Walmart net income up 25.3% in fiscal year, retailer forecasts slower growth

by February 20, 2025 11:31 am 1,273 views

Walmart on Thursday (Feb. 20) reported fiscal fourth quarter revenue of $180.55 billion, up 4.1% compared with the same period a year ago. Net income totaled $5.25 billion in the quarter, down 4.4% compared with a year ago.

Fiscal year revenue was $680.98 billion, up 5.1%, with membership income rising 17.5% from the prior year. Net income in the fiscal year was $19.43 billion, up 25.3% compared with the previous fiscal year.

“Our team finished the year with another quarter of strong results,” CEO Doug McMillon noted in the release. “We have momentum driven by our low prices, a growing assortment and an e-commerce business driven by faster delivery times. We are gaining market share, our top line is healthy and we are in great shape with inventory.”

He said the company is focused on growth, improving operating margins, and a stronger return on investment.

Bright spots in the fourth quarter included gross margins up 0.53% led by Walmart U.S., operating income growth of 8.3%, and improved profitability in the e-commerce business. Global e-commerce sales grew 16% and global advertising revenue increased 29% and was up 24% in the U.S.

SEGMENT SUMMARY

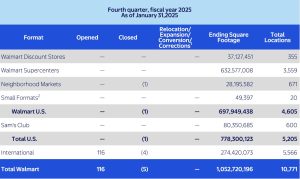

Walmart U.S. had fourth quarter sales of $123.5 billion, up 5%, with comp sales gains of 4.6%. The retailer reported transactions were down but average ticket sales increased. E-commerce sales were up 20% and contributed 2.9% to the overall U.S. store comp. Operating income grew 7.4% to $6.5 billion in the quarter.

Sam’s Club posted quarterly revenue of $23.1 billion, up 5.7%. Comp sales grew 6.8%, with transactions up 5.4% and average ticket gains of 1.3%. E-commerce growth of 24% contributed 2.8% to the overall comp. Membership income grew 13% from a year ago.

The international business reported consolidated revenue of $32.2 billion, down slightly from a year ago, On a constant-currency basis revenue rose 5.7%. The company said currency rate fluctuations reduced sales by $2 billion in the quarter. Operating income also took a hit from the higher value of the dollar, but on a constant currency basis operating income improved 10.1%. E-commerce sales grew 20% and advertising revenue increased 26%.

TARIFF CONCERN

Chief Financial Officer John David Rainey said the retailer won’t be immune from looming tariffs on Mexico and Canada. That uncertainty and expected reduced consumer spending prompted Walmart to lower full-year guidance below analysts estimates, which sent the share price down more than 5% in early trading Thursday.

Walmart forecast net sales to grow between 3% to 4% on a constant currency basis in the first quarter, with earnings per share ranging between 57 cents and 58 cents, including a 2-cent offset from currency rate fluctuations.

For the full year the retailer pegs sales to grow between 3% to 4% with adjusted operating income growth between 3.5% to 5.5%. The per share earnings for fiscal 2026 are expected to range between $2.50 and $2.60, including a 5-cent offset from currency headwinds. This is below Wall Street consensus estimate of $2.76 and sales growth of 4%.

For the full year the retailer pegs sales to grow between 3% to 4% with adjusted operating income growth between 3.5% to 5.5%. The per share earnings for fiscal 2026 are expected to range between $2.50 and $2.60, including a 5-cent offset from currency headwinds. This is below Wall Street consensus estimate of $2.76 and sales growth of 4%.

CONSUMER CONCERN

Walmart’s lower-than-expected guidance is a warning that U.S. consumer spending is slowing, said Brian Mulberry, a client portfolio manager at Zacks Investment Management, and a Walmart investor. He said if Walmart’s soft guidance is followed by a decline in jobs, “it would be a strong signal that economic growth is slowing.”

Despite issuing the lower guidance, Rainey said U.S. shoppers as “resilient” and focused on value.

“We’re one month into the year, so I think it’s prudent to have an outlook that is somewhat measured,” Rainey said when asked about the guidance change. “We don’t want to get ahead of ourselves. There is certainly some unpredictability in any environment that we have, but we feel really good about our ability to navigate that.”

Walmart shares (NYSE: WMT) fell more than 6% following the earnings release, reversing the upward trajectory the stock had been on for the much of 2024. Shares were up more 80% over the past year heading into the earnings day release. Trading at $97.33, shares were down $6.77 or 6,41% on in heavy volume on Thursday morning. During the past 52 weeks the share price has traded between $57.77 and $103.30.