Walmart to acquire telehealth provider MeMD

by May 6, 2021 5:47 pm 1,588 views

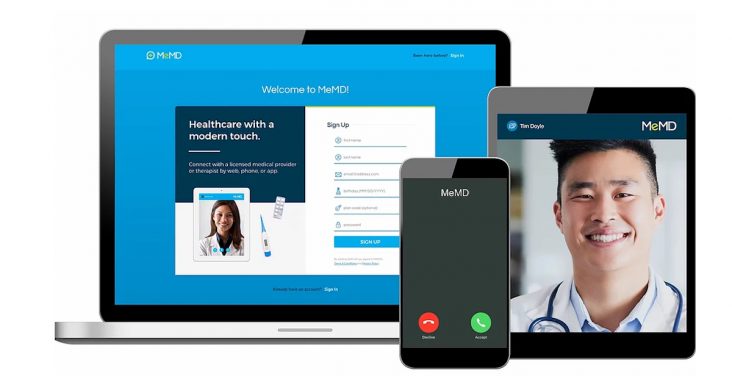

Walmart is acquiring a telehealth provider MeMD, based in Phoenix for an undisclosed amount. The platform leverages data and technology in an effort to improve engagement, health equity and outcomes, the retailer noted Thursday (May 6) on its corporate website.

Walmart said the acquisition will allow its health unit to provide access to virtual care across the nation including urgent, behavioral and primary care, complementing the in-person Walmart Health centers. Walmart also said using virtual health has been shown to improve health outcomes and lower the overall host of healthcare across all populations.

“Telehealth offers a great opportunity to expand access and reach consumers where they are and complements our brick-and-mortar Walmart Health locations. Today people expect omnichannel access to care, and adding telehealth to our Walmart Health care strategies allows us to provide in-person and digital care across our multiple assets and solutions,” said Dr. Cheryl Pegus, executive vice president of Walmart Health & Wellness.

MeMD was founded in 2010 by Dr. John Shufeldt to provide virtual care nationwide using online technologies to deliver health care around the clock. The company said it now delivers medical and mental health visits to 5 million members across the nation.

“We’ve achieved incredible strides in making health care available to individuals and businesses around the country through our easy, affordable and intuitive online platform. We can’t imagine a better partner than Walmart as we are both committed to innovative health care delivery and bringing affordable, high-quality care to as many people as possible,” said MeMD CEO Bill Goodwin. “MeMD’s mission fits perfectly with Walmart’s dedicated focus to help people save money and live better, and now we can impact millions more by being part of Walmart.”

MeMd’s website notes virtual medical visits cost $67 for common illnesses and injuries. The mental health therapy session costs $85 per session. Walmart already offers tele-health services to its employees through a third party provider. Sam’s Club offers its members tele-health subscriptions through 98point6. Sam’s subscriptions cost $33.50 quarterly that allows them access to 98Point6 tele-health services for $1 per visit.

Scott Benedict, director of retail studies at Texas A&M University, said this is a smart play by Walmart who has already said it will focus on healthcare services to deepen the relationship it has with customers.

“There is a strong value proposition with this play because it could add value to Walmart+ members. It could be plugged into existing services or Walmart could create new services for customers and members. We will have to see what Walmart does with the platform, but they also have a huge internal option to use it with their own associates. This deal also gives Walmart a way to differentiate its service offerings with some competitors,” Benedict said.

The Walmart move also comes on the heels of Amazon’s March 17 announcement of Amazon Care telehealth U.S. expansion this summer. Amazon first began scaling its telehealth services to other Washington-based companies last year.

Carol Spieckerman, CEO of Spieckerman Retail, said telehealth is one of the hottest growth areas now and as retailers diversify into health services, telehealth acquisitions logically follow.

“Walmart is determined to be on the forefront of this movement and is poised to onboard millions of consumers. Just as Walmart has accelerated adoption of click and collect, home delivery, mobile payments, and other innovations, it will do the same for telehealth. The acquisition benefits Walmart’s overall business from a data-gathering perspective and also through direct links to its pharmacies (which in turn drives incremental sales in other categories). The potential to integrate telehealth services into Walmart Plus is a clear opportunity that will allow Walmart to forge deeper relationships, and dependencies, with its customers. Another aggressive diversification play from Walmart,” Spieckerman said.

Walmart said the acquisition, which is subject to regulatory approval, is expected to close in the coming months.