Arkansas farm income expected to drop 8% next year

by December 1, 2025 10:00 am 321 views

Courtesy University of Arkansas System Division of Agriculture / Ryan McGeeney

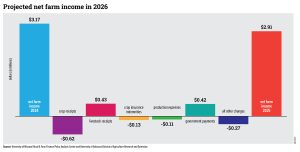

Net farm income in Arkansas this year is projected to be down sharply when compared to 2024, but there are reasons — primarily new federal aid — to think net farm incomes could rebound in 2026.

Net farm income this year will be down 8% or $2.91 billion, according to the “Fall 2025 Farm Income Outlook for Arkansas” report.

The report was generated by the Rural and Farm Finance Policy Analysis Center, or RaFF, working with agricultural economists from the University of Arkansas System Division of Agriculture. Corn and soybean prices might spike next year if promised federal assistance is realized, the report notes.

Total cash receipts will be down 3%, or $390 million, while total crop receipts will decline by 13%, or $620 million. Farm receipts are expected to be down 18%, $210 million, but that could be offset by a 5%, or $430 million, increase in livestock receipts.

Near record-setting rains in April drove down the number of planted corn, rice and soybean acres, and that helped to drive down crop receipts, the report notes. Economists project a further erosion in crop receipts in 2026.

“There will likely be reductions in rice and cotton acreage, with acreage shifting more into corn and soybeans on more favorable margins,” said UA agriculture economist Hunter Biram. “All crop margins are still negative for 2026, according to our crop enterprise budgets, but soybeans and corn appear to show the lowest likely loss.”

Among row crops, soybeans appear to have the nearest ‘breakeven potential’ next year, the economist noted. As the harvest numbers are calculated, it appears that peanut farmers might be doing better than expected this year.

“Peanuts are showing a healthy positive return — more than $100 per acre — but account for less than 1% of total planted acreage across the state and will not significantly impact total state-level net farm income,” Biram said.

“This is about a $350 million downward revision largely driven by less-than-anticipated payments received from the Supplemental Disaster Relief Program and Emergency Livestock Relief Program,” Biram said. “However, this decline in supplemental and ad hoc disaster assistance in 2025 comes at a nearly $300 million projected increase in government assistance in 2026 via the Price Loss Coverage program due to provisions in the One Big Beautiful Bill Act.”

Egg prices have been higher this year, and that will likely lead to higher receipts in that sector. Livestock receipts increased by $430 million in 2025. That number will likely be down in 2026 due to an anticipated 24% drop in egg prices. For the past several years, highly pathogenic avian influenza has decimated flocks around the country, and it drove egg prices higher. Analysis by economists Jada Thompson and James Mitchell, said the avian flu, or HPAI, impact on egg prices might not be that predictable.

“Cash receipt estimates from eggs are lower in 2026 with declining egg prices, but that estimate should be interpreted with caution because there is still a lot of uncertainty from year to year on losses due to HPAI,” Mitchell said.

“We have some moderate cases coming in this year which may indicate another hard HPAI year, but these are still early signs and we don’t know the full effects,” Thompson said. “Egg prices are following very consistent seasonal patterns, where winter affects egg production coupled with seasonal holiday demand. Layer HPAI on top of this and if case counts rise dramatically, we may see egg prices climb. If HPAI moderates, or has fewer cases, then we will not see the historic prices of last year.”

Other livestock receipts are expected to decline by 2%, the report noted.

“Livestock receipts are down on lower cattle sales and higher prices with broader herd rebuilding in the cattle sector expected to in 2026,” Mitchell said.

The Fall 2025 Farm Income Outlook for Arkansas is co-published by the University of Arkansas System Division of Agriculture and RaFF at the University of Missouri. RaFF collaborates with several states to develop farm income projections with local expertise, offering additional coverage of key Midwestern and Southern regions.

“The information for 2025 and 2026 in RaFF’s Farm Income Outlooks is intended to inform policymakers, industry analysts, and agricultural practitioners about the expected profitability of the local agricultural sector and its main drivers,” said RaFF Director Alejandro Plastina.

“Our state-level projections complement and add granularity to national projections by the USDA and FAPRI-MU, providing valuable insights on local agricultural trends. When planning for 2026, it is important for farmers and ranchers to take action to secure sufficient liquidity to operate under sustained tight margins, barring unanticipated new government payments or pent-up demand for agricultural commodities,” he added.