Walmart shareholders elect new board, bid Rob Walton farewell

by June 5, 2024 1:53 pm 6,409 views

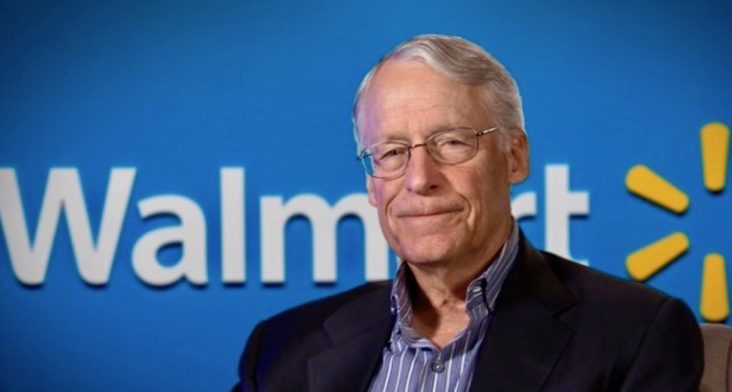

Rob Walton

Walmart shareholders on Wednesday (June 5) ushered in a new slate of directors that included one less Walton. Rob Walton, 79, who logged nearly five decades of board service, is no longer on the board.

Aside from saying goodbye to Walton, shareholders celebrated fiscal 2024, in which Walmart posted net income growth of 32.8% and revenue gains of 5.7%.

“Rob is the last Walton to have inside experience as an employee early on and then board chairman for more than two decades,” said Alan Ellstrand, associate dean of the Sam M. Walton College of Business at the University of Arkansas. “He is also likely the only director to have longtime meaningful interactions with Sam. The family is still well-represented on the board with chairman Greg Penner (son-in-law of Rob Walton) and Steuart Walton (grandson to the founders).”

Ellstrand said Walton’s board departure comes as the company has good momentum while also logging incredible growth during his decades of tenure. Ellstrand said given Walton’s age and since his purchase of the Denver Broncos, there are other things that may need his attention.

Penner, who opened the 54th annual shareholder meeting Wednesday morning, said Walton’s leadership has been critical as Walmart has grown the business, and his service will be missed. Walmart CEO Doug McMillon echoed that sentiment, adding, “I have never seen him take any credit for many of his contributions to Walmart’s growth. He has my gratitude and respect.”

McMillon said the company had a tremendous year of growth across its business segments while lowering inventory, reducing e-commerce expenses, and boosting base wages by 30%.

SHAREHOLDER GROWTH

Walmart shareholders have enjoyed almost 30% growth in share value this year. Tim Seymour, chief investment officer of Seymour Asset Management, said Walmart is behaving more like a tech stock than a retail or conservative defensive play. He said the company is gaining market share from competitors.

Walmart completed a 3-for-1 stock split on Feb. 26. Walmart shares were trading at $175.56 ahead of the split. The following trading day, shares opened at $59.29. McMillon said it had always been important to the Walton family that the stock be accessible for employees. The split lowered the stock price and increased the total shares, and employees purchasing stock through the company’s payroll deduction option could acquire full shares faster. He said employee participation rates have increased 7% since the split.

Walmart has had a long history of stock splits since the company went public in 1970 and began trading on the New York Stock Exchange on Aug. 25, 1972. Those early investors who acquired Walmart stock prior to Aug. 25, 1975, would have seen tremendous growth in the stock they held. One share would be equal to 1,536 shares today. Also, in fiscal 2024, Walmart’s board raised the dividend by 9%.

During the meeting Wednesday, Walmart shares (NYSE: WMT) were trading at $66.53, up 12.5% since the split and up 27.3% this calendar year.

BUSINESS MEETING

Shareholders voted to approve the following slate of directors for the next year: Cesar Conde, Tim Flynn, Sarah Friar, Carla Harris, Tom Horton, Marissa Mayer, McMillon, Brian Niccol, Penner, Randall Stephenson and Steuart Walton.

Other ballot items approved by the shareholder majority include approval of executive officer compensation performance bonus pay and ratification of Ernst & Young as the company’s independent registered public accounting firm.

Seven proposals were brought by concerned shareholders. The board was against all of them, and based on preliminary results, none received a majority vote.

Proposal #4 asked Walmart to transition to gestation crates in its pork supply chain. Proposal #5 asked Walmart to conduct a third-party racial equity audit seeking to improve the company’s racial equity impact. Proposal #6 asked Walmart to publish a Human Rights Impact Assessment on its website. Proposal #7 asked Walmart to establish company wage policies more inline with a living wage. Walmart said it committed to paying good wages and offering advancements and training for higher-paying jobs, and the proposal is not necessary.

Proposal #8 asked the company to report on civil rights and non-discrimination results from an internal audit. Proposal #9 sought Walmart to conduct a third-party, independent review of the impact of company policies and practices on workplace safety and violence, including gun violence. Proposal #10 asked Walmart to create a board committee to oversee corporate financial sustainability and review the impact of the company’s policy positions, advocacy and charitable giving.