highway needs.

“It’s not the long-term solution, but it is a critical first step to making sure that we can match our federal funds for the foreseeable future,” Bennett said.

The move will reduce the amount of general improvement funds (GIF) available to legislators and perhaps the executive branch to spend on specific projects, Hutchinson said. Rep. Dan Douglas, R-Bentonville, who sponsored a bill in 2015 to dedicate sales taxes from new and used vehicles to highways, told reporters that’s OK.

“Every dollar that goes into highways is something that every citizen in the state of Arkansas benefits from,” he said. “It’s not just to one particular group. I think it’s a better use of tax dollars, the GIF money going into highways, than it is anywhere else you can put it,” he said.

But Rep. Joe Jett, D-Success, who in 2015 floated the idea of using surplus money for highways, said the move could result in legislators trying to exert greater control over the constitutionally independent Highway Commission.

“If you start to dipping in general revenue … you want to have some type of control over the money spent,” he said.

He also expressed concern that funding highways out of a surplus could lead to policymakers budgeting especially conservatively to make sure the money is available.

Hutchinson had appointed a Governor’s Working Group on Highway Funding to look for ways of raising money for highways. The primary means of funding highways, the motor fuels tax, has not increased at the federal level since 1993 or at the state level since 2001, and those taxes were never indexed to inflation. While construction costs have increased, fuel efficiency has improved, meaning vehicles are using less fuel to travel the same miles while generating less in fuel taxes.

The Working Group presented Hutchinson a menu of items in December, most of which would have increased taxes one way or another, but Hutchinson insisted that any increase in revenues for highways would have to be offset by a decrease in revenues elsewhere.

The Arkansas Highway and Transportation Department had hoped for $110 million in new funding for itself over the next one to three years and $250 million over the next three to five years. That amount would enable the department to implement an enhanced maintenance program for existing highways and fund a $125 million resurfacing program. It has said it needs $400 million in new revenues in six to nine years, counting the $250 million.

Ten years in the future, the Highway Department hopes for $1.68 billion in new revenues annually for 10 years, which would enable the completion of I-49 along the state’s western border and I-69 through south Arkansas, and also result in no major capacity or congestion issues anywhere in Arkansas.