CenterPoint seeks $35.6 million rate change, would raise average monthly gas 12%

by November 11, 2015 11:02 am 321 views

CenterPoint Energy has filed an application with the Arkansas Public Service Commission (APSC) to change the company’s natural gas distribution rates that will push up the average residential customer’s bill by $6.68 per month, company officials said today (Nov. 11).

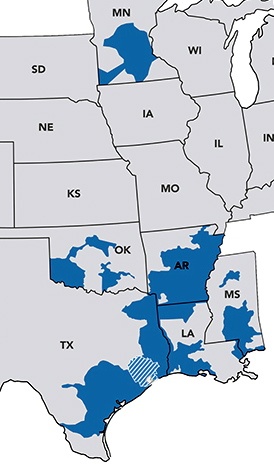

Houston-based CenterPoint, the state’s largest gas utility, has 430,000 residential, commercial and industrial customers across Arkansas. If the PSC approves the filing, CenterPoint expects the new rates would go into effect in the third quarter of 2016 and would generate approximately $35.6 million in additional revenue each year. The effect on individual monthly bills will vary depending on natural gas use and customer class, officials said.

The company’s application was filed Tuesday the Arkansas subsidiary of the Houston-based natural gas utility. Walter Bryant, CenterPoint Energy’s vice president of Arkansas gas operations, submitted more than 90 pages of testimony and supporting exhibits in support of the rate hike.

“Our last increase in base rates went into effect approximately eight years ago; since that time, CenterPoint Energy has continued to make significant investments, such as our ongoing pipeline replacement programs, to maintain the safety and reliability of our natural gas system and benefit our customers and communities,” Bryant said in a statement. “These capital investments, which are the primary reasons for this proposed increase, help ensure that we have a modernized, technologically advanced natural gas system that will continue to meet the needs of customers now and in the future.”

The 12% rate adjustment filing comes less than two weeks after CenterPoint officials announced on Oct. 31 that CenterPoint’s customers in Arkansas and other state would see lower heating bills this winter due to natural gas prices that have fallen well below $2.40 per million British thermal units on the futures markets, which is near a three-year low.

According to the PSC filing, CenterPoint is seeking approval to change the base rate portion of a customer’s natural gas bill, which makes up about 60% of the total proposed average residential bill and covers the cost of distributing natural gas. The natural gas utility operator and distributor also is proposing a formula rate plan rider under the recently enacted provisions of Act 725 of 2015.

Under the new regulatory reform rules sponsored by Rep. Charlie Collins, R-Fayetteville, during the 90th General Assembly, natural gas utilities are allowed to file annual rate plan adjustments that promote economic development and job growth in Arkansas. According to the new regulations, energy companies can account for capital investments required to “meter, regulate, and connect each class of customers to the natural gas utility’s system.”

CenterPoint officials said this annual mechanism will help reduce lag in the company’s recovery of investments and expenses, and smooth out rate adjustments by leveling out customers’ bills over time. Those rate adjustments would become effective for Arkansas natural gas customers each year on or after the first billing cycle in January.

Wednesday’s filing will not affect the Gas Supply Rate (GSR), which makes up the other 40% of the total proposed average residential bill and represents the cost of the natural gas that CenterPoint buys to deliver to customers with no markup.

The rate fall adjustment filed by CenterPoint in late October, which doesn’t have to be approved by the PSC, will begin this month and reduce the GSR portion billed to customers by about 19% percent for a residential gas bill using 100 Ccf (hundred cubic feet) of natural gas.

On Nov. 5 the company reported a third quarter loss of $391 million resulting from a one-time impairment charge of $794 million related to its Enable Midstream business. Without the one-time charge, the company would have posted net income of $146 million in the quarter, up from $143 million during the same period of 2014. Utility operations generated $265 million in operating income for the quarter, up from $233 million in the same period of 2014.

CenterPoint shares (NYSE: CNP) closed at $17.13 on Tuesday, and were trading slightly lower in Wednesday morning trading. During the past 52 weeks the share price has ranged from a $24.94 high to a $17.05 low.