On its 30th anniversary, the Supercenter format remains a key sales driver for Walmart

by May 31, 2018 3:13 pm 5,196 views

David Glass, former president and CEO of Walmart Inc. and now owner of the Kansas City Royals, said the Supercenter is the “best retail format around and still as relevant today” as it was when the first one opened 30 years ago.

In a recent interview with Talk Business & Politics, Glass said the Supercenter concept was modeled after French retailer Carrefour and Meijer, a Midwestern retailer. But Walmart also created a laboratory to study the giant box format in the mid-1980s with four Hyper-Mart locations, which operated under a separate division within Walmart.

Glass said the Hyper-Mart formats, which opened in Garland and Arlington, Texas; Kansas City, Mo.; and Topeka, Kan., were massive boxes in excess of 225,000 square feet and proved challenging for the retailer, which had very little food retailing experience. The formats were expensive to run given the large refrigerated section, and even harder to staff.

He said the idea for the Supercenter was born out of the failure of the Hyper-Mart and something customers were requesting — a one-stop shopping destination. Retired Walmart executive Andy Wilson said he remembers well the challenges of the Hyper-Mart format.

“This format was stretching us thin, and we dreaded hearing bad news reported at each Friday meeting when sales numbers came in,” Wilson recalled. “The format was failing. But the learnings were great.”

He said management didn’t want to give up on the concept and kept working on the prototype of the Supercenter.

“I remember clearly seeing the first blueprint for the Supercenter prototype,” Wilson said. “I was 31 and an officer at the company. Sam called us into his office, and he unveiled it. David, Tom Coughlin and Jack Shewmaker were already privy to the format, but it was the first time I had seen it. We looked it over, and Sam told us all that day, ‘What you are looking at is the future.’”

Wilson said he trusted his leader, but coming off the failures of the Hyper-Mart, the room was quiet as management tried to grasp the concept and see the opportunities. He said Walmart had conquered the business as a discounter of general merchandise, but food was a whole new game. He said Glass had some grocery experience, and his promotion to CEO in 1988 was a big part of the format’s success out of the gate.

The first Walmart Supercenter format opened in 1988 in Washington, Mo., a town located 50 miles west of St. Louis that, at the time, was home to about 10,000 people. The company continued its experiment with the Hyper-Mart for a few more years, testing out concepts such as pharmacy, vision care, photo processing and video arcades that would later be added to the Supercenter. Walmart put the Supercenter format in a division separate from the discount stores. Wilson said that was crucial because it allowed the team to focus on the new format.

“We tried to hire good talent with food experience, and our employees didn’t cross back and forth from the discount side in the beginning,” Wilson said. “Walmart didn’t just try to bolt this business onto what they were already doing. They took time to learn and slowly integrate it.”

Glass said much of the format’s success is attributed to what it learned from good competitors.

“The best thing we did was to put the Supercenter where we had strong food competition,” he said. “Our thinking was, ‘We will learn from them or they will run us out of business.’ Back then there were grocery chains much bigger and better operators than we were in the beginning. It wasn’t long before we developed our own distribution network. We had a desire to change, improve, [and] copy best practices until we mastered the food business.”

RISE TO THE TOP

In the early years, Walmart continued to expand its Supercenter format, which was smaller than the Hyper-Mart, and has continued to change in size over the years. The smallest Supercenter is 70,000 square feet, and the largest is 260,000 square feet, according to Walmart’s recent annual report. The average size is 178,888 square feet.

Wilson said managing the big boxes was an eye-opening experience. He said the faster turnover of food inventory made the formats more difficult to master. In the early days, out-of-stocks ran high at times as suppliers were also challenged. The early Supercenter format was doing two to three times sales volume of the discount store.

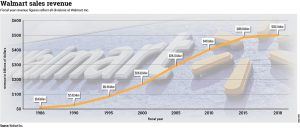

And though there were hiccups, the format was financially successful out of the gate. Between 1988 and 1991, Walmart’s sales doubled in part because of the Supercenter. Walmart overtook Sears and Kmart in fiscal 1991 as the largest U.S. retailer with sales revenue of $32.6 billion, rising 26% from the previous year.

Wilson said he moved to human resources in 1990 when Coughlin and Glass asked him to focus on ramping up the retail talent they were going to need as they continued a fast growth trajectory. As Wilson worked on talent recruitment and training programs, he said the work Glass had done on the Retail Link inventory system was crucial to the success of the Supercenter.

Walmart was able to build out a supply chain system with distribution centers handling its own inventory and taking costs of the supply chain. Walmart’s brick-and-mortar growth was unparalleled through the next 20 years despite having to combat union pressures and a host of competitors from regional grocers to specialty big box chains like Best Buy constantly vying for market share.

NEW CONCEPTS

The first Neighborhood Market concept store opened in 1998 in Bentonville. It wasn’t until 2010 that the retailer, under then Walmart U.S. CEO Bill Simon, began to focus on building more of the smaller stores.

Simon’s plan was to build out smaller formats into retail ecosystems that would surround Supercenters. The retail giant was losing market share to Dollar General, with the Goodlettsville, Tenn.-based company building 1,200 new stores a year. Walmart shifted its focus toward the smaller Neighborhood Markets, a pure grocery format introduced earlier but never built out as the company focused on Supercenters.

The Supercenter was beginning to be seen as clunky and inefficient, with discounters like Aldi on the scene offering low prices and small-store convenience. Walmart’s massive real estate holdings of more than 4,000 stores also were seen as cumbersome as more sales were moving online.

In 2013, Walmart began to test the even smaller Express format in Northwest Arkansas and North Carolina, using the Supercenter as distribution centers to restock the small stores. Simon said the small-box stores tethered to Supercenters and “endless aisle” opportunity from Walmart.com would give consumers the best of both worlds — convenience in terms of local access, as well as the broadest assortment possible.

“Think of it this way,” Simon said at the time. “A Walmart Express with site-to-store, ship-to-store, full grocery, gas and pharmacy can drive the same sales as three to five dollar stores.”

He said the hybrid Neighborhood Market would drive the sales of 10 dollar stores, and both models made better use of capital because of lower building costs.

Walmart built 102 of the small Express formats and added another 255 Neighborhood Market locations. But the small format experiment wound down in early 2016, about a year after Greg Foran took over as CEO of Walmart U.S. The company announced the shuttering of 102 Express formats, as well as 52 Neighborhood Markets, which were cannibalizing sales from Supercenters. In the past few years, Walmart has closed about a dozen other locations located in close proximity to Supercenters.

Analysts said Walmart was proficient at managing Supercenters, and the small formats were too much work for too little return. They proved challenging to keep stocked and using Supercenters as fulfillment centers also hindered that format’s sales.

SUPERCENTER IMPROVED

Foran said in 2015 the Supercenter was the best retail shopping format in the world when ran correctly. His mission was to clean up the stores, improve services with more attention to detail on everything from clean bathrooms to how much time people were spending in line.

In the past three years, Foran worked to improve the shopping experience by using technology that enabled online grocery ordering, which can now be picked up for free at more than 1,200 locations. Foran said getting “fresh” foods right, improving service at the front-end of the store with things like more self-checkouts, pickup towers for easy retrieval of online general merchandises orders and no-waiting for online refills in the pharmacy all work together for improved customer experience.

In a recent interview with Talk Business & Politics, Foran said running a Supercenter is managing many moving parts. He said it started with getting the inventory flow of product right between private and branded products, then layering on services like fuel stations, pharmacies and financial services that help to create an ecosystem.

“They have to be well-managed, and training plays a huge part,” Foran said. “Layering on digital capabilities today with online grocery and pickup in store complicates the management but makes it a better operation. We have to get it all right and still win on price with our customers. We work on it every day, and we’re still about one-third of the way from where we need to be.”

Glass gives President and CEO Doug McMillon and his executive team much credit for paying attention to what customers want and continuing to reinvent the Supercenter format. He said Sam Walton was obsessed with pleasing customers and he would be smiling today at how the Supercenter concept has evolved.