FinX experiences provide ‘bottom up’ view of Arkansas’ unbanked

by September 10, 2019 5:16 pm 1,025 views

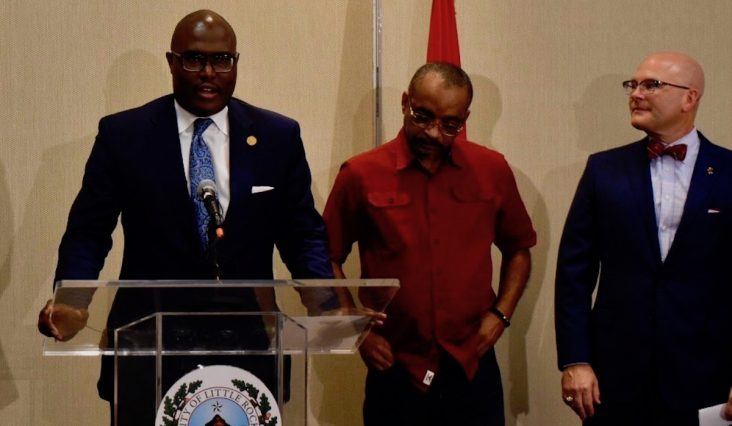

Little Rock Mayor Frank Scott talks about lessons learned Tuesday during an event that provided officials experience on how the so-called “unbanked” and “underbanked” navigate day-to-day interactions.

Little Rock Mayor Frank Scott and a host of business, government and community leaders on Tuesday (Sept. 10) got a taste of how one out of every four Arkansans struggle to stay afloat financially without access to ordinary banking services during the city’s first FinX experience.

The five-hour event, sponsored by Southern Bancorp Inc., left Scott and 48 other participants from the public and private sector awed by the firsthand experience to learn how the so-called “unbanked” and “underbanked” navigate day-to-day interactions.

According to Southern Bancorp spokesman Nathan Pittman, the FinX team competition allowed the participants to go beyond simply hearing about the challenges that consumers without checking or other banking services face and to experience firsthand the real-life constraints and options they encounter.

At the beginning of the event, Pittman said, participants were assigned to one of 11 teams and given a packet with checks along with a set of transactions to complete at local businesses. Each team then attempted to complete financial transactions such as cashing a check, acquiring and using a prepaid card, and sending money. As they made their way through local communities, each team had to weigh decisions around fees, expediency, time and transportation, Pittman said.

“You saw firsthand what it feels like to try and be a consumer and manage your financial affairs in today’s environment. It is difficult, it is frustrating, and it is expensive,” Southern Bancorp CEO Darrin Williams told the participants after the half-day odyssey that started and ended at the Four Points Sheraton in Little Rock’s midtown. “By working together in a public-private partnership, financial institutions, community organizations, and governments can work to alleviate poverty by giving citizens tools they need to reduce debt, build savings and create stronger financial foundations here in Little Rock and beyond.”

Williams said Southern Bancorp, the state’s largest community development financial institution (CDFI), recruited Bank On Arkansas+ to help develop the “in-the-field activity” by embedding the four dozen participants in a real-life experience where they must make some of the same decisions struggling consumers face on a daily basis. Exactly a year ago, Bank On Arkansas+ was developed as a special project of the Arkansas Asset Funders Network, a statewide coalition of financial institutions, large corporations and community nonprofits. Nationally, the first Bank On initiatives sprung up in New York and San Francisco in 2006. In the dozen years since, more than 75 additional cities have formed Bank On coalitions.

In Arkansas, Southern Bancorp, Bank of America, Citizens Bank, Diamond Lakes, Federal Credit Union, First Security Bank, Iberia Bank, U.S. Bank, Wells Fargo, and Simmons Bank are Bank On partners that provide checking accounts with no overdraft fees, no minimum monthly balances, and access to a debit or ATM card for all participants.

At the end of Tuesday’s event, Scott signed an agreement with Bank On Arkansas+ to expand access to the service in Little Rock through several local initiatives, including providing financial literacy and education for 2,500 city employees, department managers and directors during monthly training and onboarding sessions.

Scott, who participated in the FinX event with Little Rock City Councilor Ken Richardson, thanked Williams, Southern Bancorp and Bank On Arkansas+ officials for sponsoring the challenge to give local community leaders a better viewpoint of families struggling to make ends meet.

“We took time out of our day, some two to four hours, to gain a better understanding and perspective about brothers and sisters that are part of the underserved and underbanked community,” said Scott, a former banker and local minister. “So as city leaders, and other (community) leaders that were here with us today, once we get that type of understanding, it gives us a great perspective on how we can provide solutions.”

Richardson, the city councilor for Ward 2 in Little Rock, concurred with Scott’s assessment. He said the FinX experience showed him that the world looks a lot different “from the bottom up, than the top down.”

“We also know there are a number of misery merchants who are dependent on the misery of a lot of folks for them to survive and exist,” said Richardson. “A lot of the times we start talking about revitalization and redevelopment, we are talking about streets, and curbs and gutters, but we are not talking about people.

“It does us no good to talk about five million-dollar sidewalks and there are five-dollar people – and that’s an exaggeration – walking down those sidewalks,” Richardson added.

According to the Federal Deposit Insurance Corp.’s 2017 national survey on the unbanked, 7% of U.S. households, about 9 million, are unbanked. An additional 19.9% of U.S. households (24.5 million) are underbanked, meaning that the household had a checking or savings account but also obtained financial products and services outside of the banking system.

In Arkansas, Bank On officials said one in 10 Arkansas households have no bank account. Of those that do, over 22% rely on alternative services to access their own money to cover basic expenses such as rent, utilities, food and medicine. In Central Arkansas, there are 27% of local households that are unbanked or underbanked.

“And that is a little bit higher than the national average …, so, yes, definitely we want to have a target focus on that population,” said Kara Wilkins, director of Bank On Arkansas+. “We applaud the (Little Rock’s) commitment to work alongside financial service providers to make it easier for families and individuals to open bank accounts.”

Besides providing training for the city of Little Rock, Bank On Arkansas+ will also provide the following services under the agreement signed today, including:

• Assisting city of Little Rock employees with signing up for a Bank On Arkansas+ account;

• Offering Bank On materials to citizens who participate in the city’s municipal ID card program and refer them to participating Bank On Arkansas+ financial institutions;

• Engaging students through the Department of Youth Services on early financial education, particularly through the Summer Youth Employment Program; and

• Planning for a possible City of Little Rock Super Tax Day/Volunteer Income Tax Assistance site in February 2020, which will provide free tax services and financial planning to families and individuals in Little Rock.