Interest rate reductions will help NWA commercial real estate market

by November 25, 2024 12:56 pm 728 views

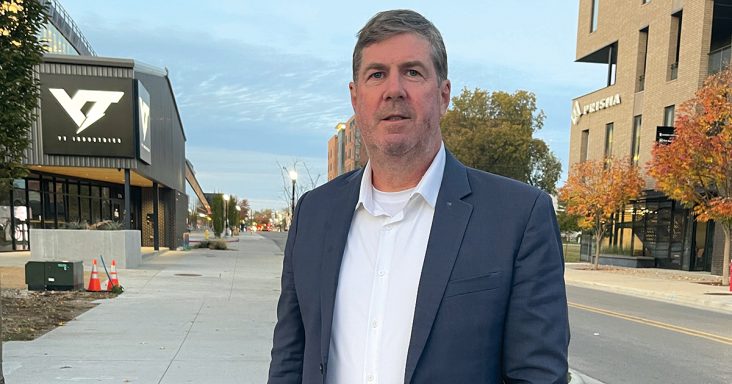

Paul Esterer, managing director for Moses Tucker Partners, and CEO, president and founder of Esterer Investments

The Federal Reserve has lowered the federal funds rate by 0.75 percentage points in its past two meetings and signaled that another 0.25 percentage point cut may happen before year-end.

Lower interest rates will positively impact the commercial and residential real estate markets as well as affect the financing that is critical for infrastructure investment, key to Northwest Arkansas’ growing population needs.

The tricky part is that interest rate fluctuations will impact those key real estate and infrastructure projects in vastly different ways, said Paul Esterer, managing director for Moses Tucker Partners, and CEO, president and founder of Esterer Investments. Esterer has nearly 30 years of experience in the regional, state and national commercial real estate markets, so his observations aren’t short-sighted. And they rely on work that has weathered plenty of industry ups and downs.

“What you’re seeing as the fed fund rates are dropping, that does not correlate to the 10-year Treasury yield, which is more of an indication of commercial rates out there for banks and traditional investors across the United States,” he said. “Since short-term rates have been dropped, long-term rates have gone up. So therefore, that is both the good position, but also we’ve still got risk out there in the market based on the fact that short-term construction and variable rates that were booked over the last four to five years are coming due and having to reprice assets.”

Investors like Esterer contend the 10-year Treasury yield curve needs to be comfortably higher than the two-year curve. When the two-year is higher or near-even to the 10-year, it is generally considered a bellwether of a slowing economy. In short, the 10-year Treasury note indicates the return that investors require to tie up their money for 10 years versus the two-year note over a two-year period. In mid-November, the 10-year Treasury note hovered around 4.28%, while the two-year treasury bounced around 4.26%.

“The reason why that’s important is because an inverted yield curve obviously gives investors of real estate the concern of is the whole yield curve going to come down? Is it going to start changing? This is the critical piece because real estate people want to make long-term investments,” Esterer said.

BANK LIQUIDITY, INVESTOR CAPITAL

That said, Esterer is extremely bullish on Northwest Arkansas’ future for several reasons. First, community banks are in a particularly healthy position generally speaking. The lower interest rates from the Fed actions are helping with short-term lending for smaller projects, refinancing, consumer loans and small business activity.

“Banks have more liquidity today. They’re lending, again, they’re repricing assets that need to be repriced, and that is a good sign where we just don’t see any pain and we need to have an active community bank lending environment in Northwest Arkansas,” Esterer said.

His experience has also shown him that Northwest Arkansas is unique among many U.S. metro areas. With the year-over-year population growth in the region, there are vast needs for residential and commercial construction and costly infrastructure projects such as sewer, water and energy improvements to keep up with progress.

“I would have to say we have a very broad base of investors and developers that now believe this is a primary growth market in the U.S. that brings us in more competition and investors for all parts of the capital stack,” he added.

SKYLINE REPORT

In the first half of 2024, the Arvest Bank Skyline Report, which celebrated its 20th anniversary this year, noted strong home sales and low vacancy rates in multifamily and commercial properties in the region. According to the new report on residential real estate, 4,799 homes were sold in the first half of this year, up 8.5% from the 4,422 homes sold in the same period last year. Of the homes sold, 1,896 were new construction.

In the multifamily market, the vacancy rate increased to 3.3% from 2.2% last year “but remains at a very healthy level despite a significant number of new apartment complexes and units entering the market,” the report showed.

The Skyline Report on commercial real estate highlighted a “very healthy market.” The overall vacancy rate for all types of commercial space remained flat at 6.4% from the past two reports, as 538,455 square feet of new leasable space entered the market in the first half of 2024.

Amid rising vacancy rates in the nationwide office market, the vacancy rate in Northwest Arkansas fell to 7.4% in the first half of 2024 from 8.8% in the second half of 2023. Leasing activity was strong in the class A submarket, as 61,325 square feet of new space was added. In the retail submarket, the vacancy rate also declined, falling from 7.9% in the second half of 2023 to 6.2% in the first half of 2024, as 61,098 square feet of new space was added. There was strong leasing activity in the class B retail submarket.

Over the same period, the vacancy rate for the warehouse submarket rose from 3.6% to 8% as 313,356 square feet of new space entered the market and two large existing spaces became available. Still, after visiting with area developers, the report said there’s rising demand for additional warehouse space in the region.

Mervin Jebaraj, director of the Center for Business and Economic Research at the University of Arkansas’ Walton College of Business, oversees the Skyline Report. He underscored the healthiness of the commercial real estate market in Northwest Arkansas.

“We don’t expect the small decreases in interest rates to have a huge impact on new projects. The cuts so far haven’t been large enough to offset the expensive lot prices and construction costs, such as labor and materials. Nonetheless, there are a lot of planned projects in the pipeline, but we aren’t expecting more than normal in the short term,” Jebaraj said.

WARNING SIGNS

Esterer said the new Trump administration and its policy changes could lead to major shifts in the economy. For now, developers are in a wait-and-see holding pattern as they gauge how far tariffs may impact sectors of the economy and costs of building materials, how a mass deportation policy could affect the labor force, and how stimulus money could be curtailed or increased for infrastructure projects.

And mortgage rates are still taking their time to drop as quickly as they rose — a factor Esterer said is important for the fast-growing region that is already struggling to keep up with housing a larger labor force and coping with affordability in that sector.

“Sometimes the residential market affects the commercial market because of workers’ mobility to move to this market to start a new job, to start a new business, to relocate, and the affordability of any market is essential for its viability of growth,” Esterer said.

“I would say the biggest thing for commercial real estate is the continued emphasis on the capital needed for infrastructure. Both water, sewer and electricity are major concerns in the growth market that can affect that growth rate. Secondly, the affordability of the market by either lowering the cost of construction or the lowering of mortgage rates to attract people in is important. They’re both big issues in Northwest Arkansas that can slow the growth rate,” he said.

Editor’s note: Jeff Della Rosa contributed to this report.